Berkshire Hathaway 2004 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2004 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Clearly, Berkshire’ s results would have been far better if I had caught this swing of the pendulum.

That may seem easy to do when one looks through an always-clean, rear-view mirror. Unfortunately,

however, it’ s the windshield through which investors must peer, and that glass is invariably fogged. Our

huge positions add to the difficulty of our nimbly dancing in and out of holdings as valuations swing.

Nevertheless, I can properly be criticized for merely clucking about nose-bleed valuations during

the Bubble rather than acting on my views. Though I said at the time that certain of the stocks we held

were priced ahead of themselves, I underestimated just how severe the overvaluation was. I talked when I

should have walked.

What Charlie and I would like is a little action now. We don’ t enjoy sitting on $43 billion of cash

equivalents that are earning paltry returns. Instead, we yearn to buy more fractional interests similar to

those we now own or – better still – more large businesses outright. We will do either, however, only when

purchases can be made at prices that offer us the prospect of a reasonable return on our investment.

* * * * * * * * * * * *

We’ ve repeatedly emphasized that the “realized” gains that we report quarterly or annually are

meaningless for analytical purposes. We have a huge amount of unrealized gains on our books, and our

thinking about when, and if, to cash them depends not at all on a desire to report earnings at one specific

time or another. A further complication in our reported gains occurs because GAAP requires that foreign

exchange contracts be marked to market, a stipulation that causes unrealized gains or losses in these

holdings to flow through our published earnings as if we had sold our positions.

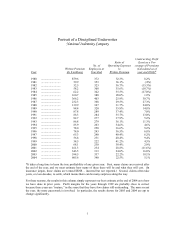

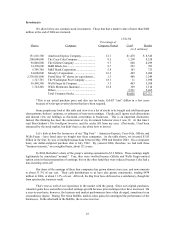

Despite the problems enumerated, you may be interested in a breakdown of the gains we reported

in 2003 and 2004. The data reflect actual sales except in the case of currency gains, which are a

combination of sales and marks to market.

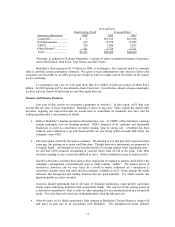

Category Pre-Tax Gain (in $ millions)

2004 2003

Common Stocks ............................. $ 870 $ 448

U.S. Government Bonds................. 104 1,485

Junk Bonds ..................................... 730 1,138

Foreign Exchange Contracts........... 1,839 825

Other............................................... (47) 233

Total ............................................... $3,496 $4,129

The junk bond profits include a foreign exchange component. When we bought these bonds in

2001 and 2002, we focused first, of course, on the credit quality of the issuers, all of which were American

corporations. Some of these companies, however, had issued bonds denominated in foreign currencies.

Because of our views on the dollar, we favored these for purchase when they were available.

As an example, we bought €254 million of Level 3 bonds (10 ¾% of 2008) in 2001 at 51.7% of

par, and sold these at 85% of par in December 2004. This issue was traded in Euros that cost us 88¢ at the

time of purchase but that brought $1.29 when we sold. Thus, of our $163 million overall gain, about $85

million came from the market’ s revised opinion about Level 3’ s credit quality, with the remaining $78

million resulting from the appreciation of the Euro. (In addition, we received cash interest during our

holding period that amounted to about 25% annually on our dollar cost.)

* * * * * * * * * * * *

The media continue to report that “Buffett buys” this or that stock. Statements like these are

almost always based on filings Berkshire makes with the SEC and are therefore wrong. As I’ ve said

before, the stories should say “Berkshire buys.”

17