Berkshire Hathaway 2004 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2004 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

Property and casualty losses (Continued)

occurrence. Casualty losses usually have very long claim-tails, occasionally extending for decades. Casualty claims are more

susceptible to litigation and can be significantly affected by changing contract interpretations and the legal environment, which

contributes to extended claim-tails. Claim-tails for reinsurers may be further extended due to delayed reporting by ceding

insurers or reinsurers due to contractual provisions or reporting practices. The loss and loss expense reserves include provisions

for those claims that have been reported (referred to as “case reserves”) and for those claims that have not been reported, referred

to as incurred but not yet reported (“IBNR”) reserves.

Receivables recorded with respect to insurance losses ceded to other reinsurers under reinsurance contracts are

estimated in a manner similar to liabilities for insurance losses and, therefore, are also subject to estimation error. In addition to

the factors cited above, reinsurance recoverables may ultimately prove to be uncollectible if the reinsurer is unable to perform

under the contract. Reinsurance contracts do not relieve the ceding company of its obligations to indemnify its own

policyholders.

Each of Berkshire’ s significant insurance operations (including GEICO, General Re and BHRG) utilize techniques for

establishing reserves that are believed to best fit the business. Additional information regarding reserves established by each of

the significant businesses follows.

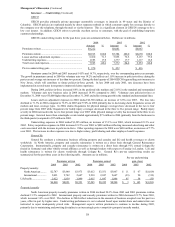

GEICO

GEICO’ s gross unpaid losses and loss adjustment expense reserves as of December 31, 2004 totaled $5,112 million

and net of reinsurance recoverable were $4,867 million. As of December 31, 2004, gross reserves included $3,690 million of

case reserves and $1,422 million of IBNR reserves.

GEICO predominantly writes private passenger auto insurance which has a relatively short claim-tail. Accordingly, the

risk of estimation error is thought to be much less at GEICO than for either General Re or BHRG. The key assumptions

affecting GEICO’ s reserves include projections of ultimate claim counts and average loss per claim (“severity”), which includes

loss adjustment expenses. GEICO’ s reserving methodologies produce reserve estimates based upon the individual claims (or a

“ground-up” approach), which in the aggregate yields a point estimate of the ultimate losses and loss adjustment expenses.

Ranges of loss estimates are not calculated in the aggregate. A detailed discussion of the process and significant factors

considered in establishing reserves follows.

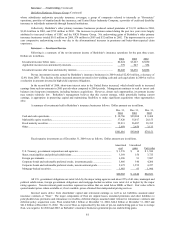

Actuaries establish and evaluate unpaid loss reserves using recognized standard statistical loss development methods

and techniques. The significant reserve components (and percentage of gross reserves) are: (1) average reserves (20%), (2) case

and case development reserves (55%), and (3) incurred-but-not-reported (“IBNR”) reserves (25%). Each component of loss

reserves is affected by the expected frequency and average severity of claims. Such amounts are analyzed using statistical

techniques on historical claims data and adjusted when appropriate to reflect perceived changes in loss patterns. Data is

analyzed by policy coverage, jurisdiction of loss, reporting date and occurrence date, among other factors. A brief discussion of

each component follows.

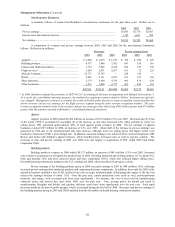

Average reserve amounts are established for property claims and new liability claims prior to the development of an

individual case reserve. Average reserve amounts are driven by the estimated average severity per claim and the number of new

claims opened. The average severity per claim amount is projected each accident quarter, reflecting both reported claims and

unreported claims.

Claim adjusters generally establish individual liability claim case loss and loss adjustment expense reserve estimates as

soon as the specific facts and merits of each claim can be evaluated. Case reserves represent the amounts that in the judgment of

the adjusters are reasonably expected to be paid in the future to completely settle the claim, including expenses. Individual case

reserves are revised as more information becomes known.

For most liability coverages, case reserves alone are an insufficient measure of the ultimate cost due in part to the

longer claim-tail, the greater chance of protracted litigation and the incompleteness of facts available at the time the claim is first

reported. Therefore, additional case development reserve estimates are established, usually as a percentage of the case reserve.

In general, case development factors are selected by historical statistical analysis, which includes incurred case loss analysis for

groups of claims from period-to-period projected to future dates and amounts (or age-to-age techniques) when substantially all of

the claims are expected to be settled. Case development factors are reviewed and revised periodically based upon trends in loss

development patterns.

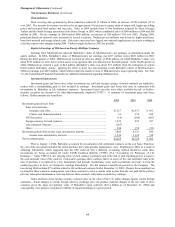

For unreported claims, IBNR reserve estimates are calculated by first projecting the ultimate number of claims

expected (reported and unreported) for each significant coverage by using historical quarterly and monthly claim counts, to

develop age-to-age projections of the ultimate counts by accident quarter. Reported claims are subtracted from the ultimate

claim projections to produce an estimate of the number of unreported claims. The number of unreported claims is multiplied by

an estimate of the average cost per unreported claim to produce the IBNR reserve amount. Actuarial techniques are difficult to

apply reliably in certain situations, such as to new legal precedents, class action suits, long-term claimants from personal injury

protection coverages or recent catastrophes. Consequently, supplemental IBNR reserves for these types of events may be

established.