Delta Airlines 2007 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2007 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

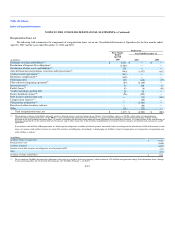

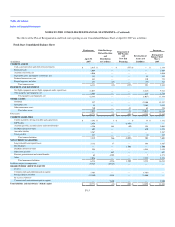

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

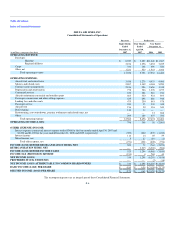

companies; (2) a review and analysis of several recent transactions in the airline industry; and (3) a calculation of the present value of future cash flows based

on our projections. Utilizing these methodologies, the reorganization value of the Successor was estimated to be in the range of $9.4 billion and $12.0 billion.

The enterprise value, and corresponding reorganization value, is dependent upon achieving the future financial results set forth in our projections, as well as

the realization of certain other assumptions. There can be no assurance that the projections will be achieved or that the assumptions will be realized. The

excess reorganization value (using the low end of the range) over the fair value of tangible and identifiable intangible assets, net of liabilities, has been

reflected as goodwill in the Fresh Start Consolidated Balance Sheet. The financial projections and estimates of enterprise and reorganization value are not

incorporated herein.

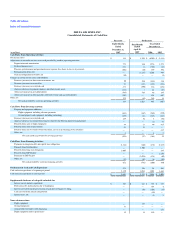

All estimates, assumptions and financial projections, including the fair value adjustments, the financial projections, and the enterprise value and

reorganization value projections, are inherently subject to significant uncertainties and the resolution of contingencies beyond our control. Accordingly, there

can be no assurance that the estimates, assumptions and financial projections will be realized, and actual results could vary materially.

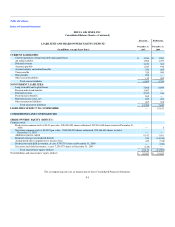

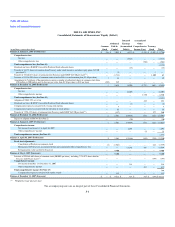

The adjustments set forth in the following Fresh Start Consolidated Balance Sheet in the columns captioned "Debt Discharge, Reclassifications and

Distribution to Creditors," "Repayment of DIP Facility and New Exit Financing" and "Revaluation of Assets and Liabilities" reflect the effect of the

consummation of the transactions contemplated by the Plan of Reorganization, including the settlement of various liabilities, securities issuances, incurrence

of new indebtedness and cash payments.

F-14