Delta Airlines 2007 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2007 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

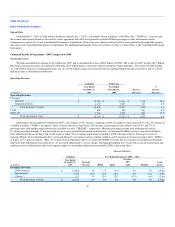

Due to the record high fuel costs experienced over the last several years, aircraft fuel expense and related taxes have become our largest cost. In an

effort to manage these costs, we hedged 38% of our fuel consumption in 2007, resulting in an average fuel price per gallon of $2.21. We realized $111 million

in cash gains on fuel hedge contracts settled during the year.

Consistent with our positive operating financial results for 2007, cash flows from operations generated $1.4 billion, which are net of $875 million in

cash used under the Plan of Reorganization to satisfy our bankruptcy-related obligations to the Air Line Pilots Association ("ALPA") and the Pension Benefit

Guaranty Corporation (the "PBGC"). During 2007, we strengthened our balance sheet through the payment of $1.0 billion in net debt, including two then

outstanding debtor-in-possession financing facilities (the "DIP Facility"), our bankruptcy-related obligations to ALPA and the PBGC and certain other higher

interest-bearing debt maturities. We also invested more than $1.0 billion in capital expenditures, focused primarily on customer service initiatives, such as

new flight equipment and improvements at our Atlanta and New York-JFK hubs.

Business Initiatives

Recent initiatives that we expect will generate positive momentum in our business include:

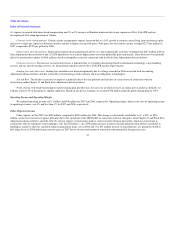

• A joint venture agreement with Air France announced on October 17, 2007, to share revenue and cost on certain transatlantic routes. The initial

implementation of the joint venture in April 2008 will include flights operated by both carriers between Air France's Paris-Charles de Gaulle,

Orly and Lyon hubs and our Atlanta, Cincinnati, New York-JFK and Salt Lake City hubs, as well as all flights between London Heathrow

Airport and the U.S. By 2010, the joint venture is scheduled to be extended to all transatlantic flights operated by Air France and Delta between

North America and Europe and the Mediterranean, as well as all flights between Los Angeles and Tahiti.

• The right to offer nonstop flights between our hub in Atlanta and Shanghai, China, effective March 30, 2008.

• The completion of the conversion of 11 B-767-400 aircraft from domestic to international service, with three remaining B-767-400 aircraft to be

converted by spring 2008. These aircraft support our international expansion strategy. In addition, we launched 16 new international routes

including service from Atlanta to Dubai, Lagos, Prague, Seoul, and Vienna and from New York-JFK to Bucharest and Pisa.

• The announcement of our New York strategy to improve our customers' travel experience at New York-JFK by adding a premium customer

check-in facility in our international terminal and redesigning our schedule to permit significant growth in international routes while helping to

reduce congestion and delays at peak times.

In late 2007, our Board of Directors established a special committee of the Board to work with management to review and analyze strategic options,

including potential consolidation transactions, to assist us in maintaining our leadership position in the airline industry. Any decision of the Board of Directors

regarding strategic options will be based on the best, long-term interests of all Delta stakeholders, including stockholders, employees, customers and the

communities we serve.

27