Berkshire Hathaway 2004 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2004 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

General Re (Continued)

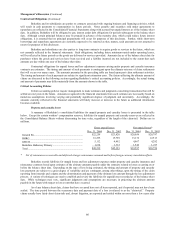

Expected loss ratios are selected by reserve cell, by accident year, based upon reviewing indicated ultimate loss ratios

predicted from aggregated pricing statistics. Indicated ultimate loss ratios are calculated using the selected loss emergence

pattern, reported losses and earned premium. If the selected emergence pattern is not accurate, then the indicated ultimate loss

ratios will not be correct and this can influence the selected loss ratios and hence the IBNR reserve. As with selected loss

emergence patterns, selecting expected loss ratios is not a strictly mechanical process and judgment is used in the analysis of

indicated ultimate loss ratios and department pricing loss ratios.

IBNR reserves are estimated by reserve cell, by accident year, using the expected loss emergence pattern and the

expected loss ratios. The expected loss emergence patterns and expected loss ratios are the critical IBNR reserving assumptions

and are generally updated every year-end. Once the year-end IBNR reserves are determined, actuaries calculate expected case

loss emergence for the upcoming calendar year. This calculation does not involve new assumptions and uses the prior year-end

expected loss emergence patterns and expected loss ratios. The expected losses are then allocated into interim estimates that are

compared to actual reported losses in the subsequent year. This comparison provides a test of the adequacy of prior year-end

IBNR reserves and forms the basis for possibly changing IBNR reserve assumptions during the course of the year.

In certain reserve cells (excess directors and officers and errors and omissions) IBNR reserves are based on estimated

ultimate losses, without consideration of expected emergence patterns. These cells typically involve a spike in loss activity

arising from recent industry developments making it difficult to select an expected loss emergence pattern as has been

experienced from the recent wave of corporate scandals that have caused an increase in reported losses. Overall industry-wide

loss experience data and informed judgment are used when internal loss data is of limited reliability, such as in setting the

estimates for asbestos and hazardous waste claims. Unpaid environmental, asbestos and mass tort reserves at December 31, 2004

were approximately $1.6 billion gross and $1.3 billion net of reinsurance. Such reserves were approximately $1.2 billion gross

and $1.0 billion net of reinsurance as of December 31, 2003. Claims paid attributable to such losses were about $70 million in

2004.

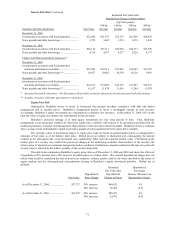

BHRG

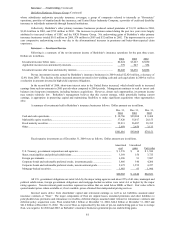

BHRG’ s unpaid losses and loss adjustment expenses as of December 31, 2004 are summarized as follows. Amounts

are in millions.

Property Casualty Total

Reported case reserves .......................................................... $ 1,526 $ 1,506 $ 3,032

IBNR reserves ....................................................................... 991 2,167 3,158

Retroactive ............................................................................ — 10,045 10,045

Gross reserves ....................................................................... $ 2,517 $13,718 16,235

Ceded reserves and deferred charges..................................... (3,103)

Net reserves........................................................................... $13,132

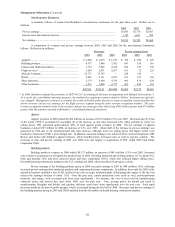

As of December 31, 2004, BHRG’ s gross loss reserves related to retroactive reinsurance policies were attributed to

casualty losses. Retroactive policies include excess of loss contracts, in which losses above a contractual retention are

indemnified as well as contracts that indemnify all losses paid by the counterparty after the effective date. Retroactive losses

paid in 2004 totaled $860 million. The classification “reported case reserves” has no practical analytical value with respect to

retroactive policies since the amount is derived from reports in bulk from ceding companies, who may have inconsistent

definitions of “case reserves.” Reserves are reviewed and established in the aggregate including provisions for IBNR reserves.

In establishing retroactive reinsurance reserves, historical aggregate loss payment patterns are analyzed and projected

into the future under various scenarios. The claim-tail is expected to be very long for many policies and may last several

decades. Management attributes judgmental probability factors to these aggregate loss payment scenarios and an expectancy

outcome is determined. Due to contractual limits of indemnification, maximum unpaid losses under retroactive policies

approximated $12.2 billion as of December 31, 2004. Management cannot reasonably estimate the low-end of the retroactive

reserve range given the nature of the liabilities assumed.

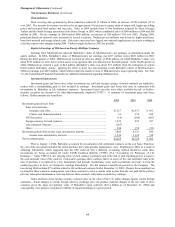

BHRG’ s liabilities for environmental, asbestos, and latent injury losses and loss adjustment expenses are presently

believed to be concentrated within retroactive reinsurance contracts. Reserves for such losses were approximately $4.2 billion at

December 31, 2004 and $4.4 billion at December 31, 2003. Claims paid in 2004 attributable to such losses were approximately

$334 million. BHRG, as a reinsurer, does not regularly receive reliable information regarding numbers of asbestos,

environmental and latent injury claims from ceding companies on a consistent basis, particularly with respect to multi-line treaty

or aggregate excess of loss policies.

BHRG’ s other property and casualty loss reserves derive from catastrophe, individual risk and multi-line reinsurance

policies. Reserve amounts are based upon loss estimates reported by ceding companies and IBNR reserves, which are primarily

a function of reported losses from ceding companies and anticipated loss ratios established on an individual contract basis

supplemented by management’ s judgment of the impact on each contract of major catastrophe events as they become known.

Anticipated loss ratios are based upon management’ s judgment considering the type of business covered, analysis of each ceding

company’ s loss history and evaluation of that portion of the underlying contracts underwritten by each ceding company, which

are in turn ceded to BHRG. A range of reserve amounts as a result of changes in underlying assumptions is not prepared.