Delta Airlines 2007 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2007 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

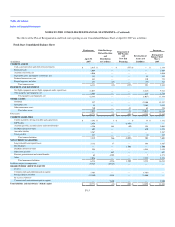

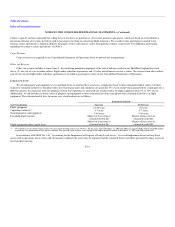

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

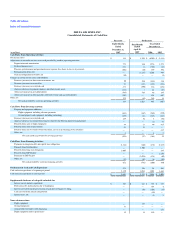

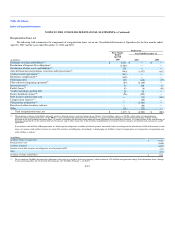

Reorganization Items, net

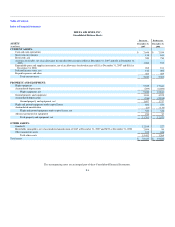

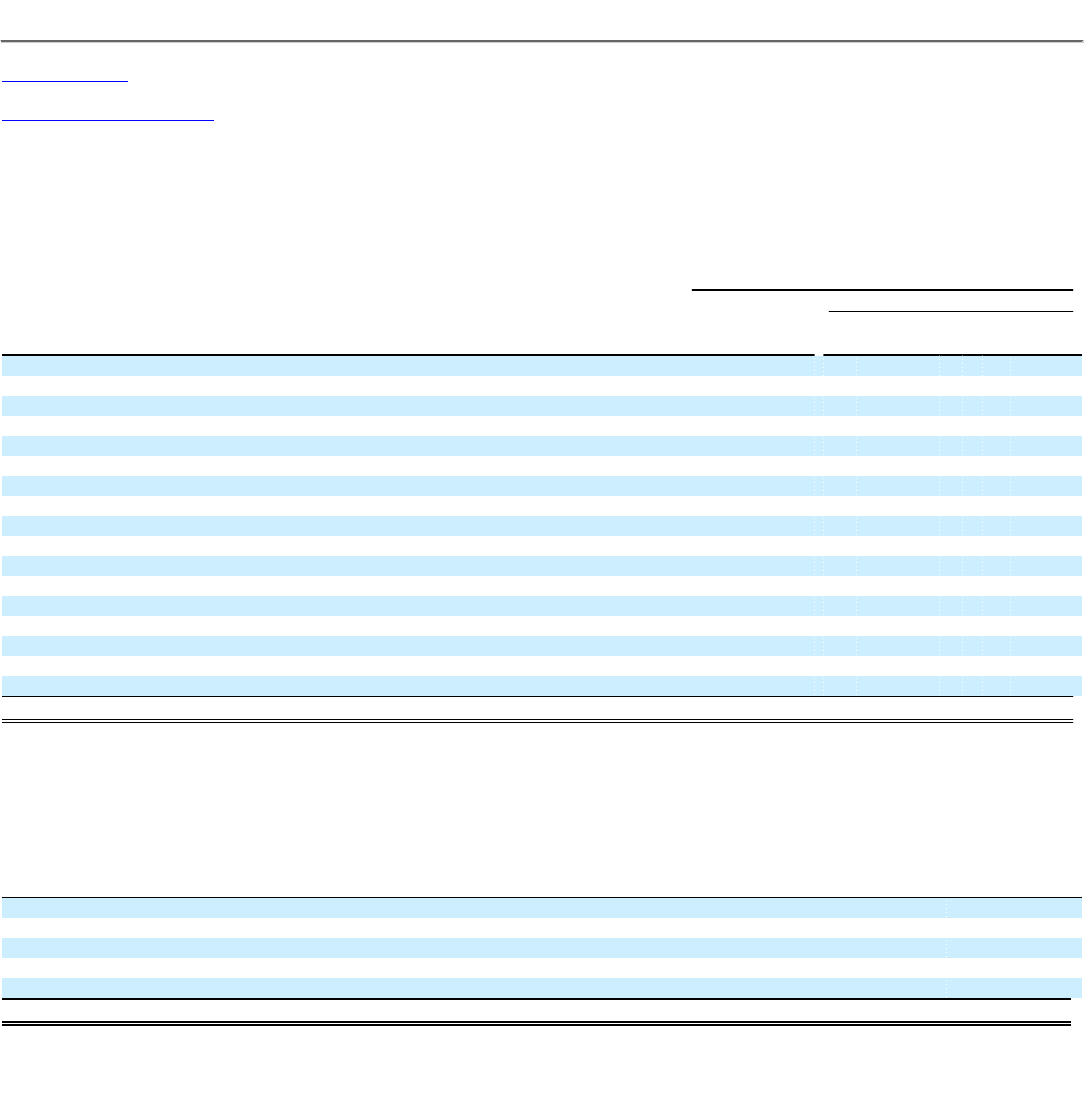

The following table summarizes the components of reorganization items, net on our Consolidated Statements of Operations for the four months ended

April 30, 2007 and the years ended December 31, 2006 and 2005:

Predecessor

Four Months

Ended

April 30,

2007

Year Ended December 31,

(in millions) 2006 2005

Discharge of claims and liabilities(1) $ 4,424 $ — $ —

Revaluation of frequent flyer obligation(2) (2,586) — —

Revaluation of other assets and liabilities(3) 238 — —

Aircraft financing renegotiations, rejections and repossessions(4) (440) (1,671) (611)

Contract carrier agreements(5) (163) — —

Emergence compensation(6) (162) — —

Professional fees (88) (110) (39)

Pilot collective bargaining agreement(7) (83) (2,100) —

Interest income(8) 50 109 17

Facility leases(9) 43 (8) (88)

Vendor waived pre-petition debt 29 36 —

Retiree healthcare claims(10) (26) (539) —

Debt issuance and discount costs — (13) (163)

Compensation expense(11) — (55) —

Pilot pension termination(12) — (1,743) —

Rejection of other executory contracts — (89) —

Other (21) (23) —

Total reorganization items, net $ 1,215 $ (6,206) $ (884)

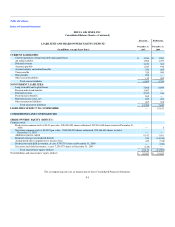

(1) The discharge of claims and liabilities primarily relates to allowed general, unsecured claims in our Chapter 11 proceedings, such as (a) ALPA's claim under our comprehensive

agreement reducing pilot labor costs; (b) the PBGC's claim relating to the termination of the Pilot Plan; (c) claims relating to changes in postretirement healthcare benefits and the

rejection of our non-qualified retirement plans; (d) claims associated with debt and certain municipal bond obligations based upon their rejection; (e) claims relating to the restructuring of

financing arrangements or the rejection of leases for aircraft; and (f) other claims due to the rejection or modification of certain executory contracts, unexpired leases and contract carrier

agreements.

In accordance with the Plan of Reorganization, we discharged our obligations to holders of allowed general, unsecured claims in exchange for the distribution of 386 million newly issued

shares of common stock and the issuance of certain debt securities and obligations. Accordingly, in discharging our liabilities subject to compromise, we recognized a reorganization gain

of $4.4 billion as follows:

(in millions)

Liabilities subject to compromise $ 19,345

Reorganization value (9,400)

Liabilities reinstated (4,429)

Issuance of new debt securities and obligations, net of discounts of $22 (938)

Other (154)

Discharge of claims and liabilities $ 4,424

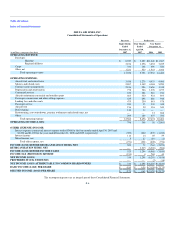

(2) We revalued our SkyMiles frequent flyer obligation at fair value as a result of fresh start reporting, which resulted in a $2.6 billion reorganization charge. For information about a change

in our accounting policy for our frequent flyer program (the "SkyMiles Program"), see Note 2.

F-12