Berkshire Hathaway 2004 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2004 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

Financial Condition

Berkshire’ s balance sheet continues to reflect significant liquidity and a strong capital base. Consolidated

shareholders’ equity at December 31, 2004 totaled $85.9 billion. Consolidated cash and invested assets, excluding assets of

finance and financial products businesses, totaled approximately $102.9 billion at December 31, 2004 (including cash and cash

equivalents of $40.0 billion) and $95.6 billion at December 31, 2003 (including $31.3 billion in cash and cash equivalents).

Berkshire’ s consolidated notes payable and other borrowings, excluding borrowings of finance businesses, totaled $3.5

billion at December 31, 2004 and $4.2 billion at December 31, 2003. During 2004, commercial paper and short-term borrowings

of subsidiaries declined $388 million, primarily from repayments arising from operating cash flow of NetJets and Shaw.

Additionally, investment contract balances of $226 million were repaid during 2004.

In May 2002, Berkshire issued the SQUARZ securities, which consist of $400 million par amount of senior notes due

in November 2007 together with warrants to purchase 4,464 Class A equivalent shares of Berkshire common stock, which expire

in May 2007. A warrant premium is payable to Berkshire at an annual rate of 3.75% and interest is payable to note holders at a

rate of 3.00%. Each warrant provides the holder the right to purchase either 0.1116 shares of Class A or 3.348 shares of Class B

stock for $10,000. In addition, holders of the senior notes have the option to require Berkshire to repurchase the senior notes at

par on May 15, 2005 and 2006, provided that the holders also surrender a corresponding amount of warrants for cancellation.

All warrants and senior notes were outstanding as of December 31, 2004.

Assets of the finance and financial products businesses totaled $30.1 billion as of December 31, 2004, compared to

$49.0 billion at June 30, 2004 and $28.3 billion at December 31, 2003. Liabilities totaled $20.4 billion as of December 31, 2004

compared to $42.2 billion at June 30, 2004 and $22.0 billion at December 31, 2003. As discussed in Note 15 to the Consolidated

Financial Statements, Berkshire consolidated the accounts of Value Capital, L.P. beginning as of January 1, 2004, and as a result

of a reduction of its ownership interest in the partnership, discontinued consolidation effective July 1, 2004. As of June 30,

2004, Value Capital’ s assets and liabilities totaled $24.1 billion and $23.4 billion, respectively.

Cash and cash equivalents of finance and financial products businesses totaled $3.4 billion as of December 31, 2004

and $4.7 billion as of December 31, 2003. During 2004, manufactured housing loans of Clayton increased approximately $5.0

billion to $7.5 billion as of December 31, 2004. The increase was primarily attributed to a loan portfolio acquisition of

approximately $3.7 billion on December 30, 2004. Clayton is a leading builder of manufactured housing, provides financing to

customers, and acquires other installment loan portfolios. Prior to its acquisition by Berkshire in August 2003, Clayton

securitized and sold a significant portion of its installment loans through special purpose entities. In early 2003, Clayton

discontinued loan securitizations and sales.

Notes payable and other borrowings of Berkshire’ s finance and financial products businesses totaled $5.4 billion at

December 31, 2004 and $4.9 billion at December 31, 2003. During 2004, Berkshire Hathaway Finance Corporation (“BHFC”)

issued a total of $1.6 billion par amount of medium term notes due from 2007 through 2014. The proceeds of these issues were

used to finance originated and acquired loans of Clayton. These medium term notes are guaranteed by Berkshire. On January 4,

2005, BHFC issued an additional $3.75 billion par amount of medium term notes to finance Clayton’ s December 30, 2004 loan

portfolio acquisition discussed above. In February 2004, the remaining balance of Berkadia’ s bank borrowing ($525 million)

was repaid upon the collection of the final $525 million loan to FINOVA and in the second quarter GRS repaid debt of

approximately $550 million.

Berkshire believes that it currently maintains sufficient liquidity to cover its existing contractual obligations and

provide for contingent liquidity.

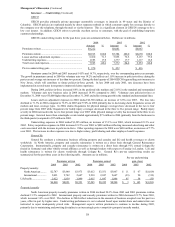

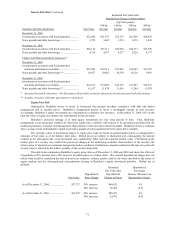

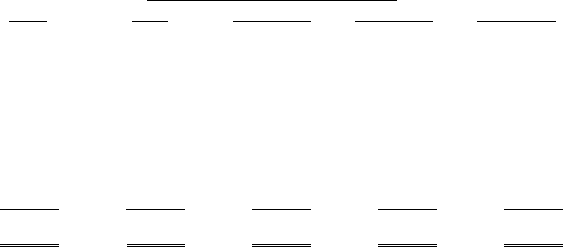

Contractual Obligations

A summary of long-term contractual obligations as of December 31, 2004 follows. Amounts represent estimates of

gross undiscounted amounts payable over time. In addition, certain losses and loss adjustment expenses for property and

casualty loss reserves are ceded to others under reinsurance contracts and therefore are recoverable. Such potential recoverables

are not reflected in the table. Amounts are in millions.

Estimated payments due by period

Total 2005 2006-2007 2008-2009 After 2009

Notes payable and other borrowings (1) .......... $11,753 $ 1,937 $ 2,138 $ 2,321 $ 5,357

Securities sold under agreements to

repurchase

(1) .............................................. 5,831 5,831 — — —

Operating leases ............................................. 1,628 364 528 328 408

Purchase obligations (2) .................................. 7,759 3,103 2,285 1,504 867

Unpaid losses and loss expenses .................... 47,878 11,023 12,280 6,637 17,938

Other long-term policyholder liabilities......... 4,308 94 78 72 4,064

Other (3) .......................................................... 7,124 430 517 416 5,761

Total............................................................... $86,281 $22,782 $17,826 $11,278 $34,395

(1) Includes interest

(2) Principally relates to NetJets’ aircraft purchases

(3) Principally annuity reserves and employee benefits