Delta Airlines 2007 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2007 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

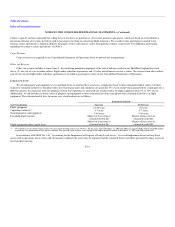

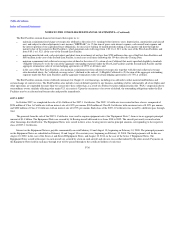

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(b) Cost approach. Amount that would be required to replace the service capacity of an asset (replacement cost).

(c) Income approach. Techniques to convert future amounts to a single present amount based on market expectations (including present value

techniques, option-pricing and excess earnings models).

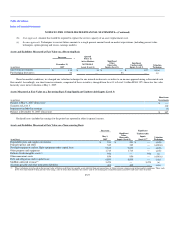

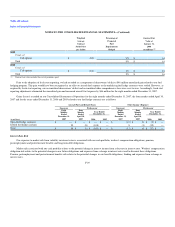

Assets and Liabilities Measured at Fair Value on a Recurring Basis

Successor Quoted

Prices In

Active Markets

for Identical

Assets (Level 1)

Significant

Other

Observable

Inputs (Level 2)

Significant

Unobservable

Inputs (Level 3)

Valuation

Technique

(in millions)

December 31,

2007

Short-term investments $ 138 $ 31 $ — $ 107 (a)(c)

Fuel hedging derivatives 53 — 53 — (a)

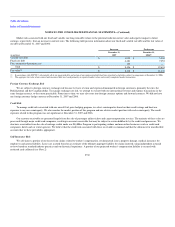

Based on market conditions, we changed our valuation technique for our insured auction rate securities to an income approach using a discounted cash

flow model. Accordingly, our short-term investments, comprised of these securities, changed from Level 1 to Level 3 within SFAS 157's three-tier fair value

hierarchy since initial valuation at May 1, 2007.

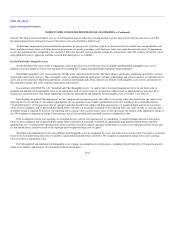

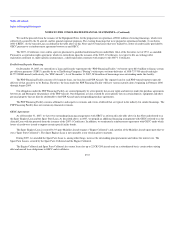

Assets Measured at Fair Value on a Recurring Basis Using Significant Unobservable Inputs (Level 3)

(in millions)

Short-term

Investments

Balance at May 1, 2007 (Successor) $ —

Transfers to Level 3 110

Impairment included in earnings (3)

Balance at December 31, 2007 (Successor) $ 107

Realized losses included in earnings for the period are reported in other (expense) income.

Assets and Liabilities Measured at Fair Value on a Nonrecurring Basis

Successor Significant

Other

Observable

Inputs (Level 2)

Significant

Unobservable

Inputs

(Level 3)(1)

Valuation

Technique

(in millions)

May 1,

2007

Expendable parts and supplies inventories $ 241 $ 241 $ — (a)(b)

Prepaid expense and other 343 343 — (a)(b)(c)

Net flight equipment and net flight equipment under capital lease 9,833 9,833 — (a)(b)

Other property and equipment 1,713 1,713 — (a)(b)

Definite-lived intangible assets(2) 956 — 956 (c)

Other noncurrent assets 856 856 — (a)(b)(c)

Debt and obligations under capital lease 6,899 6,899 — (a)(c)

SkyMiles deferred revenue(3) 3,474 — 3,474 (a)

Accounts payable and other noncurrent liabilities 405 405 — (a)(c)

(1) These valuations were based on the present value of future cash flows for specific assets derived from our projections of future revenue, expense and airline market conditions. These cash

flows were discounted to their present value using a rate of return that considers the relative risk of not realizing the estimated annual cash flows and time value of money.

F-27