Berkshire Hathaway 2004 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2004 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

Notes to Consolidated Financial Statements (Continued)

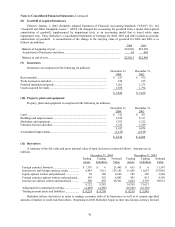

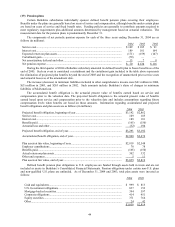

(13) Notes payable and other borrowings (Continued)

$3.75 billion par amount of senior notes consisting of $1.5 billion par of 4.125% notes due 2010, $1.0 billion par of

4.85% notes due 2015, and $1.25 billion par of floating rate notes due 2008. Aggregate proceeds of $3,733 million were

used to finance a loan portfolio acquisition on December 30, 2004 by Clayton Homes.

Generally, Berkshire’ s guarantee of a subsidiary’ s debt obligation is an absolute, unconditional and irrevocable

guarantee for the full and prompt payment when due of all present and future payment obligations of the issuer.

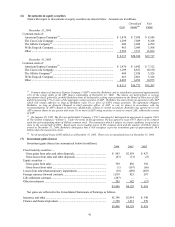

Payments of principal amounts expected during the next five years are as follows (in millions).

2005 2006 2007 2008 2009

Insurance and other.............................................................. $1,388 $ 121 $ 554 $ 15 $ 293

Finance and financial products ............................................ 257 133 810 1,388 279

$1,645 $ 254 $1,364 $1,403 $ 572

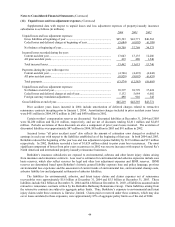

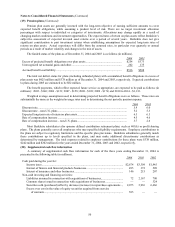

(14) Income taxes

The liability for income taxes as of December 31, 2004 and 2003 as reflected in the accompanying Consolidated

Balance Sheets is as follows (in millions).

2004 2003

Payable currently ................................................................................. $ 1,073 $ 44

Deferred ............................................................................................... 11,174 10,950

$12,247 $10,994

The tax effects of temporary differences that give rise to significant portions of deferred tax assets and deferred tax

liabilities at December 31, 2004 and 2003 are shown below (in millions).

2004 2003

Deferred tax liabilities:

Unrealized appreciation of investments ............................................ $11,020 $10,663

Deferred charges reinsurance assumed ............................................. 955 1,080

Property, plant and equipment .......................................................... 1,201 1,124

Investments ....................................................................................... 509 573

Other ................................................................................................. 665 629

14,350 14,069

Deferred tax assets:

Unpaid losses and loss adjustment expenses..................................... (1,129) (1,299)

Unearned premiums .......................................................................... (388) (372)

Other ................................................................................................. (1,659) (1,448)

(3,176) (3,119)

Net deferred tax liability ...................................................................... $11,174 $10,950

Deferred income taxes have not been established with respect to undistributed earnings of certain foreign

subsidiaries. Such earnings are expected to remain reinvested indefinitely and totaled approximately $490 million as of

December 31, 2004. Upon distribution as dividends or otherwise, such amounts would be subject to taxation in the

United States as well as foreign countries. However, U.S. tax liabilities could be offset, in whole or in part, by tax

credits allowable from taxes paid to foreign jurisdictions. Determination of the potential net tax due is impracticable

due to the complexities of hypothetical calculations involving uncertain timing and amounts of taxable income and the

effects of multiple taxing jurisdictions.

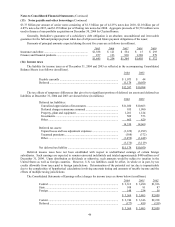

The Consolidated Statements of Earnings reflect charges for income taxes as shown below (in millions).

2004 2003 2002

Federal ................................................................................................. $ 3,313 $ 3,490 $1,916

State ..................................................................................................... 108 81 87

Foreign ................................................................................................. 148 234 56

$ 3,569 $ 3,805 $2,059

Current ................................................................................................. $ 3,746 $ 3,346 $2,218

Deferred ............................................................................................... (177) 459 (159)

$ 3,569 $ 3,805 $2,059