Delta Airlines 2007 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2007 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

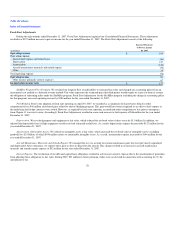

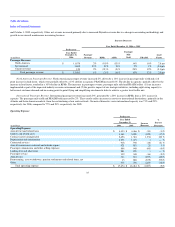

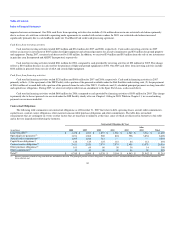

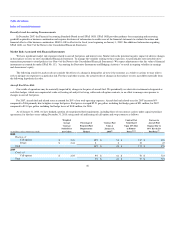

Operating expense was $17.5 billion for 2006, a $1.0 billion, or 5%, decrease compared to 2005. Operating capacity decreased 6% to 148.0 billion

ASMs primarily due to the reduction of our aircraft fleet as part of our business plan initiatives. CASM remained relatively constant at 11.80¢.

Aircraft fuel and related taxes. Aircraft fuel and related taxes remained relatively constant due to reduced consumption despite higher fuel prices. Our

average fuel price per gallon increased 17% to $2.10. Fuel gallons consumed decreased 15% primarily due to a reduction in Mainline capacity and our sale of

ASA. As a result of this sale, ASA's fuel gallons are no longer part of our fuel gallons consumed. Aircraft fuel expense includes fuel hedge losses of $108

million in 2006. We had no fuel hedge gains or losses in 2005.

Salaries and related costs. The decrease in salaries and related costs primarily reflects an 11% decline due to lower Mainline headcount and our sale of

ASA, and an 8% decrease from salary rate and benefit cost reductions for our pilot and non-pilot employees, partially offset by Accounting Adjustments

discussed above.

Contract carrier arrangements. Contract carrier arrangements expense increased primarily due to a 73% increase from the change in how we classify

ASA's expense as a result of its sale to SkyWest and an 18% increase from new contract carrier agreements with Shuttle America and Freedom.

Landing fees and other rents. Landing fees and other rents remained relatively constant due to (1) a 4% decrease from the change in how we classify

ASA's expense as a result of its sale to SkyWest and (2) a net 4% decrease due to our shifting of capacity from domestic to international offset by Accounting

Adjustments discussed above.

Aircraft rent. The decline in aircraft rent expense is primarily due to a 29% decrease from the renegotiation and rejection of certain leases in connection

with our restructuring efforts and an 8% decrease from the change in how we classify ASA's expense as a result of its sale to SkyWest.

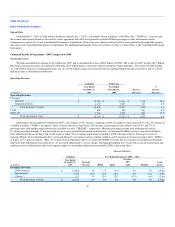

Restructuring, asset writedowns, pension settlements and related items, net. For 2006, restructuring, asset writedowns, pension settlements and related

items, net totaled a $13 million charge, primarily due to the following:

• Workforce Reduction. A $29 million charge related to our decision in 2005 to reduce staffing by approximately 7,000 to 9,000 jobs by December

2007. This charge was partially offset by a $21 million reduction in accruals associated with prior year workforce reduction programs.

For 2005, restructuring, asset writedowns, pension settlements and related items, net totaled an $888 million charge consisting of the following:

• Pension curtailment charge. A $447 million curtailment charge related to the Pilot Plan and the qualified defined benefit pension plan for eligible

non-pilot employees and retirees (the "Non-Pilot Plans"). This charge relates to the freeze of service accruals under the Pilot Plan effective

December 31, 2004, and the impact of the planned reduction of 6,000 to 7,000 jobs announced in November 2004 on the Non-Pilot Plan (see

Note 10 of the Notes to the Consolidated Financial Statements).

• Pension settlements. $388 million in settlement charges primarily related to the Pilot Plan due to a significant increase in pilot retirements and

lump sum distributions from plan assets (see Note 10 of the Notes to the Consolidated Financial Statements).

• Workforce reduction. A $46 million charge related to our decision in 2005 to reduce staffing by approximately 7,000 to 9,000 jobs by December

2007. This charge was partially offset by a net $3 million reduction in accruals associated with prior year workforce reduction programs.

• Asset charges. A $10 million charge related to the removal from service of six B-737-200 aircraft prior to their lease expiration dates.

36