Berkshire Hathaway 2004 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2004 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

Notes to Consolidated Financial Statements (Continued)

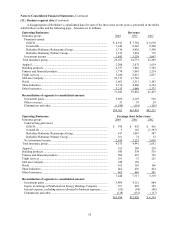

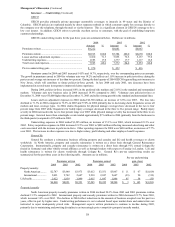

(21) Business segment data (Continued)

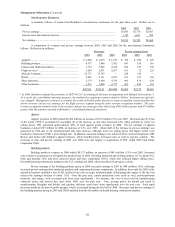

Consolidated sales and service revenues in 2004, 2003 and 2002 totaled $43.2 billion, $32.1 billion and $17.0

billion respectively. Over 90% of such amounts in each year were in the United States with the remainder primarily in

Canada and Europe. In 2004, consolidated sales and service revenues included $8.5 billion of sales to Wal-Mart Stores,

Inc. which were primarily related to McLane’ s wholesale distribution business that Berkshire acquired in May 2003.

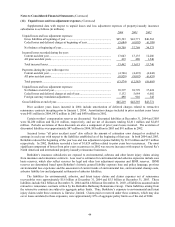

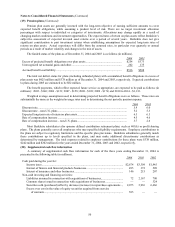

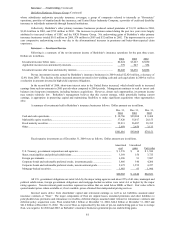

Premiums written and earned by Berkshire’ s property/casualty and life/health insurance businesses during each of

the three years ending December 31, 2004 are summarized below. Dollars are in millions.

Property/Casualty Life/Health

2004 2003 2002 2004 2003 2002

Premiums Written:

Direct................................................................ $11,483 $10,710 $ 9,457

Assumed........................................................... 8,039 9,227 10,471 $2,775 $2,517 $2,031

Ceded................................................................ (516) (559) (961) (753) (679) (132)

$19,006 $19,378 $18,967 $2,022 $1,838 $1,899

Premiums Earned:

Direct................................................................ $11,301 $10,342 $ 8,825

Assumed........................................................... 8,278 9,992 9,293 $2,769 $2,520 $2,021

Ceded................................................................ (509) (688) (822) (754) (673) (135)

$19,070 $19,646 $17,296 $2,015 $1,847 $1,886

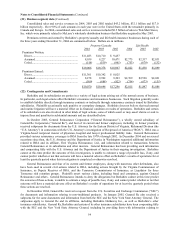

(22) Contingencies and Commitments

Berkshire and its subsidiaries are parties in a variety of legal actions arising out of the normal course of business.

In particular, such legal actions affect Berkshire’ s insurance and reinsurance businesses. Such litigation generally seeks

to establish liability directly through insurance contracts or indirectly through reinsurance contracts issued by Berkshire

subsidiaries. Plaintiffs occasionally seek punitive or exemplary damages. Berkshire does not believe that such normal

and routine litigation will have a material effect on its financial condition or results of operations. Berkshire and certain

of its subsidiaries are also involved in other kinds of legal actions, some of which assert or may assert claims or seek to

impose fines and penalties in substantial amounts and are described below.

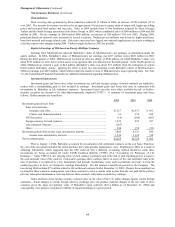

In October 2003, General Reinsurance Corporation (“General Reinsurance”), a wholly owned subsidiary of

General Re Corporation (“General Re”), and four of its current and former employees, including its former president,

received subpoenas for documents from the U.S. Attorney for the Eastern District of Virginia, Richmond Division (the

“U.S. Attorney”) in connection with the U.S. Attorney’ s investigation of Reciprocal of America (“ROA”). ROA was a

Virginia-based reciprocal insurer of physician, hospital and lawyer professional liability risks. General Reinsurance

provided various reinsurance coverages to ROA from the late 1970’ s through 2002. In December 2004 and on several

occasions since then, the U.S. Attorney and the Department of Justice in Washington requested additional information

related to ROA and its affiliate, First Virginia Reinsurance, Ltd., and information related to transactions between

General Reinsurance or its subsidiaries and other insurers. General Reinsurance has been providing such information

and cooperating fully with the U.S. Attorney and the Department of Justice in their ongoing investigation. Berkshire

cannot at this time predict the outcome of this investigation, is unable to estimate a range of possible loss, if any, and

cannot predict whether or not that outcome will have a material adverse effect on Berkshire’ s results of operations for at

least the quarterly period when this investigation is completed or otherwise resolved.

General Reinsurance and four of its current and former employees, along with numerous other defendants, also

have been sued in several civil actions related to ROA, including actions brought by the Virginia Commissioner of

Insurance, as Deputy Receiver of ROA, and the Tennessee Commissioner of Insurance, as Liquidator for three

Tennessee risk retention groups. Plaintiffs assert various claims, including fraud and conspiracy, against General

Reinsurance and others. General Reinsurance intends to deny the allegations but Berkshire cannot at this time predict

the outcome of these actions, is unable to estimate a range of possible loss, if any, and cannot predict whether or not that

outcome will have a material adverse effect on Berkshire’ s results of operations for at least the quarterly period when

these actions are resolved.

In December 2004, General Re received a request from the U.S. Securities and Exchange Commission (“SEC”)

for documents and information relating to non-traditional products. In January 2005, General Re also received a

subpoena for the same documents and information from both the SEC and the New York State Attorney General. The

subpoenas apply to General Re and its affiliates, including Berkshire Hathaway Inc., as well as Berkshire’ s other

insurance subsidiaries. General Re, Berkshire and certain of its other insurance subsidiaries have been cooperating fully

with the SEC and the New York State Attorney General, including by providing them with information relating to