Delta Airlines 2007 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2007 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

We generally pay the regional carriers, including Comair, amounts defined in their respective contract carrier agreements, which are based on a

determination of the carriers' respective costs of operating their Delta Connection flights and other factors intended to approximate market rates for those

services. These capacity purchase agreements are long-term agreements, usually with initial terms of at least ten years, which grant us the option to extend the

initial term and provide us the right to terminate the entire agreement, or in some cases remove some of the aircraft from the scope of the agreement, for

convenience at certain future dates. Our arrangements with Eagle, which is limited to certain flights operated to and from the Los Angeles International

Airport, as well as a portion of the flights operated by SkyWest Airlines and ExpressJet, are structured as revenue proration agreements. These proration

agreements establish a fixed dollar or percentage division of revenues for tickets sold to passengers traveling on connecting flight itineraries.

Delta Shuttle

We operate a high frequency service targeted to northeast business travelers known as the Delta Shuttle. The Delta Shuttle provides nonstop, hourly

service on business days between New York—LaGuardia Airport ("LaGuardia") and both Boston—Logan International Airport and Washington, D.C.—

Ronald Reagan National Airport ("Reagan").

Domestic Alliances

We have entered into marketing alliances with (1) Continental and Northwest (including regional carriers affiliated with each) and (2) Alaska Airlines

and Horizon Air Industries, both of which include mutual codesharing and reciprocal frequent flyer and airport lounge access arrangements. These marketing

relationships are designed to permit the carriers to retain their separate identities and route networks while increasing the number of domestic and

international connecting passengers using the carriers' route networks.

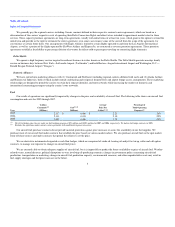

Fuel

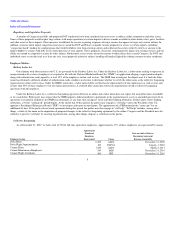

Our results of operations are significantly impacted by changes in the price and availability of aircraft fuel. The following table shows our aircraft fuel

consumption and costs for 2005 through 2007.

Year

Gallons

Consumed (2)

(Millions)

Cost(1) (2)

(Millions)

Average

Price Per

Gallon(1) (2)

Percentage of

Total Operating

Expenses(2)

2007 2,117 $ 4,686 $ 2.21 26%

2006 2,111 4,433 2.10 25%

2005 2,492 4,466 1.79 24%

(1) Net of fuel hedge gains (losses) under our fuel hedging program of $51 million and ($108) million for 2007 and 2006, respectively. We had no fuel hedge contracts in 2005.

(2) Excludes the operations under contract carrier agreements with unaffiliated regional air carriers.

Our aircraft fuel purchase contracts do not provide material protection against price increases or assure the availability of our fuel supplies. We

purchase most of our aircraft fuel under contracts that establish the price based on various market indices. We also purchase aircraft fuel on the spot market,

from off-shore sources and under contracts that permit the refiners to set the price.

We use derivative instruments designated as cash flow hedges, which are comprised of crude oil, heating oil and jet fuel swap, collar and call option

contracts, to manage our exposure to changes in aircraft fuel prices.

We are currently able to obtain adequate supplies of aircraft fuel, but it is impossible to predict the future availability or price of aircraft fuel. Weather-

related events, natural disasters, political disruptions or wars involving oil-producing countries, changes in government policy concerning aircraft fuel

production, transportation or marketing, changes in aircraft fuel production capacity, environmental concerns, and other unpredictable events may result in

fuel supply shortages and fuel price increases in the future.

4