Berkshire Hathaway 2004 Annual Report Download - page 5

Download and view the complete annual report

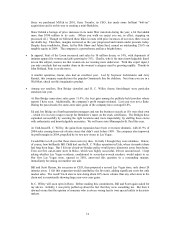

Please find page 5 of the 2004 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. Over the 35 years, American business has delivered terrific results. It should therefore have been

easy for investors to earn juicy returns: All they had to do was piggyback Corporate America in a

diversified, low-expense way. An index fund that they never touched would have done the job. Instead

many investors have had experiences ranging from mediocre to disastrous.

There have been three primary causes: first, high costs, usually because investors traded

excessively or spent far too much on investment management; second, portfolio decisions based on tips and

fads rather than on thoughtful, quantified evaluation of businesses; and third, a start-and-stop approach to

the market marked by untimely entries (after an advance has been long underway) and exits (after periods

of stagnation or decline). Investors should remember that excitement and expenses are their enemies. And

if they insist on trying to time their participation in equities, they should try to be fearful when others are

greedy and greedy only when others are fearful.

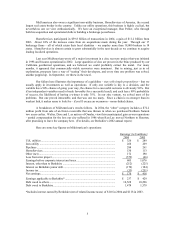

Sector Results

As managers, Charlie and I want to give our owners the financial information and commentary we

would wish to receive if our roles were reversed. To do this with both clarity and reasonable brevity

becomes more difficult as Berkshire’ s scope widens. Some of our businesses have vastly different

economic characteristics from others, which means that our consolidated statements, with their jumble of

figures, make useful analysis almost impossible.

On the following pages, therefore, we will present some balance sheet and earnings figures from

our four major categories of businesses along with commentary about each. We particularly want you to

understand the limited circumstances under which we will use debt, given that we typically shun it. We

will not, however, inundate you with data that has no real value in estimating Berkshire’ s intrinsic value.

Doing so would tend to obfuscate the facts that count.

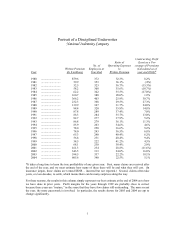

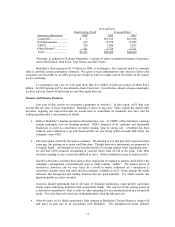

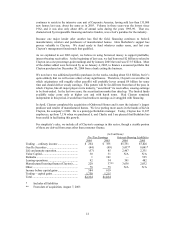

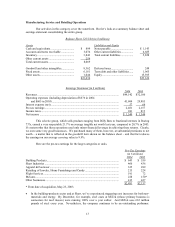

Regulated Utility Businesses

We have an 80.5% (fully diluted) interest in MidAmerican Energy Holdings, which owns a wide

variety of utility operations. The largest of these are (1) Yorkshire Electricity and Northern Electric, whose

3.7 million electric customers make it the third largest distributor of electricity in the U.K.; (2)

MidAmerican Energy, which serves 698,000 electric customers, primarily in Iowa; and (3) Kern River and

Northern Natural pipelines, which carry 7.9% of the natural gas consumed in the U.S.

The remaining 19.5% of MidAmerican is owned by three partners of ours: Dave Sokol and Greg

Abel, the brilliant managers of these businesses, and Walter Scott, a long-time friend of mine who

introduced me to the company. Because MidAmerican is subject to the Public Utility Holding Company

Act (“PUHCA”), Berkshire’ s voting interest is limited to 9.9%. Voting control rests with Walter.

Our limited voting interest forces us to account for MidAmerican in an abbreviated manner.

Instead of our fully incorporating the company’ s assets, liabilities, revenues and expenses into Berkshire’ s

statements, we make one-line entries only in both our balance sheet and income account. It’ s likely,

though, that PUHCA will someday – perhaps soon – be repealed or that accounting rules will change.

Berkshire’ s consolidated figures would then incorporate all of MidAmerican, including the substantial debt

it utilizes (though this debt is not now, nor will it ever be, an obligation of Berkshire).

At yearend, $1.478 billion of MidAmerican’ s junior debt was payable to Berkshire. This debt has

allowed acquisitions to be financed without our partners needing to increase their already substantial

investments in MidAmerican. By charging 11% interest, Berkshire is compensated fairly for putting up the

funds needed for purchases, while our partners are spared dilution of their equity interests. Because

MidAmerican made no large acquisitions last year, it paid down $100 million of what it owes us.

4