Delta Airlines 2007 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2007 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

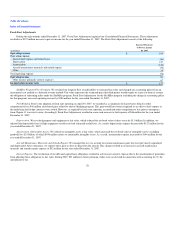

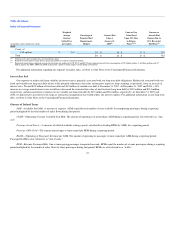

Significant Liquidity Events

Significant liquidity events during 2007 were as follows:

• We entered into the Exit Facilities to borrow up to $2.5 billion from a syndicate of lenders. We used a portion of the proceeds from the Exit

Facilities and existing cash to repay the DIP Facility. Our Exit Facilities include certain affirmative, negative and financial covenants. We were in

compliance with these covenants at December 31, 2007.

• We completed the sale of $1.4 billion of the 2007-1 Certificates. The proceeds from this transaction were primarily used to prepay $961 million

of existing aircraft-secured financing, effectively lowering the interest rate and deferring more than $560 million in maturities originally due in

2010 and 2011. The additional proceeds of $449 million are available for general corporate purposes.

• We funded $875 million associated with two bankruptcy-related obligations in accordance with our comprehensive agreement with ALPA and

our settlement agreement with the PBGC.

• We entered into an amendment to our Visa/MasterCard credit card processing agreement (the "Amended Processing Agreement") that, among

other things, resulted in the release by the credit card processor of the then existing $804 million cash reserve under the agreement and extended

the term of the agreement to October 31, 2008.

• We entered into an amendment to the Spare Parts Loan with GECC. As a result of this amendment, among other things, the outstanding principal

amount under the Spare Parts Loan was increased to $415 million, providing an incremental $181 million in proceeds, and the interest rate we

pay under this facility was reduced.

• We entered into an agreement to borrow up to $233 million to finance certain pre-delivery payments payable by us to Boeing with respect to

future deliveries of 10 B-737-700 aircraft and eight B-777-200LR aircraft.

• Our wholly owned subsidiary, Comair, entered into a long-term debt agreement to borrow up to $290 million to finance the acquisition of 14

CRJ-900 aircraft. We have provided a guarantee to the lender covering payment on behalf of Comair in the event of default. Our obligations

under this debt agreement are secured by the underlying aircraft. As of December 31, 2007, $160 million of borrowings were outstanding with

respect to delivery of eight aircraft.

For additional information about these events, see Note 6 of the Notes to the Consolidated Financial Statements.

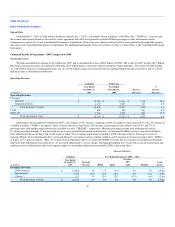

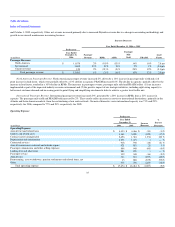

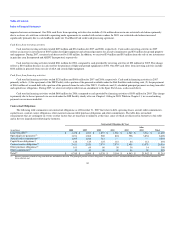

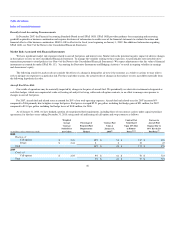

Combined Sources and Uses of Cash

Cash flows from operating activities

Cash provided by operating activities was $1.4 billion and $993 million in 2007 and 2006, respectively. Cash flows from operating activities in 2007

reflect $875 million in cash used under the Plan of Reorganization to satisfy bankruptcy-related obligations under our comprehensive agreement with ALPA

and settlement agreement with the PBGC. Cash flows from operating activities during 2007 also reflect (1) the release of $804 million from restricted cash

under the Amended Processing Agreement, (2) revenue and network productivity improvements, including right-sizing capacity to better meet customer

demand and the continued restructuring of our route network to reduce less productive short haul domestic flights and reallocate widebody aircraft to

international routes and (3) a $476 million decrease in short-term investments primarily from sales of auction rate securities.

Cash flows provided by operating activities in 2006 reflect an increase of $401 million in working capital compared to 2005. This increase was

primarily a result of revenue and network productivity improvements, restructuring initiatives and labor cost reductions implemented during our Chapter 11

proceedings and an

38