Delta Airlines 2007 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2007 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

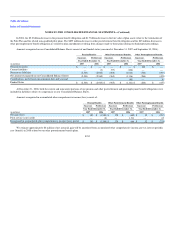

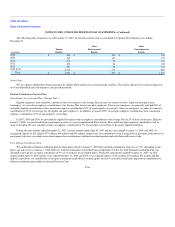

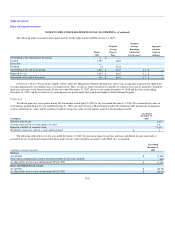

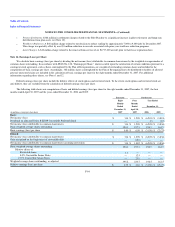

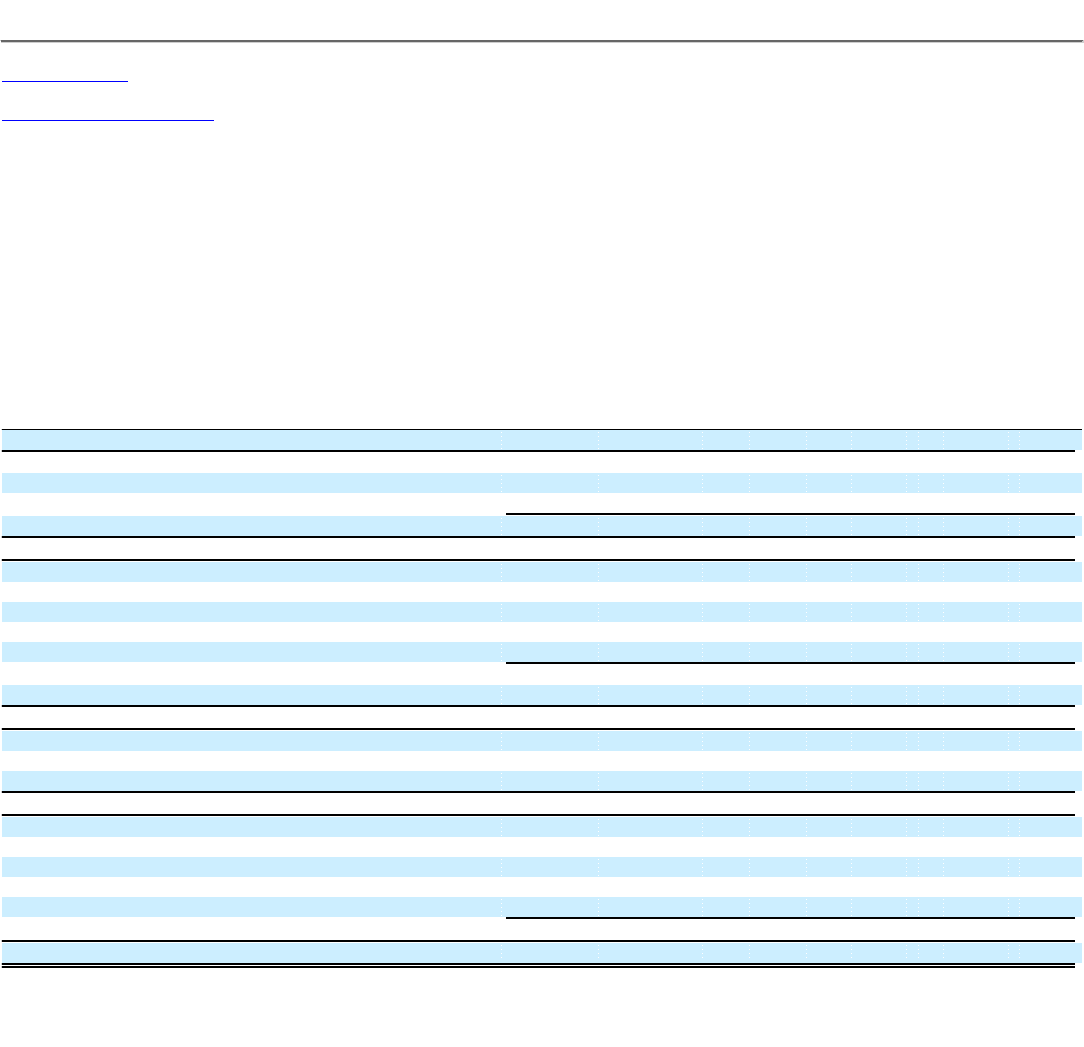

Note 13. Comprehensive Income (Loss)

Comprehensive income (loss) primarily includes (1) our reported net income (loss), (2) changes in our unrecognized pension, postretirement, and

postemployment benefit liabilities, (3) changes in our deferred tax asset valuation allowance related to our unrecognized pension, postretirement, and

postemployment liabilities and (4) changes in the effective portion of our open fuel hedge contracts, which qualify for hedge accounting.

The following table shows the components of accumulated other comprehensive income (loss) for the eight months ended December 31, 2007, the four

months ended April 30, 2007 and the years ended December 31, 2006 and 2005:

(in millions)

Additional

Minimum

Pension

Liability

Unrecognized

Pension

Liability

Fuel

Derivative

Instruments

Marketable

Equity

Securities

Valuation

Allowance Total

Balance at January 1, 2005 (Predecessor) $ (2,329) $ — $ — $ — $ (29) $ (2,358)

Additional minimum pension liability adjustments (365) — — — — (365)

Unrealized gain — — — 1 — 1

Tax effect 141 — — — (141) —

Net of tax (224) — — 1 (141) (364)

Balance at December 31, 2005 (Predecessor) (2,553) — — 1 (170) (2,722)

Termination of Pilot Plan 2,264 — — — — 2,264

Additional minimum pension liability adjustments 257 — — — — 257

Unrealized (loss) gain — — (93) 1 — (92)

Realized loss — — 70 — — 70

Tax effect (958) — — — 239 (719)

Net of tax 1,563 — (23) 1 239 1,780

Adoption of SFAS 158 990 (727) — — 161 424

Balance at December 31, 2006 (Predecessor) — (727) (23) 2 230 (518)

Pension adjustment — 6 — — — 6

Unrealized gain — — 70 — — 70

Realized gain — — (1) — — (1)

Balance at April 30, 2007 (Predecessor) — (721) 46 2 230 (443)

Elimination of Predecessor other comprehensive loss — 721 (46) (2) (230) 443

Pension adjustment — 408 — — — 408

Unrealized gain — — 73 — — 73

Realized gain — — (46) — — (46)

Tax effect — (155) (11) — 166 —

Net of tax — 253 16 — 166 435

Balance at December 31, 2007 (Successor) $ — $ 253 $ 16 $ — $ 166 $ 435

For additional information related to our fuel hedge contracts and our additional minimum pension liability, see Notes 4 and 10, respectively.

F-62