Delta Airlines 2007 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2007 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

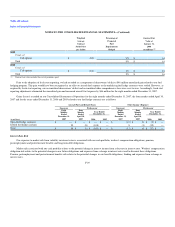

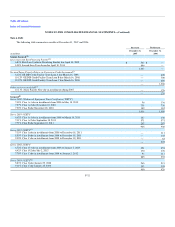

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(3) interruption to our operations due to employee strike, terrorist attack, etc. and/or (4) consolidation of competitors within the industry, which are not offset

by other factors such as improved yield or an increase in Control Premiums, could result in an impairment in the year in which the change occurs and in future

years.

In accordance with SOP 90-7, a reduction in the valuation allowance associated with the realization of pre-emergence deferred tax assets will

sequentially reduce the value of recorded goodwill followed by other indefinite-lived intangible assets until the net carrying cost of these assets is zero.

During the eight months ended December 31, 2007, we reduced goodwill by $223 million comprised of (1) $211 million associated with recognition of pre-

emergence deferred tax assets and (2) $12 million of other income tax reserve adjustments.

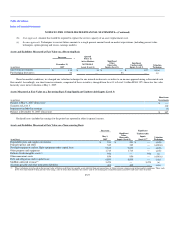

Interest Expense

While operating as a debtor-in-possession, in accordance with SOP 90-7, we recorded interest expense only to the extent (1) interest would be paid

during our Chapter 11 proceedings or (2) it was probable interest would be an allowed priority, secured or unsecured claim. Interest expense recorded on our

Consolidated Statements of Operations totaled $390 million for the eight months ended December 31 2007, $262 million for the four months ended April 30,

2007 and $870 million and $1.0 billion for the years ended December 31, 2006 and 2005, respectively. Contractual interest expense (including interest

expense that is associated with obligations classified as liabilities subject to compromise) totaled $366 million for the four months ended April 30, 2007 and

$1.2 billion for each of the years ended December 31, 2006 and 2005.

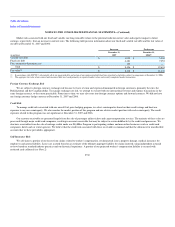

Income Taxes

In accordance with SFAS 109, we account for deferred income taxes under the liability method. Under this method, we recognize deferred tax assets

and liabilities based on the tax effects of temporary differences between the financial statement and tax bases of assets and liabilities, as measured by current

enacted tax rates. A valuation allowance is recorded to reduce deferred tax assets when necessary. Deferred tax assets and liabilities are recorded net as

current and noncurrent deferred income taxes on our Consolidated Balance Sheets (see Note 9).

Our income tax provisions are based on calculations and assumptions that are subject to examination by the Internal Revenue Service and other tax

authorities. Although we believe that the positions taken on previously filed tax returns are reasonable, we have established tax and interest reserves in

recognition that various taxing authorities may challenge the positions we have taken, which could result in additional liabilities for taxes and interest. We

review the reserves as circumstances warrant and adjust the reserves as events occur that affect our potential liability, such as lapsing of applicable statutes of

limitations, conclusion of tax audits, a change in exposure based on current calculations, identification of new issues, release of administrative guidance, or

the rendering of a court decision affecting a particular issue. We would adjust the income tax provision in the period in which the facts that give rise to the

revision become known. In the event that the adjustment pertains to a pre-emergence tax position, we would adjust goodwill followed by other indefinite-

lived intangible assets until the net carrying value of these assets is zero. Beginning January 1, 2009, any adjustments to pre-emergence tax positions will be

made through the income tax provision pursuant to SFAS 141R.

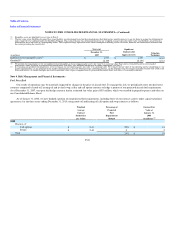

Investments in Debt and Equity Securities

We record our investments classified as available-for-sale securities at fair value in other noncurrent assets on our Consolidated Balance Sheets. Any

change in the fair value of these securities is recorded in accumulated other comprehensive income (loss). We record our investments classified as trading

securities, primarily comprised of insured auction rate securities, at fair value in current assets on our Consolidated Balance Sheets and recognize changes in

the fair value of these securities in other (expense) income on our Consolidated Statements of Operations. At December 31, 2007, we had $107 million of

insured auction rate securities recorded

F-23