Delta Airlines 2007 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2007 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

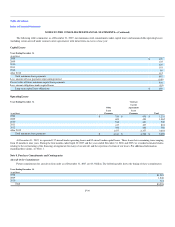

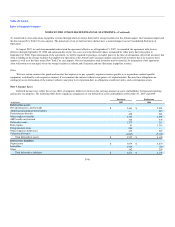

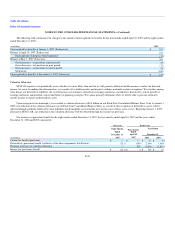

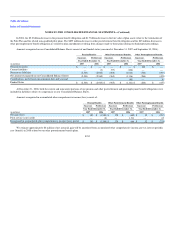

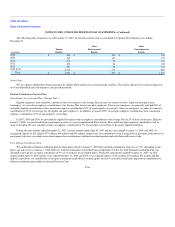

The following table presents the principal reasons for the difference between the effective tax rate and the U.S. federal statutory income tax rate for the

eight months ended December 31, 2007, the four months ended April 30, 2007 and the years ended December 31, 2006 and 2005:

Successor Predecessor

Eight Months

Ended

December 31,

2007

Four Months

Ended

April 30,

2007

Year Ended December 31,

2006 2005

U.S. federal statutory income tax rate 35.0% 35.0% (35.0)% (35.0)%

State taxes, net of federal income tax effect 3.7 3.6 (2.5) (3.3)

(Decrease) increase in valuation allowance(1) — (39.3) 23.2 36.6

Other, net 1.5 0.4 3.3 0.6

Effective income tax rate 40.2% (0.3)% (11.0)% (1.1)%

(1) For the four months ended April 30, 2007, the decrease in the valuation allowance reflects fresh start adjustments.

For additional information about our accounting policy for income taxes, see Note 2.

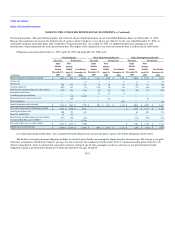

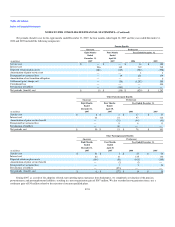

Note 10. Employee Benefit Plans

We sponsor qualified defined benefit and defined contribution pension plans, healthcare plans, and disability and survivorship plans for eligible

employees and retirees, and their eligible family members. We regularly evaluate ways to better manage our employee benefits and control costs. We reserve

the right to modify or terminate our benefit plans as to all participants and beneficiaries at any time, except as restricted by the Internal Revenue Code, the

Employee Retirement Income Security Act ("ERISA") and our collective bargaining agreements. Any changes to the plans or assumptions used to estimate

future benefits could have a significant effect on the amount of the reported obligation and future annual expense.

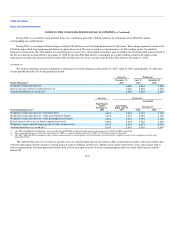

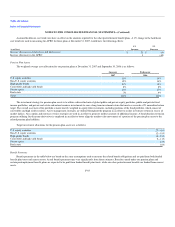

During 2006, in connection with our bankruptcy proceedings, we restructured our retiree benefit programs as follows:

Termination of Pilot Plan and Corresponding Non-Qualified Plans. Effective September 2, 2006, we terminated the Pilot Plan in a distress termination,

and also terminated the corresponding non-qualified pension plans for pilots. As a result of these terminations, we recorded settlement gains of $1.3 billion in

reorganization items, net. The PBGC received a $2.2 billion allowed general, unsecured claim and retired pilots received $810 million in total claims

(comprised of an $801 million allowed general, unsecured claim and $9 million administrative claim), in our Chapter 11 case due to the termination of the

Pilot Plan and the non-qualified plans, respectively. The total of these two claims was recorded in reorganization items, net with a corresponding offset in

liabilities subject to compromise.

Postretirement Healthcare Plans. We amended our postretirement healthcare plan for pilots (1) to increase healthcare premiums for pilots who retire

after June 1, 2006 and their survivors prior to age 65 and (2) to provide that pilots who retire after June 1, 2006 are not eligible for subsidized post age 65

healthcare, although they may purchase such coverage at full cost.

We eliminated post age 65 coverage for all non-pilot retirees and increased current retirees' (both pilot and non-pilot) share of healthcare costs. We

agreed to provide a limited subsidy for certain retirees that can be applied to alternative coverage to be made available through the retiree committee

appointed pursuant to Section 1114 of the Bankruptcy Code. Retired pilots may also apply their subsidy to the Delta Pilots Medical Plan rather than to the

alternative coverage. Current pilot and non-pilot retirees received a $539 million allowed general, unsecured claim, which was recorded in reorganization

items, net with a corresponding offset in liabilities subject to compromise. These amendments of our postretirement plans reduce participant benefits and are

accounted for as a negative plan amendment, reducing the accumulated plan benefit obligation ("APBO") for these plans by $859 million.

F-49