Delta Airlines 2007 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2007 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

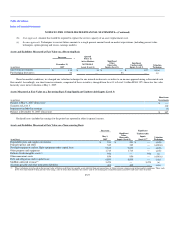

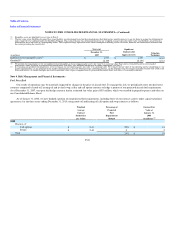

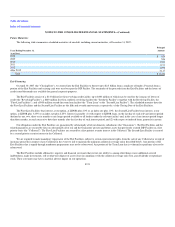

Successor Predecessor

(in millions)

December 31,

2007

December 31,

2006

Total secured and unsecured debt, including liabilities subject to compromise 8,456 12,633

Less: debt classified as liabilities subject to compromise(5)(6) — (4,945)

Total debt 8,456 7,688

Less: current maturities (929) (1,466)

Total long-term debt $ 7,527 $ 6,222

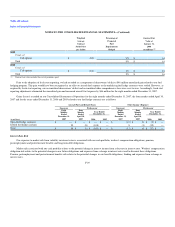

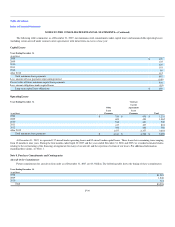

(1) Our senior secured debt and secured debt are collateralized by first liens, and in many cases second and junior liens, on substantially all of our assets, including, but not limited to,

accounts receivable, owned aircraft, certain spare engines, certain spare parts, certain flight simulators, ground equipment, landing slots, international routes, equity interests in certain of

our domestic subsidiaries, intellectual property and real property.

(2) Our variable interest rate long-term debt is shown using interest rates, which represent LIBOR or Commercial Paper plus a specified margin, as provided for in the related agreements.

The rates shown were in effect at December 31, 2007, if applicable. For our long-term debt discharged as part of our emergence from bankruptcy, the rates shown were in effect at

December 31, 2006.

(3) In October 2007, we completed the sale of $1.4 billion of Pass Through Certificates, Series 2007-1 (the "2007-1 Certificates"). The proceeds from this offering were primarily used to

prepay certain existing aircraft-secured and related financings, including these debt instruments. The rates shown for these prepaid debt instruments were in effect at September 30, 2007.

(4) For additional information about this debt, as amended, see "GECC Agreements" below.

(5) In accordance with SOP 90-7, substantially all of our unsecured debt had been classified as liabilities subject to compromise at December 31, 2006. Additionally, certain of our

undersecured debt had been classified as liabilities subject to compromise at December 31, 2006.

(6) Certain of our secured and undersecured debt, which was classified as liabilities subject to compromise at December 31, 2006, has been reclassified to long-term debt or converted to

operating leases as of our emergence from bankruptcy.

(7) In connection with our adoption of fresh start reporting upon our emergence from bankruptcy, we recorded certain of our long-term debt at fair value.

(8) In September 2007, our wholly owned subsidiary, Comair, entered into a long-term debt agreement to borrow up to $290 million to finance the acquisition of 14 CRJ-900 aircraft. We

have provided a guarantee to the lender covering payment on behalf of Comair in the event of default. Our obligations under this debt agreement are secured by the underlying aircraft. As

of December 31, 2007, $160 million of borrowings were outstanding with respect to the delivery of eight aircraft.

F-34