Delta Airlines 2007 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2007 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Prior to the amendment, the Processor withheld payment from our receivables and/or required a cash reserve of an amount ("Reserve") equal to the

Processor's potential liability for tickets purchased with Visa or MasterCard that had not yet been used for travel (the "Unflown Ticket Liability"). The

Processing Agreement allowed us to substitute a letter of credit, which was issued by a third party, for a portion of the Reserve equal to the lesser of $300

million and 45% of the Unflown Ticket Liability.

Including the letter of credit, the Reserve, which adjusted daily, totaled approximately $1.1 billion prior to entering into the Amended Processing

Agreement. In May 2007, Delta and the Processor entered into a letter agreement pursuant to which the Processor surrendered the letter of credit and

correspondingly reduced the amount of the Reserve. Upon entering into the Amended Processing Agreement, the Processor returned to us the remaining $804

million Reserve.

The Amended Processing Agreement provides that no future Reserve is required except in certain circumstances, including events that in the reasonable

determination of the Processor would have a material adverse effect on us.

Further, if either we or the Processor determines not to extend the term of the Amended Processing Agreement beyond October 31, 2008, then the

Processor may maintain a Reserve, if we do not maintain a certain amount of cash, during the period of 90 days before the expiration date of the agreement.

The Reserve would equal approximately 100% of the value of tickets for which we had received payment under the Amended Processing Agreement, but

which have not been used for travel, unless we have unrestricted cash above a level specified in the Amended Processing Agreement. Such a Reserve would

be released to us following termination of the Amended Processing Agreement as tickets are used for travel.

American Express

Our American Express credit card processing agreement, entered into in 2004 and amended in 2005, provides that American Express is permitted to

withhold our receivables in certain circumstances. These circumstances include a material increase in the risk that we will be unable to meet our obligations

under the agreement or our business undergoing a material adverse change. No amounts were withheld as of December 31, 2007 and 2006.

Other Contingencies

Regional Airports Improvement Corporation ("RAIC")

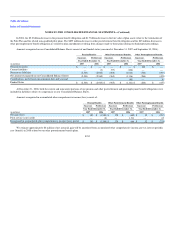

We have obligations under a facilities agreement with the RAIC to pay the bond trustee amounts sufficient to pay the debt service on $47 million in

Facilities Sublease Refunding Revenue Bonds. These bonds were issued in 1996 to refinance bonds that financed the construction of certain airport and

terminal facilities we use at Los Angeles International Airport. We also provide a guarantee to the bond trustee covering payment of the debt service.

General Indemnifications

We are the lessee under many commercial real estate leases. It is common in these transactions for us, as the lessee, to agree to indemnify the lessor and

the lessor's related parties for tort, environmental and other liabilities that arise out of or relate to our use or occupancy of the leased premises. This type of

indemnity would typically make us responsible to indemnified parties for liabilities arising out of the conduct of, among others, contractors, licensees and

invitees at or in connection with the use or occupancy of the leased premises. This indemnity often extends to related liabilities arising from the negligence of

the indemnified parties, but usually excludes any liabilities caused by either their sole or gross negligence and their willful misconduct.

F-44