Berkshire Hathaway 2004 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2004 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

Notes to Consolidated Financial Statements (Continued)

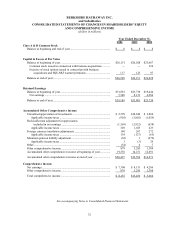

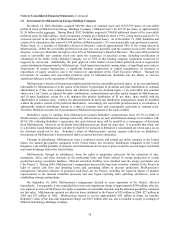

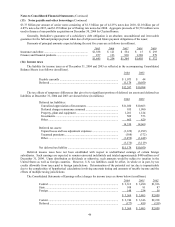

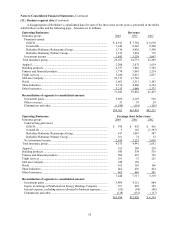

(8) Goodwill of acquired businesses

Effective January 1, 2002, Berkshire adopted Statement of Financial Accounting Standards (“SFAS”) No. 142

“Goodwill and Other Intangible Assets.” SFAS 142 changed the accounting for goodwill from a model that required

amortization of goodwill, supplemented by impairment tests, to an accounting model that is based solely upon

impairment tests. Thus, Berkshire’ s Consolidated Statements of Earnings for 2004, 2003 and 2002 include no periodic

amortization of goodwill. A reconciliation of the change in the carrying value of goodwill for 2004 and 2003 is as

follows (in millions).

2004 2003

Balance at beginning of year .......................................................................................... $22,948 $22,298

Acquisitions of businesses and other.............................................................................. 64 650

Balance at end of year .................................................................................................... $23,012 $22,948

(9) Inventories

Inventories are comprised of the following (in millions):

December 31, December 31,

2004 2003

Raw materials ..................................................................................................... $ 527 $ 472

Work in progress and other................................................................................ 256 215

Finished manufactured goods ............................................................................ 1,201 1,175

Goods acquired for resale................................................................................... 1,858 1,794

$ 3,842 $ 3,656

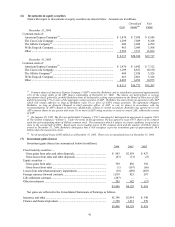

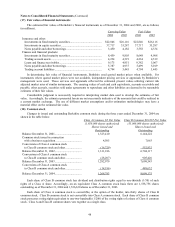

(10) Property, plant and equipment

Property, plant and equipment is comprised of the following (in millions):

December 31, December 31,

2004 2003

Land .................................................................................................................... $ 312 $ 291

Buildings and improvements ............................................................................. 2,525 2,317

Machinery and equipment.................................................................................. 5,763 5,212

Furniture, fixtures and other............................................................................... 1,332 1,259

9,932 9,079

Accumulated depreciation.................................................................................. (3,416) (2,819)

$ 6,516 $ 6,260

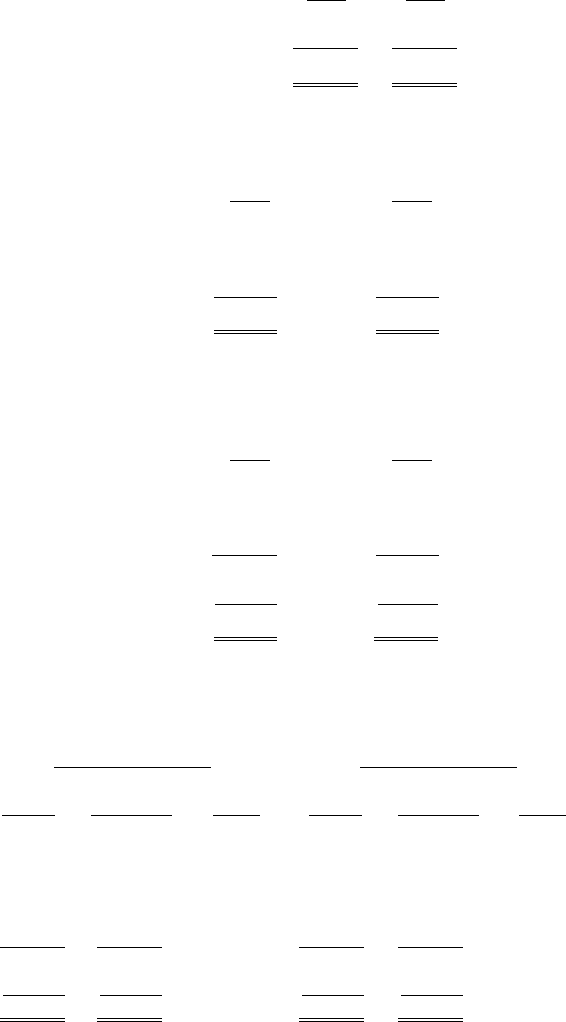

(11) Derivatives

A summary of the fair value and gross notional value of open derivatives contracts follows. Amounts are in

millions.

December 31, 2004 December 31, 2003

Trading Trading Notional Trading Trading Notional

Assets Liabilities Value Assets Liabilities Value

Foreign currency forwards .................................... $ 1,767 $ 6 21,445 $ 635 $ 6 11,347

Interest rate and foreign currency swaps ............... 6,043 7,651 153,185 11,426 11,623 333,842

Equity options written and purchased ................... 69 380 4,626 185 396 3,940

Foreign currency options written and purchased... 343 352 6,083 435 813 9,359

Interest rate options written and purchased ........... 500 893 28,961 2,024 2,793 92,912

8,722 9,282 14,705 15,631

Adjustment for counterparty netting ..................... (4,488) (4,488) (10,186) (10,186)

Trading account assets and liabilities.................... $ 4,234 $ 4,794 $ 4,519 $ 5,445

Berkshire utilizes derivatives in order to manage economic risks of its businesses as well as to assume specified

amounts of market or credit risk from others. Beginning in 2002, Berkshire began to enter into foreign currency forward