Delta Airlines 2007 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2007 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

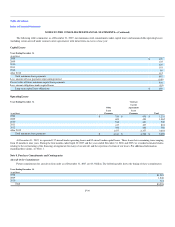

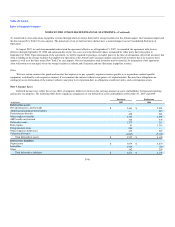

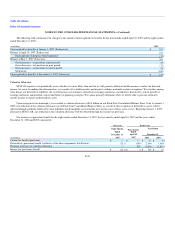

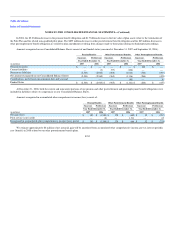

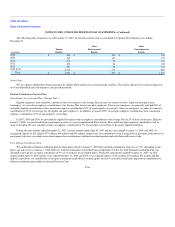

The following table summarizes the changes to the amount of unrecognized tax benefits for the four months ended April 30, 2007 and the eight months

ended December 31, 2007:

(in millions) 2007

Unrecognized tax benefits at January 1, 2007 (Predecessor) $ 217

Balance at April 30, 2007 (Predecessor) 217

Discharge upon emergence from bankruptcy (17)

Balance at May 1, 2007 (Successor) 200

Gross increases—tax positions in prior period 25

Gross decreases—tax positions in prior period (21)

Gross increases—tax positions in current period 48

Settlements (109)

Unrecognized tax benefits at December 31, 2007 (Successor) $ 143

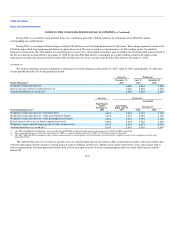

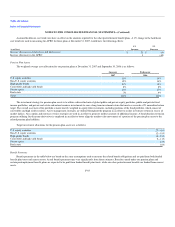

Valuation Allowance

SFAS 109 requires us to periodically assess whether it is more likely than not that we will generate sufficient taxable income to realize our deferred

income tax assets. In making this determination, we consider all available positive and negative evidence and make certain assumptions. We consider, among

other things, our deferred tax liabilities, the overall business environment, our historical earnings and losses, our industry's historically cyclical periods of

earnings and losses and potential, current and future tax planning strategies. We cannot presently determine when we will be able to generate sufficient

taxable income to realize our deferred tax assets.

Upon emergence from bankruptcy, we recorded a valuation allowance of $4.8 billion on our Fresh Start Consolidated Balance Sheet. Prior to January 1,

2009, any reduction in the valuation allowance on our Fresh Start Consolidated Balance Sheet, as a result of the recognition of deferred tax assets, will be

adjusted through goodwill, followed by other indefinite-lived intangible assets until the net carrying costs of these assets is zero. Beginning January 1, 2009,

pursuant to SFAS 141R, any reduction in this valuation allowance will be reflected through the income tax provision.

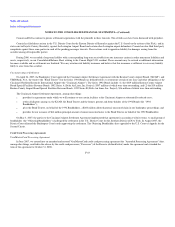

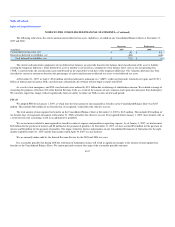

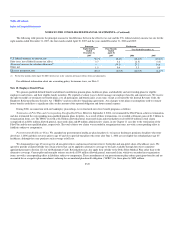

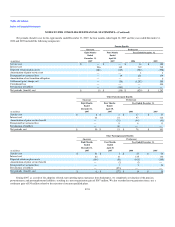

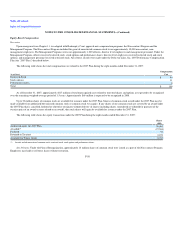

Our income tax (provision) benefit for the eight months ended December 31, 2007, the four months ended April 30, 2007 and the years ended

December 31, 2006 and 2005 consisted of:

(in millions)

Successor Predecessor

Eight Months

Ended

December 31,

2007

Four Months

Ended

April 30,

2007

Year Ended

December 31,

2006 2005

Current tax benefit (provision) $ — $ — $ 17 $ (9)

Deferred tax (provision) benefit (exclusive of the other components listed below) (211) (505) 2,364 1,464

Decrease (increase) in valuation allowance — 509 (1,616) (1,414)

Income tax (provision) benefit $ (211) $ 4 $ 765 $ 41

F-48