Delta Airlines 2007 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2007 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

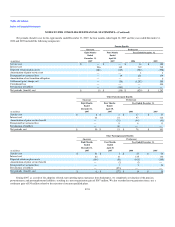

In 2006, the $5.2 billion decrease in the pension benefit obligation and $1.7 billion decrease in the fair value of plan assets relate to the termination of

the Pilot Plan and the related non-qualified pilot plans. The $859 million decrease in other postretirement benefit obligation and the $65 million decrease in

other postemployment benefit obligation are related to plan amendments resulting from changes made to those plans during our bankruptcy proceedings.

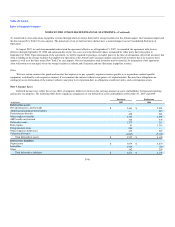

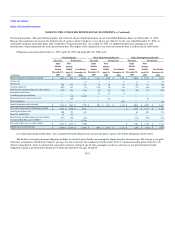

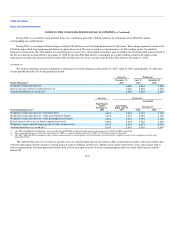

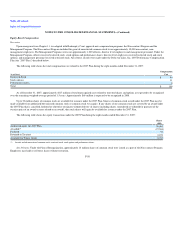

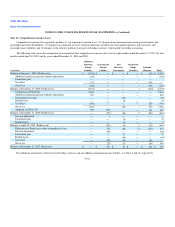

Amounts recognized on our Consolidated Balance Sheets consist of and funded status (measured at December 31, 2007 and September 30, 2006):

Pension Benefits Other Postretirement Benefits Other Postemployment Benefits

Successor Predecessor Successor Predecessor Successor Predecessor

Year Ended December 31, Year Ended December 31, Year Ended December 31,

(in millions) 2007 2006 2007 2006 2007 2006

Noncurrent assets $ — $ — $ — $ — $ 100 $ —

Current liabilities — (3) (97) (106) — —

Noncurrent liabilities (2,501) (2,962) (868) (1,010) (364) (493)

Net amount recognized on our Consolidated Balance Sheets (2,501) (2,965) (965) (1,116) (264) (493)

Contributions, net between measurement date and year end — — — (45) — 36

Funded Status $ (2,501) $ (2,965) $ (965) $ (1,161) $ (264) $ (457)

At December 31, 2006, both the current and noncurrent portions of our pension and other postretirement and postemployment benefit obligations were

included in liabilities subject to compromise on our Consolidated Balance Sheets.

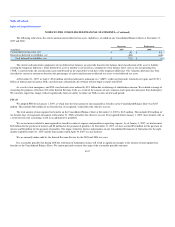

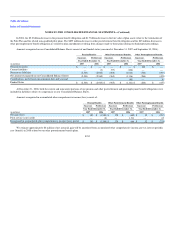

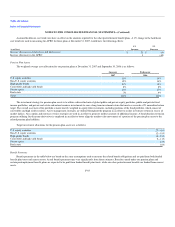

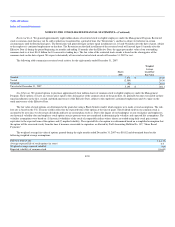

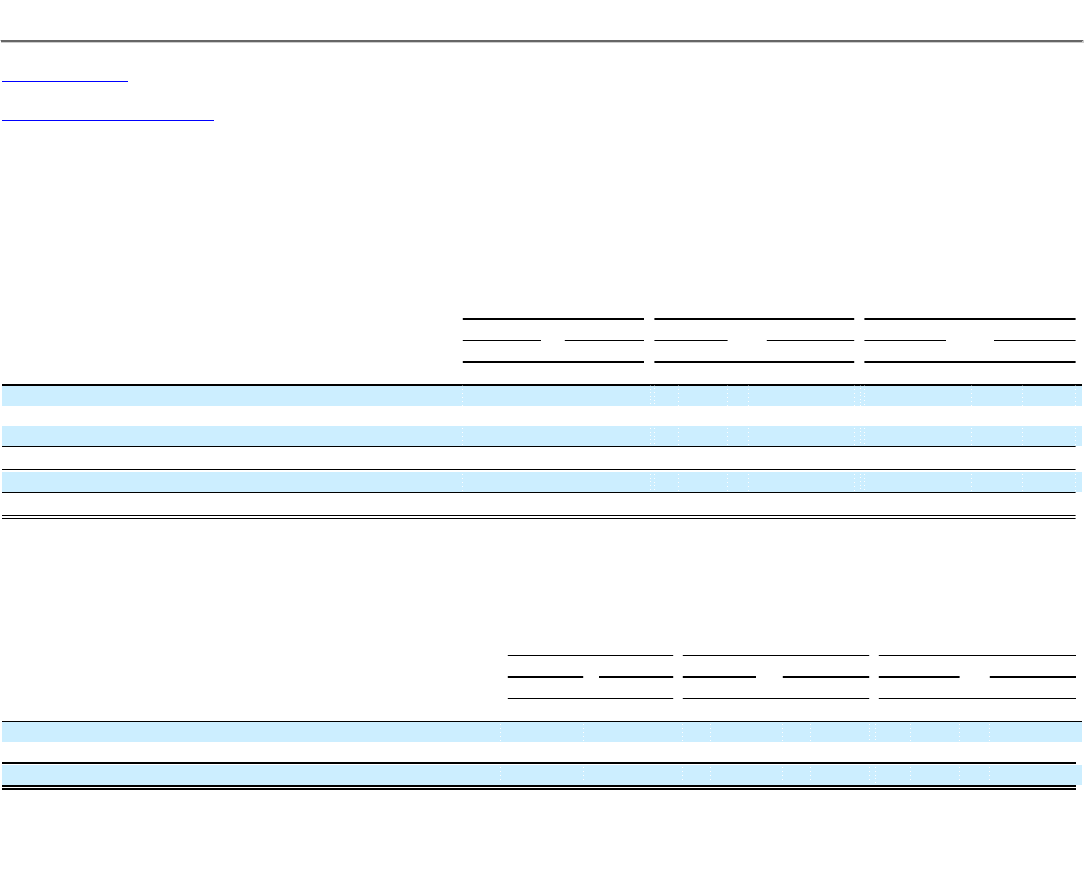

Amounts recognized in accumulated other comprehensive income (loss) consist of:

Pension Benefits Other Postretirement Benefits Other Postemployment Benefits

Successor Predecessor Successor Predecessor Successor Predecessor

Year Ended December 31, Year Ended December 31, Year Ended December 31,

(in millions) 2007 2006 2007 2006 2007 2006

Net gain (loss) $ 185 $ (1,583) $ 178 $ (645) $ 32 $ (287)

Prior service (cost) credit — (6) — 1,311 — 63

Recognized in accumulated other comprehensive income (loss), pretax $ 185 $ (1,589) $ 178 $ 666 $ 32 $ (224)

We estimate approximately $6 million of net actuarial gain will be amortized from accumulated other comprehensive income, pre-tax into net periodic

cost (benefit) in 2008 related to our other postretirement benefit plans.

F-52