Berkshire Hathaway 2004 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2004 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. But a man named Leo Goodwin had an idea for an even more efficient auto insurer and, with a

skimpy $200,000, started GEICO in 1936. Goodwin’ s plan was to eliminate the agent entirely and to deal

instead directly with the auto owner. Why, he asked himself, should there be any unnecessary and

expensive links in the distribution mechanism when the product, auto insurance, was both mandatory and

costly. Purchasers of business insurance, he reasoned, might well require professional advice, but most

consumers knew what they needed in an auto policy. That was a powerful insight.

Originally, GEICO mailed its low-cost message to a limited audience of government employees.

Later, it widened its horizons and shifted its marketing emphasis to the phone, working inquiries that came

from broadcast and print advertising. And today the Internet is coming on strong.

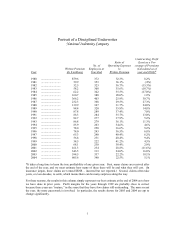

Between 1936 and 1975, GEICO grew from a standing start to a 4% market share, becoming the

country’ s fourth largest auto insurer. During most of this period, the company was superbly managed,

achieving both excellent volume gains and high profits. It looked unstoppable. But after my friend and

hero Lorimer Davidson retired as CEO in 1970, his successors soon made a huge mistake by under-

reserving for losses. This produced faulty cost information, which in turn produced inadequate pricing. By

1976, GEICO was on the brink of failure.

Jack Byrne then joined GEICO as CEO and, almost single-handedly, saved the company by heroic

efforts that included major price increases. Though GEICO’ s survival required these, policyholders fled

the company, and by 1980 its market share had fallen to 1.8%. Subsequently, the company embarked on

some unwise diversification moves. This shift of emphasis away from its extraordinary core business

stunted GEICO’ s growth, and by 1993 its market share had grown only fractionally, to 1.9%. Then Tony

Nicely took charge.

And what a difference that’ s made: In 2005 GEICO will probably secure a 6% market share.

Better yet, Tony has matched growth with profitability. Indeed, GEICO delivers all of its constituents

major benefits: In 2004 its customers saved $1 billion or so compared to what they would otherwise have

paid for coverage, its associates earned a $191 million profit-sharing bonus that averaged 24.3% of salary,

and its owner – that’ s us – enjoyed excellent financial returns.

There’ s more good news. When Jack Byrne was rescuing the company in 1976, New Jersey

refused to grant him the rates he needed to operate profitably. He therefore promptly – and properly –

withdrew from the state. Subsequently, GEICO avoided both New Jersey and Massachusetts, recognizing

them as two jurisdictions in which insurers were destined to struggle.

In 2003, however, New Jersey took a new look at its chronic auto-insurance problems and enacted

legislation that would curb fraud and allow insurers a fair playing field. Even so, one might have expected

the state’ s bureaucracy to make change slow and difficult.

But just the opposite occurred. Holly Bakke, the New Jersey insurance commissioner, who would

be a success in any line of work, was determined to turn the law’ s intent into reality. With her staff’ s

cooperation, GEICO ironed out the details for re-entering the state and was licensed last August. Since

then, we’ ve received a response from New Jersey drivers that is multiples of my expectations.

We are now serving 140,000 policyholders – about 4% of the New Jersey market – and saving

them substantial sums (as we do drivers everywhere). Word-of-mouth recommendations within the state

are causing inquiries to pour in. And once we hear from a New Jersey prospect, our closure rate – the

percentage of policies issued to inquiries received – is far higher in the state than it is nationally.

We make no claim, of course, that we can save everyone money. Some companies, using rating

systems that are different from ours, will offer certain classes of drivers a lower rate than we do. But we

believe GEICO offers the lowest price more often than any other national company that serves all segments

of the public. In addition, in most states, including New Jersey, Berkshire shareholders receive an 8%

discount. So gamble fifteen minutes of your time and go to GEICO.com – or call 800-847-7536 – to see

9