Delta Airlines 2007 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2007 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

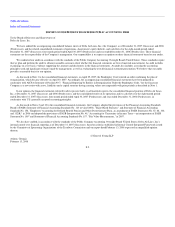

Recently Issued Accounting Pronouncements

In December 2007, the Financial Accounting Standards Board issued SFAS 141R. SFAS 141R provides guidance for recognizing and measuring

goodwill acquired in a business combination and requires disclosure of information to enable users of the financial statements to evaluate the nature and

financial effects of the business combination. SFAS 141R is effective for fiscal years beginning on January 1, 2009. For additional information regarding

SFAS 141R, see Note 9 of the Notes to the Consolidated Financial Statements.

Market Risks Associated with Financial Instruments

We have significant market risk exposure related to aircraft fuel prices and interest rates. Market risk is the potential negative impact of adverse changes

in these prices or rates on our Consolidated Financial Statements. To manage the volatility relating to these exposures, we periodically enter into derivative

transactions pursuant to stated policies (see Note 4 of the Notes to the Consolidated Financial Statements). We expect adjustments to the fair value of financial

instruments accounted for under SFAS No. 133, "Accounting for Derivative Instruments and Hedging Activities" to result in ongoing volatility in earnings

and shareowners' equity.

The following sensitivity analyses do not consider the effects of a change in demand for air travel, the economy as a whole or actions we may take to

seek to mitigate our exposure to a particular risk. For these and other reasons, the actual results of changes in these prices or rates may differ materially from

the following hypothetical results.

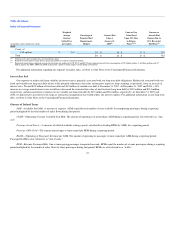

Aircraft Fuel Price Risk

Our results of operations may be materially impacted by changes in the price of aircraft fuel. We periodically use derivative instruments designated as

cash flow hedges, which are comprised of crude oil, heating oil and jet fuel swap, collar and call option contracts, in an effort to manage our exposure to

changes in aircraft fuel prices.

For 2007, aircraft fuel and related taxes accounted for 26% of our total operating expenses. Aircraft fuel and related taxes for 2007 increased 6%

compared to 2006 primarily due to higher average fuel prices. Fuel prices averaged $2.21 per gallon, including fuel hedge gains of $51 million, for 2007

compared to $2.10 per gallon, including fuel hedge losses of $108 million, for 2006.

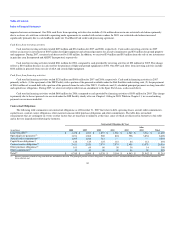

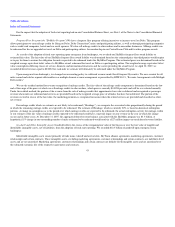

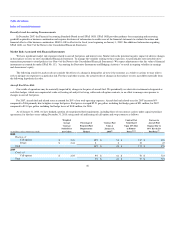

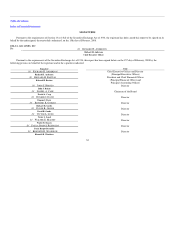

As of January 31, 2008, we have hedged a portion of our projected fuel requirements, including those of our contract carriers under capacity purchase

agreements, for the three years ending December 31, 2010, using crude oil and heating oil call option and swap contracts as follows:

(in millions, unless otherwise stated)

Weighted

Average

Contract

Strike Price

per Gallon

Percentage of

Projected Fuel

Requirements

Hedged

Contract Fair

Value at

January 31,

2008(1)

Contract Fair

Value Based

Upon 10% Rise

in Futures

Prices(1)(2)

Increase in

Aircraft Fuel

Expense Due to

10% Rise in Jet

Fuel Price(3)

2008

Heating oil

Call options $ 2.43 22% $ 91 $ 157 $ 529

Swaps $ 2.44 2 2 15 47

Total 24% $ 93 $ 172 $ 576

2009

Crude oil

Call options $ 2.05 9% $ 61 $ 70 $ 723

Total 9% $ 61 $ 70 $ 723

46