Delta Airlines 2007 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2007 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

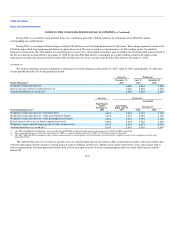

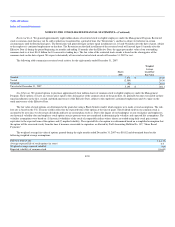

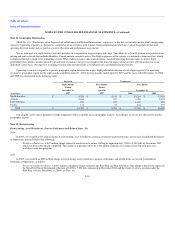

Profit Sharing Program

Our broad based employee profit sharing program provides that, for each year in which we have an annual pre-tax profit, as defined, we will pay at least

15% of that profit to employees. If the annual pre-tax profit is greater than $1.5 billion, we will pay 20% of the amount that exceeds $1.5 billion.

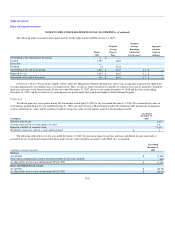

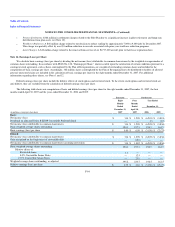

Note 11. Sale of ASA

On September 7, 2005, we sold ASA, our wholly owned subsidiary, to SkyWest for a purchase price of $425 million. In conjunction with this

transaction, we amended our contract carrier agreements with ASA and SkyWest Airlines, a wholly owned subsidiary of SkyWest, under which those regional

airlines serve as Contract Carriers. The sale of ASA resulted in an immaterial gain that is being amortized over the life of our contract carrier agreement with

ASA. For additional information on our contract carrier agreements with ASA and SkyWest Airlines, see Note 8.

After the sale of ASA to SkyWest, the revenues and expenses related to our contract carrier agreement with ASA are reported as regional affiliates

passenger revenue and contract carrier arrangements, respectively, in our Consolidated Statements of Operations. Prior to the sale, expenses related to ASA

were reported in the applicable expense line item in our Consolidated Statements of Operations.

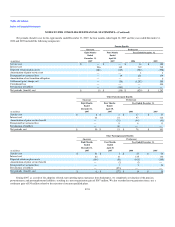

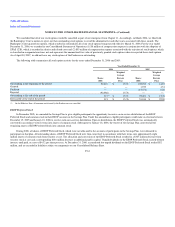

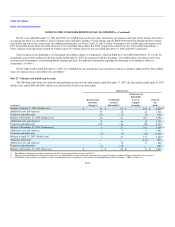

Note 12. Equity and Equity-Based Compensation

Equity

Common Stock. On the Effective Date, all common stock issued by the Predecessor was cancelled. In connection with our emergence from bankruptcy,

we began issuing shares of new common stock, par value $0.0001 per share, pursuant to the Plan of Reorganization. The new common stock is subject to the

terms of our Amended and Restated Certificate of Incorporation (the "New Certificate"), which supersedes the Certificate of Incorporation in effect prior to

the Effective Date.

The New Certificate authorizes us to issue a total of 2.0 billion shares of capital stock, of which 1.5 billion may be shares of common stock and

500 million may be shares of preferred stock. The Plan of Reorganization contemplates the issuance of 400 million shares of common stock, consisting of

386 million shares to holders of allowed general, unsecured claims and up to 14 million shares under the compensation program for our non-contract, non-

management employees ("the Non-contract Program") described below. The Plan of Reorganization also contemplates the issuance of common stock under

the compensation program for management employees (the "Management Program") described below. For additional information regarding the distribution of

new common stock under the Plan of Reorganization, see Note 1.

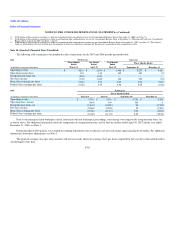

Preferred Stock. The New Certificate permits us to issue preferred stock in one or more series. It authorizes the Board of Directors (1) to fix the

descriptions, powers (including voting powers), preferences, rights, qualifications, limitations and restrictions with respect to any series of preferred stock and

(2) to specify the number of shares of any series of preferred stock. As of December 31, 2007, no preferred stock was issued and outstanding.

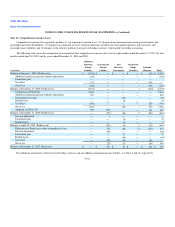

Treasury Stock. In connection with the issuance of common stock to employees under the Plan of Reorganization, we withheld the portion of shares

necessary to cover the employees' portion of required tax withholdings, as well as for awards under the 2007 Plan, which is described below. These shares are

valued at cost, which equals the market price of the common stock on the date of issuance. At December 31, 2007, there were 7,238,973 shares of common

stock held in treasury at a weighted average cost of $20.52 per share. Substantially all of these shares were withheld to cover the employees' portion of

required tax withholdings.

F-57