Delta Airlines 2007 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2007 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

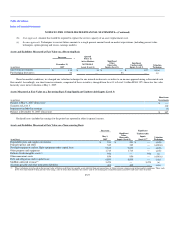

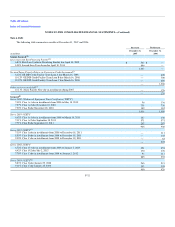

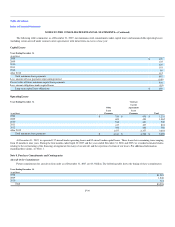

Future Maturities

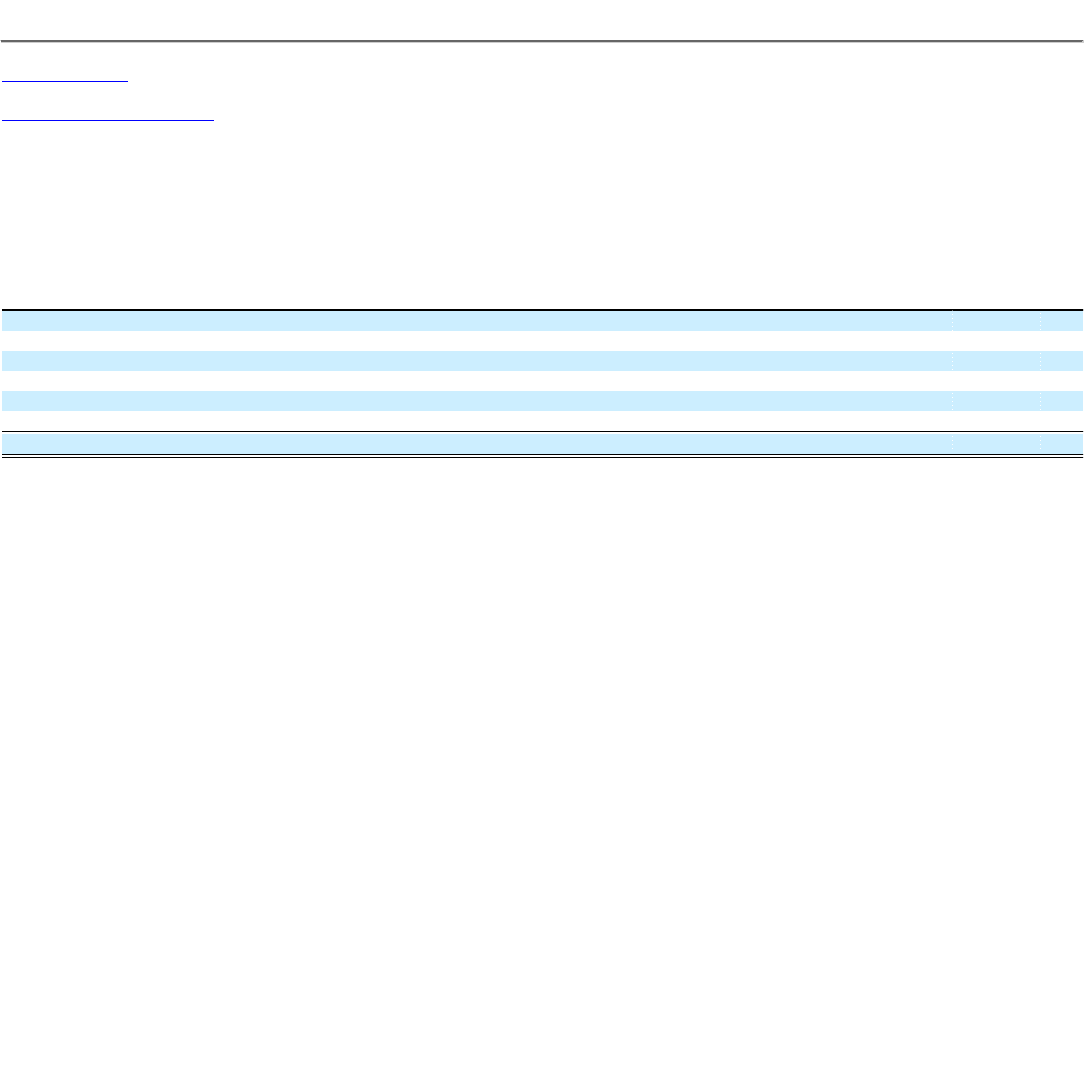

The following table summarizes scheduled maturities of our debt, including current maturities, at December 31, 2007:

Years Ending December 31,

Principal

Amount

(in millions)

2008 $ 929

2009 526

2010 1,383

2011 1,211

2012 1,290

After 2012 3,117

Total $ 8,456

Exit Financing

On April 30, 2007 (the "Closing Date"), we entered into the Exit Facilities to borrow up to $2.5 billion from a syndicate of lenders. Proceeds from a

portion of the Exit Facilities and existing cash were used to repay the DIP Facility. The remainder of the proceeds from the Exit Facilities and the letters of

credit issued thereunder are available for general corporate purposes.

The Exit Facilities consist of a $1.0 billion first-lien revolving credit facility, up to $400 million of which may be used for the issuance of letters of

credit (the "Revolving Facility"), a $600 million first-lien synthetic revolving facility (the "Synthetic Facility") (together with the Revolving Facility, the

"First-Lien Facilities"), and a $900 million second-lien term loan facility (the "Term Loan" or the "Second-Lien Facility"). The scheduled maturity dates for

the First-Lien Facilities and the Second-Lien Facility are the fifth and seventh anniversaries, respectively, of the Closing Date of the Exit Facilities.

The First-Lien Facilities bear interest, at our option, at LIBOR plus 2.0% or an index rate plus 1.0%; the Second-Lien Facility bears interest, at our

option, at LIBOR plus 3.25% or an index rate plus 2.25%. Interest is payable (1) with respect to LIBOR loans, on the last day of each relevant interest period

(defined as one, two, three or six months or any longer period available to all lenders under the relevant facility) and, in the case of any interest period longer

than three months, on each successive date three months after the first day of such interest period, and (2) with respect to indexed loans, quarterly in arrears.

Our obligations under the Exit Facilities are guaranteed by substantially all of our domestic subsidiaries (the "Guarantors"). The Exit Facilities and the

related guarantees are secured by liens on substantially all of our and the Guarantors' present and future assets that previously secured DIP Facility on a first

priority basis (the "Collateral"). The First-Lien Facilities are secured by a first priority security interest in the Collateral. The Second-Lien Facility is secured

by a second priority security interest in the Collateral.

We are required to make mandatory repayments of the Exit Facilities, subject to certain reinvestment rights, from the sale of any Collateral or receipt of

insurance proceeds in respect of any Collateral in the event we fail to maintain the minimum collateral coverage ratios described below. Any portion of the

Exit Facilities that is repaid through mandatory prepayments may not be reborrowed. Any portion of the Term Loan that is voluntarily repaid may also not be

reborrowed.

The Exit Facilities include affirmative, negative and financial covenants that restrict our ability to, among other things, incur additional secured

indebtedness, make investments, sell or otherwise dispose of assets if not in compliance with the collateral coverage ratio tests, pay dividends or repurchase

stock. These covenants may have a material adverse impact on our operations.

F-35