Delta Airlines 2007 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2007 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

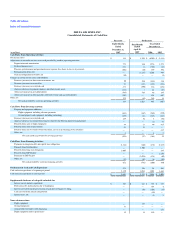

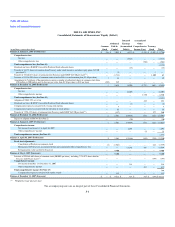

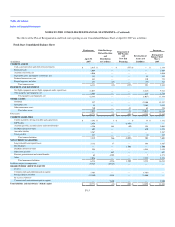

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

• Debt Discharge, Reclassifications and Distribution to Creditors. Adjustments reflect the elimination of liabilities subject to compromise totaling

$19.3 billion on our Consolidated Balance Sheet immediately prior to the Effective Date. Excluding certain liabilities assumed by the Successor,

liabilities subject to compromise of $13.8 billion were discharged in the Chapter 11 cases. Adjustments include:

(a) The recognition or reinstatement of $561 million to accounts payable, accrued salaries and related benefits comprised of (1) a $225

million obligation to the PBGC relating to the termination of the Pilot Plan (which is reflected on the Consolidated Balance Sheet net of a

$3 million discount) and (2) $339 million to reinstate or accrue certain liabilities related to the current portion of our pension and

postretirement benefit plans and for certain administrative claims and cure costs.

(b) The recognition of $697 million in other notes payable comprised of (1) the $650 million Pilot Obligation relating to our comprehensive

agreement with ALPA reducing pilot labor costs (which is reflected on the Consolidated Balance Sheet net of a $19 million discount) and

(2) $66 million principal amount of senior unsecured notes (following the reduction of the $85 million face value of the notes for the

application of certain payments made by us in 2006 and 2007) under the Cincinnati Airport Settlement Agreement. For additional

information on the Cincinnati Airport Settlement Agreement, see Note 8.

(c) The reinstatement of $4.2 billion to pension, postretirement and related benefits comprised of (1) $3.2 billion associated with our non-

pilot defined benefit pension plan (the "Non-Pilot Plan") and other long-term accrued benefits and (2) $1.0 billion associated with

postretirement benefits.

• Repayment of DIP Facility and New Exit Financing. Adjustments reflect the repayment of the DIP Facility and borrowing under the Exit

Facilities. Financing fees related to (1) the DIP Facility were written off at the Effective Date and (2) fees related to the Exit Facilities were

capitalized and will be amortized over the term of the facility. For additional information regarding the Exit Facilities, see Note 6.

• Revaluation of Assets and Liabilities. Significant adjustments reflected in the Fresh Start Consolidated Balance Sheet based on the revaluation of

assets and liabilities are summarized as follows:

(a) Property and equipment, net. A net adjustment of $1.0 billion to reduce the net book value of fixed assets to their estimated fair value.

(b) Goodwill. An adjustment of $12.1 billion to reflect reorganization value of the Successor in excess of the fair value of tangible and

identifiable intangible assets, net of liabilities. During 2007, goodwill decreased by $149 million as a result of net adjustments in the fair

value of certain assets and liabilities. These adjustments were recorded on the Successor's opening balance sheet at May 1, 2007.

(c) Intangibles. An adjustment of $2.9 billion to recognize identifiable intangible assets. These intangible assets reflect the estimated fair

value of our trade name, takeoff and arrival slots, SkyTeam alliance agreements, marketing agreements, customer relationships and

certain contracts. Certain of these assets will be subject to an annual impairment review. For additional information on intangible assets,

see Notes 2 and 5.

(d) Long-term debt and capital leases. An adjustment of $398 million primarily to reflect a $223 million net premium associated with long-

term debt and a $138 million net premium associated with capital lease obligations to be amortized to interest expense over the life of

such debt and capital lease obligations.

(e) SkyMiles deferred revenue. An adjustment to revalue our obligation under the SkyMiles Program to reflect the estimated fair value of

miles to be redeemed in the future. Adjustments of $2.0 billion and $620 million were reflected for the fair value of these miles in long-

term and current

F-16