Berkshire Hathaway 2004 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2004 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.38

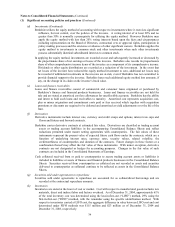

Notes to Consolidated Financial Statements (Continued)

(3) Investments in MidAmerican Energy Holdings Company

On March 14, 2000, Berkshire acquired 900,942 shares of common stock and 34,563,395 shares of convertible

preferred stock of MidAmerican Energy Holdings Company (“MidAmerican”) for $35.05 per share, or approximately

$1.24 billion in the aggregate. During March 2002, Berkshire acquired 6,700,000 additional shares of the convertible

preferred stock for $402 million. Such investments currently give Berkshire about a 9.9% voting interest and an 83.7%

economic interest in the equity of MidAmerican (80.5% on a diluted basis). As of December 31, 2004, Berkshire and

certain of its subsidiaries also owned $1,478 million of MidAmerican’ s 11% non-transferable trust preferred securities.

Walter Scott, Jr., a member of Berkshire’ s Board of Directors, controls approximately 88% of the voting interest in

MidAmerican. While the convertible preferred stock does not vote generally with the common stock in the election of

directors, it does give Berkshire the right to elect 20% of MidAmerican’ s Board of Directors. The convertible preferred

stock is convertible into common stock only upon the occurrence of specified events, including modification or

elimination of the Public Utility Holding Company Act of 1935 so that holding company registration would not be

triggered by conversion. Additionally, the prior approval of the holders of convertible preferred stock is required for

certain fundamental transactions by MidAmerican. Such transactions include, among others: a) significant asset sales or

dispositions; b) merger transactions; c) significant business acquisitions or capital expenditures; d) issuances or

repurchases of equity securities; and e) the removal or appointment of the Chief Executive Officer. Through the

investments in common and convertible preferred stock of MidAmerican, Berkshire has the ability to exercise

significant influence on the operations of MidAmerican.

MidAmerican’ s Articles of Incorporation further provide that the convertible preferred shares: a) are not mandatorily

redeemable by MidAmerican or at the option of the holder; b) participate in dividends and other distributions to common

shareholders as if they were common shares and otherwise possess no dividend rights; c) are convertible into common

shares on a 1 for 1 basis, as adjusted for splits, combinations, reclassifications and other capital changes by MidAmerican;

and d) upon liquidation, except for a de minimus first priority distribution of $1 per share, share ratably with the

shareholders of common stock. Further, the aforementioned dividend and distribution arrangements cannot be modified

without the positive consent of the preferred shareholders. Accordingly, the convertible preferred stock is, in substance, a

substantially identical subordinate interest to a share of common stock and economically equivalent to common stock.

Therefore, Berkshire accounts for its investments in MidAmerican pursuant to the equity method.

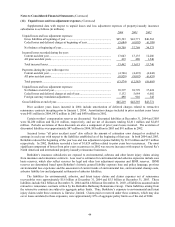

Berkshire’ s equity in earnings from MidAmerican includes Berkshire’ s proportionate share (83.7% in 2004) of

MidAmerican’ s undistributed net earnings reduced by deferred taxes on such undistributed earnings in accordance with

SFAS 109, reflecting Berkshire’ s expectation that such deferred taxes will be payable as a consequence of dividends

from MidAmerican. However, no dividends from MidAmerican are likely for some time. It is possible that when, and

if, a dividend is paid MidAmerican will then be eligible for inclusion in Berkshire’ s consolidated tax return and a tax on

the dividend would not be due. Berkshire’ s share of MidAmerican’ s interest expense (after-tax) on Berkshire’ s

investments in MidAmerican’ s trust preferred (debt) securities has been eliminated.

Through its subsidiaries, MidAmerican owns a combined electric and natural gas utility company in the United

States, two natural gas pipeline companies in the United States, two electricity distribution companies in the United

Kingdom, a diversified portfolio of domestic and international electric power projects and the second largest residential

real estate brokerage firm in the United States.

MidAmerican, through its subsidiaries, owns the rights to proprietary processes for the extraction of zinc,

manganese, silica, and other elements in the geothermal brine and fluids utilized in energy production at certain

geothermal energy generation facilities. Mineral extraction facilities were installed near the energy generation sites

(“the Project”). During 2004, MidAmerican’ s management assessed the long-term economic viability of the Project in

light of current cash flow and operating losses and continuing efforts to increase production. MidAmerican’ s

management evaluated estimates of projected cash flows for the Project, including the expected impact of planned

improvements to the mineral extraction processes and also began exploring other operating alternatives, such as

establishing strategic partnerships.

On September 10, 2004, MidAmerican’ s management decided to cease operations of the Project, effective

immediately. Consequently, it was concluded that a non-cash impairment charge of approximately $340 million, after tax,

was required to write-off the Project, the rights to quantities of extractable minerals, and the allocated goodwill to estimated

net fair value. MidAmerican incurred net after-tax losses attributed to the Project of $28 million in 2004, $27 million in

2003 and $17 million in 2002. MidAmerican expects to receive approximately $55 million in future tax benefits.

Berkshire’ s share of the non-cash impairment charge was $255 million after tax, and is included in equity in earnings of

MidAmerican Energy Holdings Company.