Berkshire Hathaway 2004 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2004 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

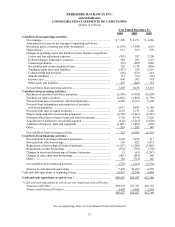

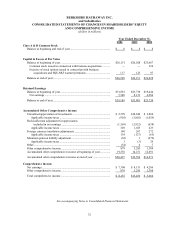

BERKSHIRE HATHAWAY INC.

and Subsidiaries

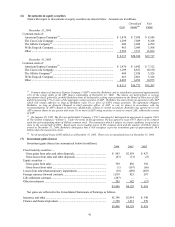

CONSOLIDATED STATEMENTS OF CASH FLOWS

(dollars in millions)

Year Ended December 31,

2004 2003 2002

Cash flows from operating activities:

Net earnings................................................................................................ $ 7,308 $ 8,151 $ 4,286

Adjustments to reconcile net earnings to operating cash flows:

Investment gains, securities and other investments .................................... (1,636) (3,304) (621)

Depreciation ............................................................................................... 911 829 679

Changes in operating assets and liabilities before business acquisitions:

Losses and loss adjustment expenses....................................................... (383) 397 3,209

Deferred charges reinsurance assumed .................................................... 360 292 (147)

Unearned premiums................................................................................. (52) (585) 1,880

Receivables and certain originated loans ................................................. 102 1,714 (896)

Trading account assets and liabilities....................................................... (367) 530 2,191

Collateral held and provided.................................................................... (86) (273) 218

Annuity liabilities .................................................................................... 131 730 (24)

Income taxes ............................................................................................ 860 505 195

Other assets and liabilities ....................................................................... 257 (548) 165

Net cash flows from operating activities .................................................... 7,405 8,438 11,135

Cash flows from investing activities:

Purchases of securities with fixed maturities.............................................. (5,924) (9,924) (16,288)

Purchases of equity securities..................................................................... (2,032) (1,842) (1,756)

Proceeds from sales of securities with fixed maturities.............................. 4,560 17,165 9,108

Proceeds from redemptions and maturities of securities

with fixed maturities ................................................................................ 5,637 9,847 6,740

Proceeds from sales of equity securities..................................................... 2,610 3,159 1,340

Finance loans and other investments purchased......................................... (6,314) (2,641) (2,281)

Principal collections on finance loans and other investments .................... 2,736 4,140 5,226

Acquisitions of businesses, net of cash acquired........................................ (414) (3,213) (2,620)

Additions of property, plant and equipment ............................................... (1,201) (1,002) (928)

Other........................................................................................................... 563 243 148

Net cash flows from investing activities..................................................... 221 15,932 (1,311)

Cash flows from financing activities:

Proceeds from borrowings of finance businesses....................................... 1,668 2,479 211

Proceeds from other borrowings................................................................. 339 822 1,472

Repayments of borrowings of finance businesses ...................................... (1,267) (2,260) (3,802)

Repayments of other borrowings................................................................ (674) (783) (774)

Changes in short term borrowings of finance businesses ........................... 13 (63) (1,207)

Changes in other short term borrowings..................................................... (401) (642) 380

Other........................................................................................................... 166 (714) 146

Net cash flows from financing activities .................................................... (156) (1,161) (3,574)

Increase in cash and cash equivalents......................................................... 7,470 23,209 6,250

Cash and cash equivalents at beginning of year............................................... 35,957 12,748 6,498

Cash and cash equivalents at end of year *.................................................. $43,427 $35,957 $12,748

* Cash and cash equivalents at end of year are comprised of the following:

Insurance and Other................................................................................... $40,020 $31,262 $10,283

Finance and Financial Products ................................................................ 3,407 4,695 2,465

$43,427 $35,957 $12,748

See accompanying Notes to Consolidated Financial Statements