Berkshire Hathaway 2004 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2004 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61

Insurance — Underwriting (Continued)

Berkshire Hathaway Primary Group (Continued)

whose subsidiaries underwrite specialty insurance coverages; a group of companies referred to internally as “Homestate”

operations, providers of standard multi-line insurance; and Central States Indemnity Company, a provider of credit and disability

insurance to individuals nationwide through financial institutions.

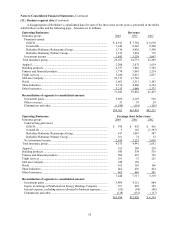

Collectively, Berkshire’ s other primary insurance businesses produced earned premiums of $1,211 million in 2004,

$1,034 million in 2003, and $712 million in 2002. The increases in premiums earned during the past two years were largely

attributed to increased volume of USIC and the NICO Primary Group. Net underwriting gains of Berkshire’ s other primary

insurance businesses totaled $161 million in 2004, $74 million in 2003 and $32 million in 2002. The improvement in year-to-

year comparative underwriting results was due to the aforementioned increases in premiums and better-than-expected claim

experience.

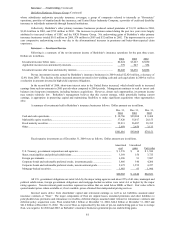

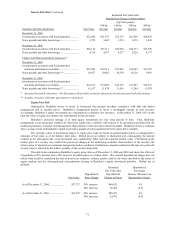

Insurance — Investment Income

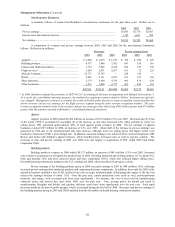

Following is a summary of the net investment income of Berkshire’ s insurance operations for the past three years.

Dollars are in millions.

2004 2003 2002

Investment income before taxes........................................................................................ $2,824 $3,223 $3,050

Applicable income taxes and minority interests................................................................ 779 947 954

Investment income after taxes and minority interests ....................................................... $2,045 $2,276 $2,096

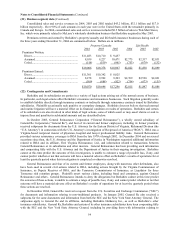

Pre-tax investment income earned by Berkshire’ s insurance businesses in 2004 totaled $2,824 million, a decrease of

12.4% from 2003. The decline reflects increased amounts invested in low-yielding cash and cash equivalents in 2004 as well as

a reduction in amounts invested in high-yield corporate obligations.

In the second half of 2004, short-term interest rates in the United States increased, which should result in increased

earnings from such investments in 2005 periods when compared to 2004 periods. Management continues to seek to invest cash

balances into long-term instruments, including business acquisitions. However, absent such opportunities, investment income

may remain relatively low. Berkshire’ s management believes that this current strategy, while potentially hurting current

earnings, is appropriate in preserving capital and maintaining flexibility to make significant acquisitions when opportunities

arise.

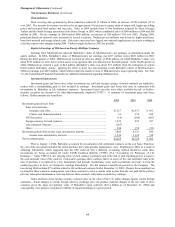

A summary of investments held in Berkshire’ s insurance businesses follows. Dollar amounts are in millions.

Dec. 31,

2004

Dec. 31,

2003

Dec. 31,

2002

Cash and cash equivalents............................................................................................... $ 38,706 $29,908 $ 9,468

Marketable equity securities............................................................................................ 37,420 35,017 28,155

Fixed maturity securities ................................................................................................. 22,831 26,087 38,395

Other................................................................................................................................ 2,059 2,656 3,133

$101,016 $93,668 $79,151

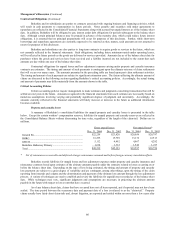

Fixed maturity investments as of December 31, 2004 were as follows. Dollar amounts are in millions.

Amortized

cost

Unrealized

gains

Fair value

U.S. Treasury, government corporations and agencies ................................................... $ 1,576 $ 14 $ 1,590

States, municipalities and political subdivisions ............................................................. 3,569 156 3,725

Foreign governments....................................................................................................... 6,996 91 7,087

Corporate bonds and redeemable preferred stocks, investment grade............................. 3,866 340 4,206

Corporate bonds and redeemable preferred stocks, non-investment grade...................... 2,675 1,552 4,227

Mortgage-backed securities............................................................................................. 1,903 93 1,996

$20,585 $ 2,246 $22,831

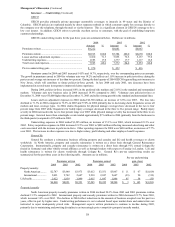

All U.S. government obligations are rated AAA by the major rating agencies and about 95% of all state, municipal and

political subdivisions, foreign government obligations and mortgage-backed securities were rated AA or higher by the major

rating agencies. Non-investment grade securities represent securities that are rated below BBB- or Baa3. Fair value reflects

quoted market prices where available or, if not available, prices obtained from independent pricing services.

Invested assets derive from shareholder capital and reinvested earnings as well as net liabilities assumed under

insurance contracts or “float.” The major components of float are unpaid losses, unearned premiums and other liabilities to

policyholders less premiums and reinsurance receivables, deferred charges assumed under retroactive reinsurance contracts and

deferred policy acquisition costs. Float totaled $46.1 billion at December 31, 2004, $44.2 billion at December 31, 2003 and

$41.2 billion at December 31, 2002. The cost of float, as represented by the ratio of pre-tax underwriting gain or loss to average

float, was negative for 2004 and 2003, as Berkshire’ s insurance businesses generated pre-tax underwriting gains.