Berkshire Hathaway 2004 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2004 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.35

(1) Significant accounting policies and practices (Continued)

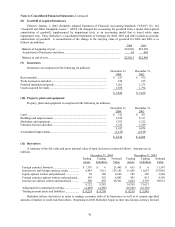

(i) Property, plant and equipment

Property, plant and equipment is recorded at cost. Depreciation is provided principally on the straight-line

method over estimated useful lives as follows: aircraft, simulators, training equipment and spare parts, 4

to 20 years; buildings and improvements, 10 to 40 years; machinery, equipment, furniture and fixtures, 3

to 20 years. Leasehold improvements are amortized over the life of the lease or the life of the

improvement, whichever is shorter. Interest is capitalized as an integral component of cost during the

construction period of simulators and facilities and is amortized over the life of the related assets.

(j) Goodwill of acquired businesses

Goodwill of acquired businesses represents the difference between purchase cost and the fair value of net

assets of acquisitions accounted for under the purchase method. Prior to 2002, goodwill from each

acquisition was generally amortized as a charge to earnings over periods not exceeding 40 years, and

was reviewed for impairment if conditions were identified that indicated possible impairment.

Effective January 1, 2002, Berkshire adopted Statement of Financial Accounting Standards (“SFAS”) No.

142 “Goodwill and Other Intangible Assets.” SFAS No. 142 eliminated the periodic amortization of

goodwill in favor of an accounting model that is based solely upon impairment tests. Goodwill is

reviewed for impairment using a variety of methods at least annually, and impairments, if any, are

charged to earnings. Annual impairment tests are performed in the fourth quarter.

(k) Revenue recognition

Insurance premiums for prospective property/casualty insurance and reinsurance and health reinsurance

policies are earned in proportion to the level of insurance protection provided. In most cases, premiums

are recognized as revenues ratably over the term of the contract with unearned premiums computed on a

monthly or daily pro rata basis. Premium adjustments on contracts and audit premiums are based on

estimates made over the contract period. Premiums for retroactive reinsurance policies are earned at the

inception of the contracts. Premiums for life reinsurance contracts are earned when due. Premiums

earned are stated net of amounts ceded to reinsurers. Premiums are estimated with respect to certain

reinsurance contracts where premiums are based upon reports from ceding companies that are

contractually reported after the balance sheet date.

Revenues from product sales are recognized upon passage of title to the customer, which generally

coincides with customer pickup, product shipment, delivery or acceptance, depending on terms of the

sales arrangement. Service revenues are recognized as the services are performed. Services provided

pursuant to a contract are either recognized over the contract period, or upon completion of the elements

specified in the contract, depending on the terms of the contract.

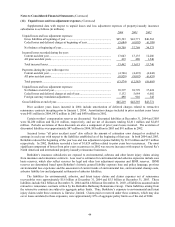

(l) Losses and loss adjustment expenses

Liabilities for unpaid losses and loss adjustment expenses represent estimated claim and claim settlement

costs of property/casualty insurance and reinsurance contracts with respect to losses that have occurred

as of the balance sheet date. The liabilities for losses and loss adjustment expenses are recorded at the

estimated ultimate payment amounts, except that amounts arising from certain workers’ compensation

reinsurance business are discounted as discussed below. Estimated ultimate payment amounts are based

upon (1) individual case estimates, (2) reports of losses from ceding insurers and (3) estimates of

incurred but not reported (“IBNR”) losses.

The estimated liabilities of workers’ compensation claims assumed under reinsurance contracts are carried

in the Consolidated Balance Sheets at discounted amounts. Discounted amounts are based upon an

annual discount rate of 4.5% for claims arising prior to 2003 and 1% for claims arising after 2002. The

lower rate for post-2002 claims reflects the lower interest rate environment prevailing in the United

States. The discount rates are the same rates used under statutory accounting principles. The periodic

discount accretion is included in the Consolidated Statements of Earnings as a component of losses and

loss adjustment expenses.

(m) Deferred charges reinsurance assumed

The excess of estimated liabilities for claims and claim costs over the consideration received with respect to

retroactive property and casualty reinsurance contracts that provide for indemnification of insurance risk

is established as a deferred charge at inception of such contracts. The deferred charges are subsequently

amortized using the interest method over the expected claim settlement periods. The periodic

amortization charges are reflected in the accompanying Consolidated Statements of Earnings as losses

and loss adjustment expenses.