Delta Airlines 2007 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2007 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(3) transferred to Aron allocations in pipeline systems through which jet fuel is delivered to storage facilities for the Atlanta airport, the Cincinnati airport and

the three major New York City area airports. The initial sale of our jet fuel inventory did not have a material impact on our Consolidated Statement of

Operations.

In August 2007, we and Aron amended and restated the agreement effective as of September 15, 2007. As amended, the agreement with Aron is

effective through September 30, 2008 and automatically renews for a one year term thereafter unless terminated by either party thirty days prior to

September 30, 2008. Upon termination of the agreement, we will be required to purchase, at market prices at the time of termination, all jet fuel inventory that

Aron is holding in the storage facilities that support our operations at the Atlanta and Cincinnati airports and all jet fuel inventory that is in transit to these

airports as well as to the three major New York City area airports. Our cost to purchase such inventory may be material. At termination of the agreement,

Aron will return to us our rights to use the storage facilities in Atlanta and Cincinnati and our allocations in pipeline systems.

Other

We have certain contracts for goods and services that require us to pay a penalty, acquire inventory specific to us or purchase contract specific

equipment, as defined by each respective contract, if we terminate the contract without cause prior to its expiration date. Because these obligations are

contingent on our termination of the contract without cause prior to its expiration date, no obligation would exist unless such a termination occurs.

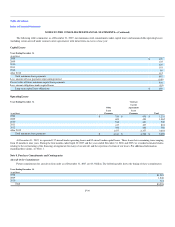

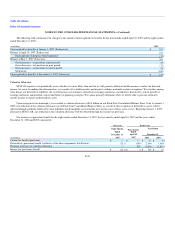

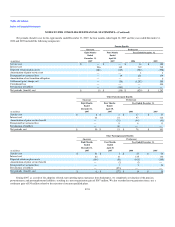

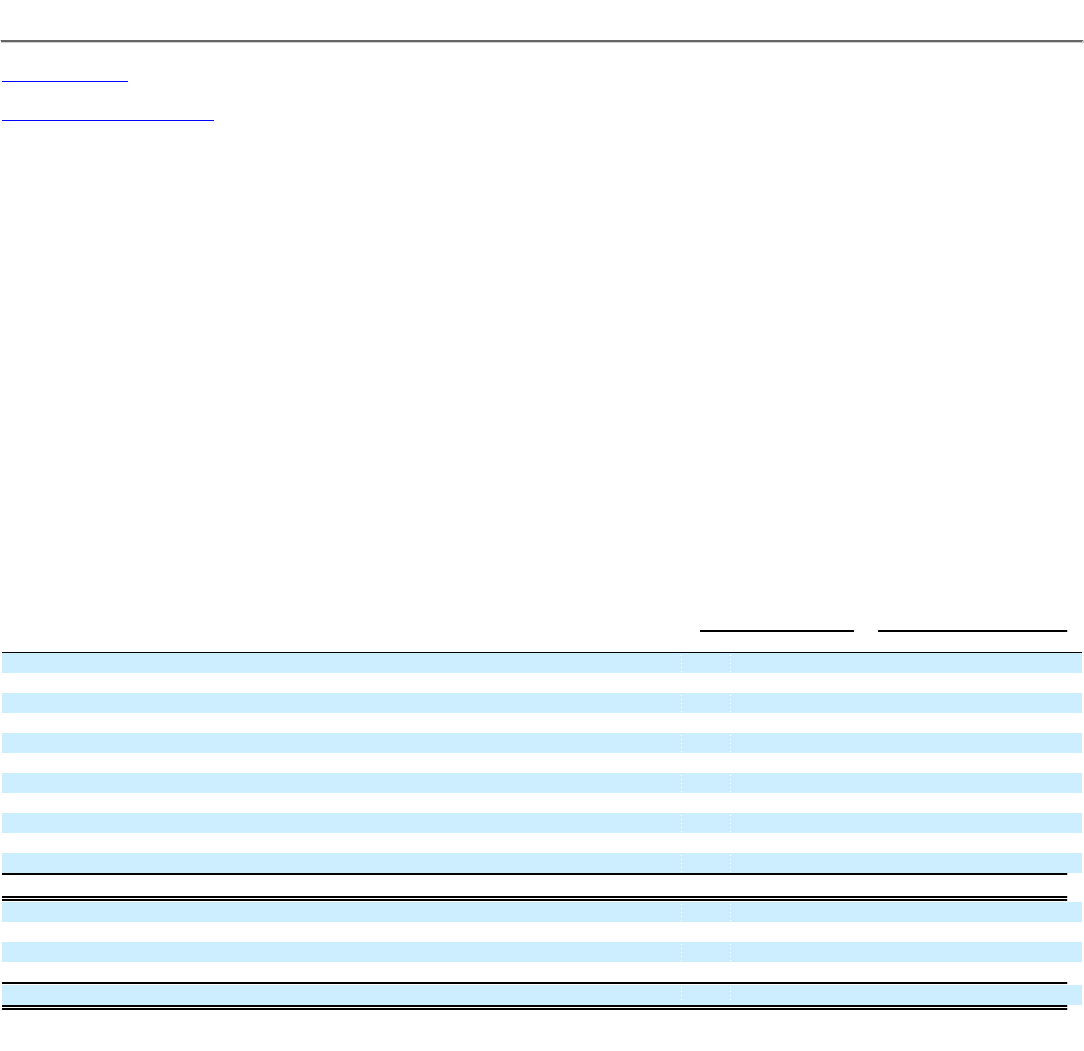

Note 9. Income Taxes

Deferred income taxes reflect the net tax effect of temporary differences between the carrying amounts of assets and liabilities for financial reporting

and income tax purposes. The following table shows significant components of our deferred tax assets and liabilities at December 31, 2007 and 2006:

Successor Predecessor

(in millions) 2007 2006

Deferred tax assets:

Net operating loss carryforwards $ 3,461 $ 2,921

Additional minimum pension liability — 615

Postretirement benefits 438 681

Other employee benefits 1,340 2,898

AMT credit carryforward 346 346

Deferred revenue 1,273 311

Rent expense 81 1,215

Reorganization items 988 —

Other temporary differences 473 287

Valuation allowance (4,843) (5,169)

Total deferred tax assets $ 3,557 $ 4,105

Deferred tax liabilities:

Depreciation $ 3,079 $ 3,870

Intangibles 1,049 (20)

Other 142 259

Total deferred tax liabilities $ 4,270 $ 4,109

F-46