Berkshire Hathaway 2004 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2004 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

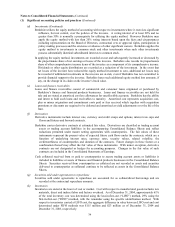

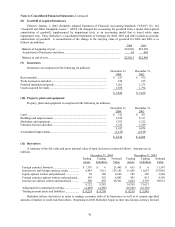

(1) Significant accounting policies and practices (Continued)

(r) Accounting pronouncements to be adopted in 2005 (Continued)

In November 2004, the FASB issued Statement of Financial Accounting Standards No. 151 (“SFAS 151”),

“Inventory Costs an amendment of ARB No. 43, Chapter 4.” SFAS 151 discusses the general principles

applicable to the pricing of inventory. This Statement amends ARB 43, Chapter 4, to clarify that

abnormal amounts of idle facility expense, freight, handling costs, and wasted materials (spoilage)

should be recognized as current-period charges. In addition, this Statement requires that allocation of

fixed production overheads to the costs of conversion be based on the normal capacity of production

facilities. The provisions of this Statement are effective for inventory costs incurred during fiscal years

beginning after June 15, 2005. The adoption of SFAS 151 is not expected to have a material effect on

Berkshire’ s financial statements.

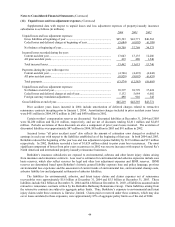

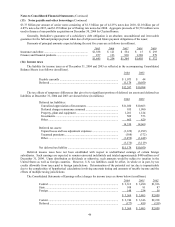

(2) Significant business acquisitions

Berkshire’ s long-held acquisition strategy is to purchase businesses with consistent earning power, good returns on

equity, able and honest management and at sensible prices. Businesses with these characteristics typically have market

values that exceed net asset value, thus producing goodwill for accounting purposes. During 2003 and 2002, Berkshire

acquired several businesses which are described in the following paragraphs.

On May 23, 2003, Berkshire acquired McLane Company, Inc. (“McLane”), from Wal-Mart Stores, Inc. for cash

consideration of approximately $1.5 billion. McLane is one of the nation’ s largest wholesale distributors of groceries

and nonfood items to convenience stores, wholesale clubs, mass merchandisers, quick service restaurants, theaters and

others.

On August 7, 2003, Berkshire acquired all the outstanding common stock of Clayton Homes, Inc. (“Clayton”) for

cash consideration of approximately $1.7 billion in the aggregate. Clayton is a vertically integrated manufactured housing

company which at the time of the acquisition had 20 manufacturing plants, 306 company owned stores, 535 independent

retailers, 89 manufactured housing communities and financial services operations that provide mortgage services and

insurance protection.

During 2002, Berkshire completed five business acquisitions for cash consideration of approximately $2.3 billion

in the aggregate. Information concerning these acquisitions follows.

Albecca Inc. (“Albecca”)

On February 8, 2002, Berkshire acquired all of the outstanding shares of Albecca. Albecca designs, manufactures

and distributes a complete line of high-quality custom picture framing products primarily under the Larson-Juhl name.

Fruit of the Loom (“FOL”)

On April 30, 2002, Berkshire acquired the basic apparel business of Fruit of the Loom, LTD. FOL is a leading

vertically integrated basic apparel company manufacturing and marketing underwear, activewear, casualwear and

childrenswear. FOL operates on a worldwide basis and sells its products principally in North America under the Fruit of

the Loom and BVD brand names.

Garan, Incorporated (“Garan”)

On September 4, 2002, Berkshire acquired all of the outstanding common stock of Garan. Garan is a leading

manufacturer of children’ s, women’ s, and men’ s apparel bearing the private labels of its customers as well as several of

its own trademarks, including GARANIMALS.

CTB International (“CTB”)

On October 31, 2002, Berkshire acquired all of the outstanding shares of CTB, a manufacturer of equipment and

systems for the poultry, hog, egg production and grain industries.

The Pampered Chef, LTD (“The Pampered Chef”)

On October 31, 2002, Berkshire acquired The Pampered Chef, LTD. The Pampered Chef is the premier direct

seller of kitchen tools in the U.S., primarily through branded product lines.

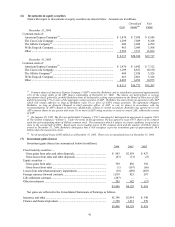

The results of operations for each of the entities acquired are included in Berkshire’ s consolidated results of

operations from the effective date of each acquisition. The following table sets forth certain unaudited consolidated

earnings data for 2003, as if each of the acquisitions discussed above were consummated on the same terms at the

beginning of each year. Dollars are in millions, except per share amounts.

2003

Total revenues ............................................................................................................................ $72,945

Net earnings ............................................................................................................................... 8,203

Earnings per equivalent Class A common share........................................................................ 5,343