Delta Airlines 2007 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2007 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

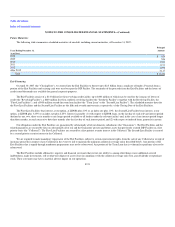

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

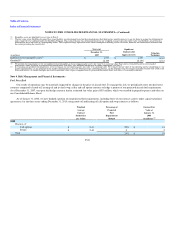

Reclassifications

Upon emergence and as a result of the adoption of fresh start reporting, we changed the classification of certain items on our Consolidated Statements

of Operations. We also reclassified prior period amounts to conform to current period presentations. These changes have no impact on operating or net income

in any period prior or subsequent to our emergence from bankruptcy. These reclassifications are as follows for the years ended December 31, 2006 and 2005:

• In-sourcing revenue. We reclassified $310 million and $240 million, respectively, associated with revenue for our maintenance in-sourcing

business to other, net revenue, and reclassified the related costs to (1) salaries and related costs, (2) aircraft maintenance materials and outside

repairs and (3) other operating expense. Previously, these revenues and expenses were reflected on a net basis in other operating expense.

• Delta Global Services, LLC ("DGS"). We reclassified $174 million and $168 million, respectively, associated with salaries for employees at our

wholly owned subsidiary, DGS, to salaries and related costs. DGS provides staffing services to both internal and external customers. Previously,

these costs were recorded in contracted services.

• Fuel taxes. We reclassified $114 million and $195 million, respectively, to aircraft fuel expense. Previously, fuel taxes were recorded in other

operating expense.

• Crown Room Club. We reclassified $51 million and $49 million, respectively, associated with the expense of our Crown Room Club operations

to several operating expense line items, primarily salaries and related costs and contracted services. Our Crown Room Club provides amenities to

members when traveling. Previously, these expenses were recorded net in other, net revenue.

• Arrangements with Other Airlines. We reclassified to passenger revenue $133 million and $32 million, respectively, of revenue associated with

(1) SkyMiles earned or redeemed on other airlines and (2) frequent flyer miles of other airlines earned or redeemed on Delta. Previously, these

amounts were reflected in other, net revenue.

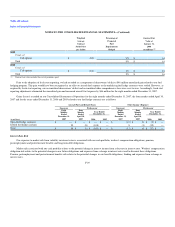

Note 3. Fair Value Measurements

As described in Note 2, we adopted SFAS 157 upon emerging from bankruptcy. SFAS 157, among other things, defines fair value, establishes a

consistent framework for measuring fair value and expands disclosure for each major asset and liability category measured at fair value on either a recurring

or nonrecurring basis. SFAS 157 clarifies that fair value is an exit price, representing the amount that would be received to sell an asset or paid to transfer a

liability in an orderly transaction between market participants. As such, fair value is a market-based measurement that should be determined based on

assumptions that market participants would use in pricing an asset or liability. As a basis for considering such assumptions, SFAS 157 establishes a three-tier

fair value hierarchy, which prioritizes the inputs used in measuring fair value as follows:

• Level 1. Observable inputs such as quoted prices in active markets;

• Level 2. Inputs, other than the quoted prices in active markets, that are observable either directly or indirectly; and

• Level 3. Unobservable inputs in which there is little or no market data, which require the reporting entity to develop its own assumptions.

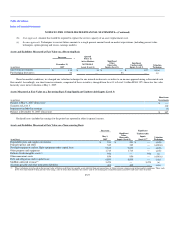

Assets and liabilities measured at fair value are based on one or more of three valuation techniques noted in SFAS 157. The three valuation techniques

are identified in the tables below. Where more than one technique is noted, individual assets or liabilities were valued using one or more of the noted

techniques. The valuation techniques are as follows:

(a) Market approach. Prices and other relevant information generated by market transactions involving identical or comparable assets or liabilities.

F-26