Berkshire Hathaway 2004 Annual Report Download - page 15

Download and view the complete annual report

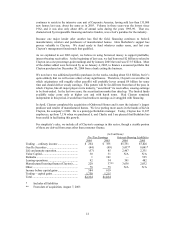

Please find page 15 of the 2004 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Since we purchased MiTek in 2001, Gene Toombs, its CEO, has made some brilliant “bolt-on”

acquisitions and is on his way to creating a mini-Berkshire.

Shaw fielded a barrage of price increases in its main fiber materials during the year, a hit that added

more than $300 million to its costs. (When you walk on carpet you are, in effect, stepping on

processed oil.) Though we followed these hikes in costs with price increases of our own, there was an

inevitable lag. Therefore, margins narrowed as the year progressed and remain under pressure today.

Despite these roadblocks, Shaw, led by Bob Shaw and Julian Saul, earned an outstanding 25.6% on

tangible equity in 2004. The company is a powerhouse and has a bright future.

• In apparel, Fruit of the Loom increased unit sales by 10 million dozen, or 14%, with shipments of

intimate apparel for women and girls growing by 31%. Charlie, who is far more knowledgeable than I

am on this subject, assures me that women are not wearing more underwear. With this expert input, I

can only conclude that our market share in the women’ s category must be growing rapidly. Thanks to

John Holland, Fruit is on the move.

A smaller operation, Garan, also had an excellent year. Led by Seymour Lichtenstein and Jerry

Kamiel, this company manufactures the popular Garanimals line for children. Next time you are in a

Wal-Mart, check out this imaginative product.

• Among our retailers, Ben Bridge (jewelry) and R. C. Willey (home furnishings) were particular

standouts last year.

At Ben Bridge same-store sales grew 11.4%, the best gain among the publicly-held jewelers whose

reports I have seen. Additionally, the company’ s profit margin widened. Last year was not a fluke:

During the past decade, the same-store sales gains of the company have averaged 8.8%.

Ed and Jon Bridge are fourth-generation managers and run the business exactly as if it were their own

– which it is in every respect except for Berkshire’ s name on the stock certificates. The Bridges have

expanded successfully by securing the right locations and, more importantly, by staffing these stores

with enthusiastic and knowledgeable associates. We will move into Minneapolis-St. Paul this year.

At Utah-based R. C. Willey, the gains from expansion have been even more dramatic, with 41.9% of

2004 sales coming from out-of-state stores that didn’ t exist before 1999. The company also improved

its profit margin in 2004, propelled by its two new stores in Las Vegas.

I would like to tell you that these stores were my idea. In truth, I thought they were mistakes. I knew,

of course, how brilliantly Bill Child had run the R. C. Willey operation in Utah, where its market share

had long been huge. But I felt our closed-on-Sunday policy would prove disastrous away from home.

Even our first out-of-state store in Boise, which was highly successful, left me unconvinced. I kept

asking whether Las Vegas residents, conditioned to seven-day-a-week retailers, would adjust to us.

Our first Las Vegas store, opened in 2001, answered this question in a resounding manner,

immediately becoming our number one unit.

Bill and Scott Hymas, his successor as CEO, then proposed a second Las Vegas store, only about 20

minutes away. I felt this expansion would cannibalize the first unit, adding significant costs but only

modest sales. The result? Each store is now doing about 26% more volume than any other store in the

chain and is consistently showing large year-over-year gains.

R. C. Willey will soon open in Reno. Before making this commitment, Bill and Scott again asked for

my advice. Initially, I was pretty puffed up about the fact that they were consulting me. But then it

dawned on me that the opinion of someone who is always wrong has its own special utility to decision-

makers.

14