Delta Airlines 2007 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2007 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

Other. The decrease in other operating expense primarily reflects (1) a 13% decrease due to an adjustment related to certain non-income tax reserves,

(2) a 12% decrease from the Accounting Adjustments discussed above and (3) a 10% decrease related to the change in how we classify ASA's expense as a

result of its sale to SkyWest.

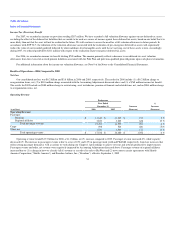

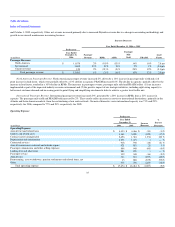

Operating Income (Loss) and Operating Margin

We reported operating income of $58 million for 2006, compared to an operating loss of $2.0 billion for 2005. Operating margin, which is the ratio of

operating income (loss) to operating revenue, was less than 1% and (12%) for 2006 and 2005, respectively.

Other (Expense) Income

Other expense, net was $820 million for 2006, compared to $974 million for 2005. This change is substantially attributable to (1) a 16%, or $162

million, decrease in interest expense primarily due to a $206 million decrease associated with the accounting treatment of certain interest charges under our

Chapter 11 proceedings in accordance with SOP 90-7 (see Note 2 of the Notes to the Consolidated Financial Statements), partially offset by a $97 million

increase from a higher level of debt outstanding and higher interest rates and (2) a $19 million increase to miscellaneous, net, primarily related to the

ineffective portion of our fuel hedge positions.

Reorganization Items, Net

Reorganization items, net totaled a $6.2 billion charge for 2006. For additional information about these items, see "Combined Results of Operations—

2007 Compared to 2006."

Reorganization items, net totaled an $884 million charge for 2005, primarily consisting of the following:

• Aircraft financing renegotiations, rejections and repossessions. A $611 million charge for estimated claims associated with restructuring the

financing arrangements for seven aircraft, the rejection of 50 aircraft leases and the repossession of 15 aircraft.

• Debt issuance and discount costs. A $163 million charge associated with the write-off of certain debt issuance costs and discounts in conjunction

with the valuation of our unsecured and undersecured debt.

• Facility leases. An $88 million charge for estimated claims in connection with the rejection of certain unexpired facility leases and the related

bond obligations.

Income Tax Benefit

For 2006, we recorded an income tax benefit totaling $765 million. The amount primarily reflects a decrease to our deferred tax asset valuation

allowances from the reversal of accrued pension liabilities associated with the Pilot Plan and pilot non-qualified plan obligations upon each plan's termination.

For 2005, we recorded an income tax benefit totaling $41 million. The amount is primarily the result of a $1.6 billion adjustment to our deferred tax

asset valuation allowance due to increases in the deferred tax asset related to our additional minimum pension liability and net operating loss carryforwards.

For additional information about the income tax valuation allowance, see Note 9 of the Notes to the Consolidated Financial Statements.

Financial Condition and Liquidity

We expect to meet our cash needs for 2008 from cash flows from operations, cash and cash equivalents and short-term investments and financing

arrangements. We also have an undrawn $1.0 billion revolving credit facility that is a part of our Exit Facilities. Our cash and cash equivalents and short-term

investments were $2.8 billion at December 31, 2007, compared to $2.6 billion at December 31, 2006.

37