Delta Airlines 2007 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2007 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

Income Tax (Provision) Benefit

For 2007, we recorded an income tax provision totaling $207 million. We have recorded a full valuation allowance against our net deferred tax assets,

excluding the effect of the deferred tax liabilities that are unable to be used as a source of income against these deferred tax assets, based on our belief that it is

more likely than not that the asset will not be realized in the future. We will continue to assess the need for a full valuation allowance in future periods. In

accordance with SOP 90-7, the reduction of the valuation allowance associated with the realization of pre-emergence deferred tax assets will sequentially

reduce the value of our recorded goodwill followed by other indefinite-lived intangible assets until the net carrying cost of these assets is zero. Accordingly,

during 2007, we reduced goodwill by $211 million with respect to the realization of pre-emergence deferred tax assets.

For 2006, we recorded an income tax benefit totaling $765 million. The amount primarily reflects a decrease to our deferred tax asset valuation

allowances from the reversal of accrued pension liabilities associated with the Pilot Plan and pilot non-qualified plan obligations upon each plan's termination.

For additional information about the income tax valuation allowance, see Note 9 of the Notes to the Consolidated Financial Statements.

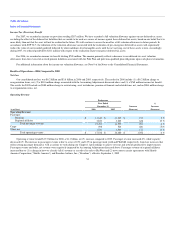

Results of Operations—2006 Compared to 2005

Net Loss

Our consolidated net loss was $6.2 billion and $3.8 billion in 2006 and 2005, respectively. The results for 2006 include (1) a $6.2 billion charge to

reorganization items, net, (2) a $310 million charge associated with the Accounting Adjustments discussed above and (3) a $765 million income tax benefit.

The results for 2005 include an $888 million charge to restructuring, asset writedowns, pension settlements and related items, net, and an $884 million charge

to reorganization items, net.

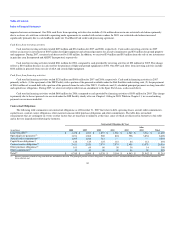

Operating Revenue

Predecessor

Year Ended

December 31, Increase

(Decrease)

%

Increase

(Decrease)(in millions) 2006 2005

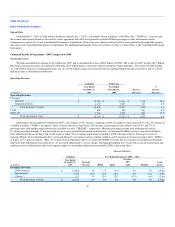

Operating Revenue:

Passenger:

Mainline $ 11,640 $ 11,367 $ 273 2 %

Regional affiliates 3,853 3,225 628 19 %

Total passenger revenue 15,493 14,592 901 6 %

Cargo 498 524 (26) (5)%

Other, net 1,541 1,364 177 13 %

Total operating revenue $ 17,532 $ 16,480 $ 1,052 6 %

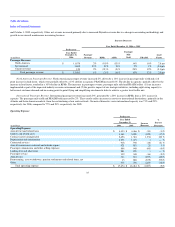

Operating revenue totaled $17.5 billion for 2006, a $1.1 billion, or 6%, increase compared to 2005. Passenger revenue increased 6%, while capacity

decreased 6%. The increase in passenger revenue is due to a rise of 10% and 12% in passenger mile yield and PRASM, respectively, from fare increases that

reflect strong passenger demand as well as actions we took during our Chapter 11 proceedings to achieve revenue and network productivity improvements.

Passenger revenue and other, net revenue were negatively impacted by Accounting Adjustments discussed above. Passenger revenue of regional affiliates

increased due to (1) a change in how we classify ASA's revenue as a result of its sale to SkyWest and (2) new contract carrier agreements with Shuttle

America Corporation ("Shuttle America") and Freedom Airlines, Inc. ("Freedom"), effective September 1, 2005

34