Delta Airlines 2007 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2007 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

improved revenue environment. Our 2006 cash flows from operating activities also include a $116 million decrease in our restricted cash balance primarily

due to a release of cash from restricted to operating under agreements we reached with certain vendors. In 2005, our restricted cash balance increased

significantly primarily due to cash holdbacks under our Visa/MasterCard credit card processing agreement.

Cash flows from investing activities

Cash used in investing activities totaled $625 million and $361 million for 2007 and 2006, respectively. Cash used in investing activities in 2007

reflects an increase in investment of $545 million for flight equipment and advanced payments for aircraft commitments and $78 million for ground property

and equipment. During 2007, restricted cash decreased by $185 million. In addition, we received $34 million and $83 million from the sale of our investments

in priceline.com Incorporated and ARINC Incorporated, respectively.

Cash used in investing activities totaled $361 million for 2006, compared to cash provided by investing activities of $22 million for 2005. This change

reflects a $401 million decrease in cash used for the purchase of flight and ground equipment in 2006. Our 2005 cash flows from investing activities include

$842 million in proceeds from our sale of ASA and certain flight equipment.

Cash flows from financing activities

Cash used in financing activities totaled $120 million and $606 million for 2007 and 2006, respectively. Cash used in financing activities in 2007

primarily reflects (1) the repayment of the DIP Facility with a portion of the proceeds available under the Exit Facilities and existing cash, (2) the prepayment

of $863 million of secured debt with a portion of the proceeds from the sale of the 2007-1 Certificates and (3) scheduled principal payments on long-term debt

and capital lease obligations. During 2007, we also received proceeds from an amendment to the Spare Parts Loan, as discussed above.

Cash used in financing activities totaled $606 million for 2006, compared to cash provided by financing activities of $830 million for 2005. This change

is primarily due to the net proceeds we received under the DIP Facility shortly after our Chapter 11 filing in 2005. While in Chapter 11, we ceased making

payments on our unsecured debt.

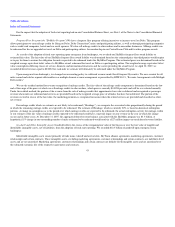

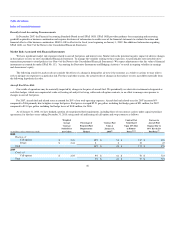

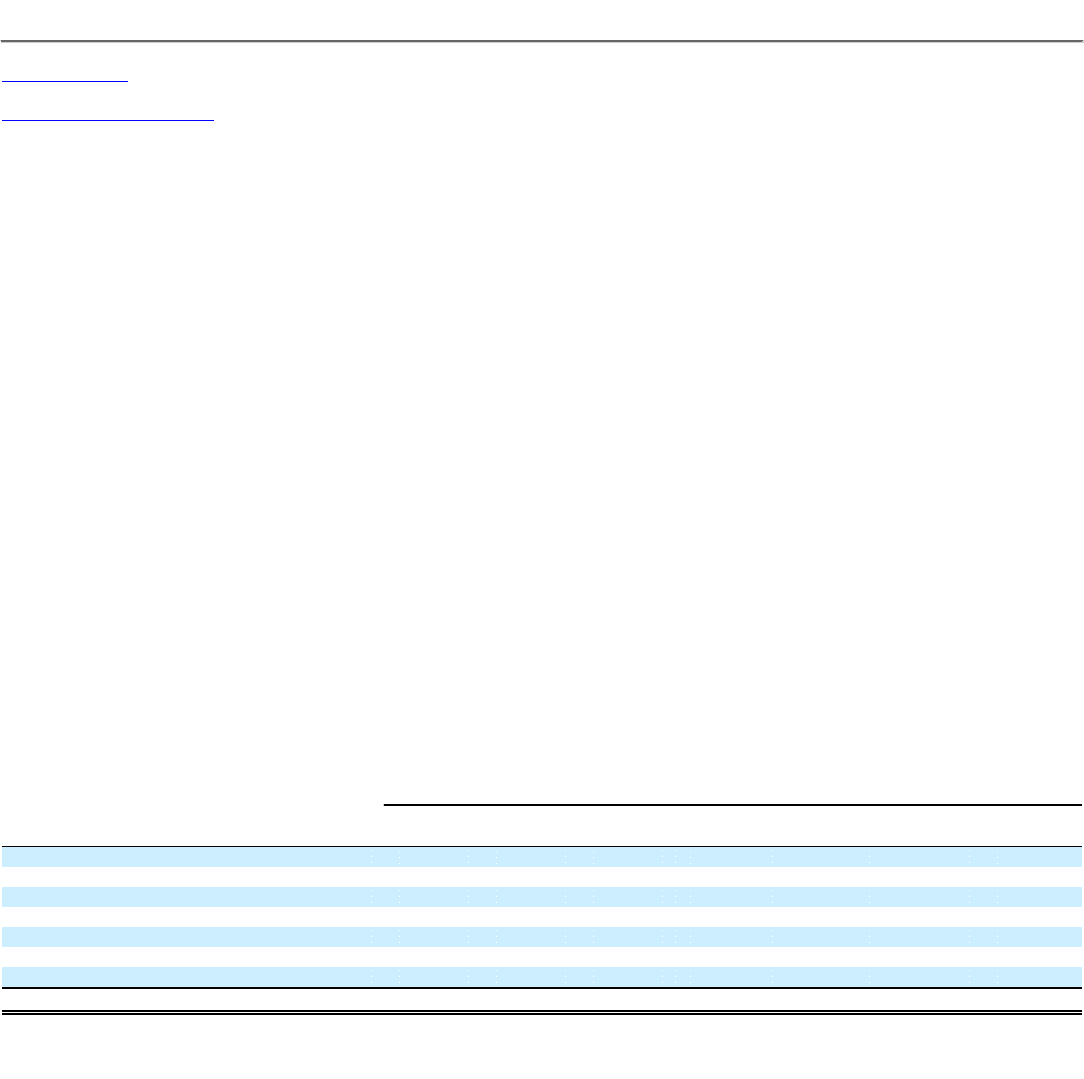

Contractual Obligations

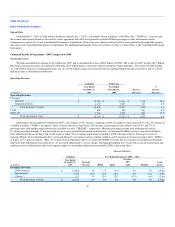

The following table summarizes our contractual obligations as of December 31, 2007 that relate to debt, operating leases, aircraft order commitments,

capital leases, contract carrier obligations, other material, noncancelable purchase obligations and other commitments. The table does not include

commitments that are contingent on events or other factors that are uncertain or unknown at this time, some of which are discussed in footnotes to this table

and in the text immediately following the footnotes.

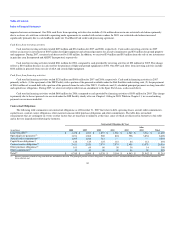

Contractual Obligations by Year

(in millions) 2008 2009 2010 2011 2012

After

2012 Total

Long-term debt(1) $ 1,478 $ 1,035 $ 1,857 $ 1,588 $ 1,567 $ 3,964 $ 11,489

Operating lease payments(2) 1,231 1,062 969 824 758 3,854 8,698

Aircraft order commitments(3) 1,295 1,248 712 — — — 3,255

Capital lease obligations(4) 128 125 125 118 84 112 692

Contract carrier obligations(5) 2,411 2,520 2,575 2,574 2,458 13,978 26,516

Other purchase obligations(6) 161 69 60 50 36 14 390

Other commitments(7) 41 40 40 40 40 20 221

Total(8) $ 6,745 $ 6,099 $ 6,338 $ 5,194 $ 4,943 $ 21,942 $ 51,261

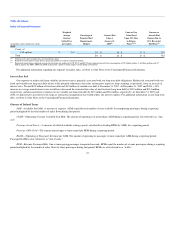

(1) Interest payments related to long-term debt are included in the table. The principal portion of these obligations is included in our Consolidated Balance Sheets. Estimated amounts for

future interest and

39