Berkshire Hathaway 2004 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2004 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.70

Management’s Discussion (Continued)

Other Critical Accounting Policies

Berkshire records as assets deferred charges with respect to liabilities assumed under retroactive reinsurance contracts.

At the inception of these contracts the deferred charges represent the difference between the consideration received and the

estimated ultimate liability for unpaid losses. No net gain or loss is recognized at the inception of the contract. Deferred charges

are amortized using the interest method over an estimate of the ultimate claim payment period and are reflected in earnings as a

component of losses and loss expenses. The deferred charge balances are adjusted periodically to reflect new projections of the

amount and timing of loss payments. Adjustments to these assumptions are applied retrospectively from the inception of the

contract. Unamortized deferred charges totaled $2.7 billion at December 31, 2004. Significant changes in either the timing or

ultimate amount of loss payments may have a significant effect on unamortized deferred charges and the amount of periodic

amortization.

Berkshire’ s Consolidated Balance Sheet as of December 31, 2004 includes goodwill of acquired businesses of

approximately $23 billion. These amounts have been recorded as a result of Berkshire’ s numerous prior business acquisitions

accounted for under the purchase method. Prior to 2002, goodwill from each acquisition was generally amortized as a charge to

earnings over periods not exceeding 40 years. Under SFAS No. 142, which was adopted by Berkshire as of January 1, 2002,

periodic amortization ceased, in favor of an impairment-only accounting model.

A significant amount of judgment is required in performing goodwill impairment tests. Such tests include periodically

determining or reviewing the estimated fair value of Berkshire’ s reporting units. Under SFAS No. 142, fair value refers to the

amount for which the entire reporting unit may be bought or sold. There are several methods of estimating a reporting unit’ s fair

value, including market quotations, asset and liability fair values and other valuation techniques, such as discounted projected net

earnings and multiples of earnings. If the carrying amount of a reporting unit, including goodwill, exceeds the estimated fair

value, then individual assets, including identifiable intangible assets and liabilities of the reporting unit are estimated at fair

value. The excess of the estimated fair value of the reporting unit over the estimated fair value of net assets would establish the

implied value of goodwill. The excess of the recorded amount of goodwill over the implied value is then charged to earnings as

an impairment loss.

Berkshire’ s consolidated financial position reflects large amounts of invested assets. A substantial portion of these

assets are carried at fair values based upon current market quotations and, when not available, based upon fair value pricing

models. Certain fixed maturity securities Berkshire owns are not actively traded in the markets. Further, Berkshire’ s finance

businesses maintain significant balances of finance receivables, which are carried at amortized cost. Considerable judgment is

required in determining the assumptions used in certain pricing models, including interest rate, loan prepayment speed, credit

risk and liquidity risk assumptions. Significant changes in these assumptions can have a significant effect on carrying values.

Information concerning recently issued accounting pronouncements which are not yet effective is included in Note 1(r)

to the Consolidated Financial Statements. As indicated in Note 1(r) to the Consolidated Financial Statements, Berkshire does not

expect any of the recently issued accounting pronouncements to have a material effect on its financial statements.

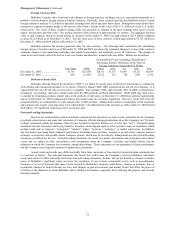

Market Risk Disclosures

Berkshire’ s Consolidated Balance Sheets include a substantial amount of assets and liabilities whose fair values are

subject to market risks. Berkshire’ s significant market risks are primarily associated with interest rates and equity prices and to a

lesser degree derivatives. The following sections address the significant market risks associated with Berkshire’ s business

activities.

Interest Rate Risk

Berkshire’ s management prefers to invest in equity securities or to acquire entire businesses based upon the principles

discussed in the following section on equity price risk. When unable to do so, management may alternatively invest in bonds,

loans or other interest rate sensitive instruments. Berkshire’ s strategy is to acquire securities that are attractively priced in

relation to the perceived credit risk. Management recognizes and accepts that losses may occur. Berkshire has historically

utilized a modest level of corporate borrowings and debt. Further, Berkshire strives to maintain the highest credit ratings so that

the cost of debt is minimized. Berkshire utilizes derivative products to manage interest rate risks to a very limited degree.

The fair values of Berkshire’ s fixed maturity investments and notes payable and other borrowings will fluctuate in

response to changes in market interest rates. Increases and decreases in prevailing interest rates generally translate into decreases

and increases in fair values of those instruments. Additionally, fair values of interest rate sensitive instruments may be affected

by the creditworthiness of the issuer, prepayment options, relative values of alternative investments, the liquidity of the

instrument and other general market conditions. Fixed interest rate investments may be more sensitive to interest rate changes

than variable rate investments.

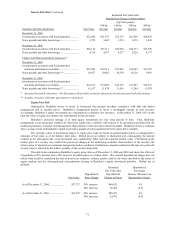

The following table summarizes the estimated effects of hypothetical increases and decreases in interest rates on assets

and liabilities that are subject to interest rate risk. It is assumed that the changes occur immediately and uniformly to each

category of instrument containing interest rate risks. The hypothetical changes in market interest rates do not reflect what could

be deemed best or worst case scenarios. Variations in market interest rates could produce significant changes in the timing of

repayments due to prepayment options available. For these reasons, actual results might differ from those reflected in the table.

Dollars are in millions.