Berkshire Hathaway 2004 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2004 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72

Management’s Discussion (Continued)

Foreign Currency Risk

Berkshire’ s market risks associated with changes in foreign currency exchange rates are concentrated primarily in a

portfolio of short duration foreign currency forward contracts. Generally, these contracts provide that Berkshire receive certain

foreign currencies and pay U.S. dollars at specified exchange rates and at specified future dates. Management entered into these

contracts as a partial economic hedge of the adverse effect from a decline in the value of the U.S. dollar on its net U.S. dollar-

based assets. The value of these contracts changes daily due primarily to changes in the spot exchange rates and to a lesser

degree, interest rates and time value. The average duration of the contracts is approximately six months. The aggregate notional

value of such contracts, which are spread among 12 currencies at December 31, 2004, was approximately $21.4 billion compared

to about $12.0 billion as of December 31, 2003. The fair value asset of these contracts totaled approximately $1,761 million at

December 31, 2004 and $630 million at December 31, 2003.

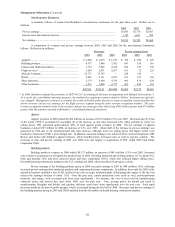

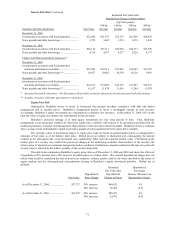

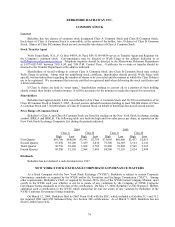

Berkshire monitors the currency positions daily for each currency. The following table summarizes the outstanding

foreign currency forward contracts as of December 31, 2004 and 2003 and shows the estimated changes in values of the contracts

assuming changes in the underlying exchange rates applied immediately and uniformly across all currencies. The changes in

value do not necessarily reflect the best or worst case results and therefore, actual results may differ. Dollars are in millions.

Estimated Fair Value Assuming a Hypothetical

Percentage Increase (Decrease) in the Value of

Foreign Currencies Versus the U.S. Dollar

Fair Value (20%) (10%) (1%) 1% 10% 20%

December 31, 2004............................. $1,761 $(2,614) $(475) $1,533 $1,991 $4,127 $6,669

December 31, 2003............................. 630 (1,583) (512) 512 748 1,865 3,230

Derivatives Dealer Risk

Berkshire, through General Re Securities (“GRS”), is a dealer in various types of derivative instruments in conjunction

with offering risk management products to its clients. Effective January 2002, GRS commenced the run-off of its business. It is

expected that the run-off will take several years to complete. Since January 2002, approximately 88% of GRS’ s contracts have

terminated. Accordingly, derivatives market risks from the GRS portfolio declined substantially. While GRS may incur losses

to unwind its remaining positions, market risks in the portfolio of derivatives at December 31, 2004 have declined significantly

and as of December 31, 2004 management believes that market risks are no longer significant. However, credit risks from the

potential inability of counterparties to settle amounts due to GRS remains. Management monitors counterparty credit constantly

and contracts may require such exposures to be collateralized. Uncollateralized credit exposure as of December 31, 2004 totaled

$2.0 billion. No significant credit losses have occurred to date.

Forward-Looking Statements

Investors are cautioned that certain statements contained in this document, as well as some statements by the Company

in periodic press releases and some oral statements of Company officials during presentations about the Company, are “forward-

looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995 (the “Act”). Forward-looking

statements include statements which are predictive in nature, which depend upon or refer to future events or conditions, which

include words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “estimates,” or similar expressions. In addition,

any statements concerning future financial performance (including future revenues, earnings or growth rates), ongoing business

strategies or prospects, and possible future Company actions, which may be provided by management are also forward-looking

statements as defined by the Act. Forward-looking statements are based on current expectations and projections about future

events and are subject to risks, uncertainties, and assumptions about the Company, economic and market factors and the

industries in which the Company does business, among other things. These statements are not guaranties of future performance

and the Company has no specific intention to update these statements.

Actual events and results may differ materially from those expressed or forecasted in forward-looking statements due

to a number of factors. The principal important risk factors that could cause the Company’ s actual performance and future

events and actions to differ materially from such forward-looking statements, include, but are not limited to, changes in market

prices of Berkshire’ s significant equity investees, the occurrence of one or more catastrophic events, such as an earthquake,

hurricane or an act of terrorism that causes losses insured by Berkshire’ s insurance subsidiaries, changes in insurance laws or

regulations, changes in Federal income tax laws, and changes in general economic and market factors that affect the prices of

securities or the industries in which Berkshire and its affiliates do business, especially those affecting the property and casualty

insurance industry.