Berkshire Hathaway 2004 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2004 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

BERKSHIRE HATHAWAY INC.

and Subsidiaries

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

Results of Operations

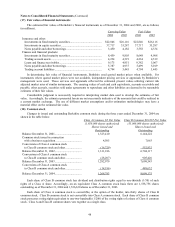

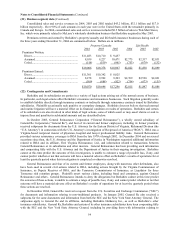

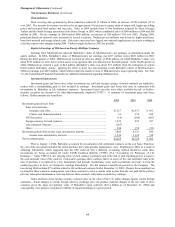

Net earnings for each of the past three years are disaggregated in the table that follows. Amounts are after deducting

income taxes and minority interests. Dollars are in millions.

2004 2003 2002

Insurance – underwriting............................................................................................... $1,008 $1,114 $ (284)

Insurance – investment income..................................................................................... 2,045 2,276 2,096

Non-insurance businesses ............................................................................................. 1,913 1,745 1,668

Equity in earnings of MidAmerican Energy Holdings Company ................................. 237 429 359

Interest expense, unallocated ........................................................................................ (59) (59) (55)

Other ............................................................................................................................. (95) (83) (64)

Investment gains ........................................................................................................... 2,259 2,729 566

Net earnings...................................................................................................... $7,308 $8,151 $ 4,286

Berkshire’ s operating businesses are managed on a decentralized basis. There are essentially no centralized or

integrated business functions (such as sales, marketing, purchasing or human resources) and there is minimal involvement by

Berkshire’ s corporate headquarters in the day-to-day business activities of the operating businesses. Berkshire’ s corporate office

management participates in and is ultimately responsible for significant capital allocation decisions, investment activities and the

selection of the Chief Executive to head each of the operating businesses.

Accordingly, Berkshire’ s reportable business segments are organized in a manner that reflects how Berkshire’ s top

management views those business activities. Certain businesses have been grouped based upon similar products or product lines,

marketing, selling and distribution characteristics even though those businesses are operated by separate local management.

There are approximately 40 separate reporting units.

The business segment data (Note 21 to Consolidated Financial Statements) should be read in conjunction with this

discussion.

Insurance — Underwriting

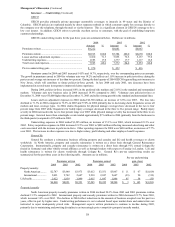

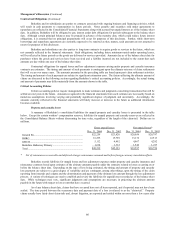

A summary follows of underwriting results from Berkshire’ s insurance businesses for the past three years. Dollars are

in millions.

2004 2003 2002

Underwriting gain (loss) attributable to:

GEICO.................................................................................................................... $ 970 $ 452 $ 416

General Re .............................................................................................................. 3 145 (1,393)

Berkshire Hathaway Reinsurance Group................................................................ 417 1,047 547

Berkshire Hathaway Primary Group....................................................................... 161 74 32

Underwriting gain (loss) — pre-tax .............................................................................. 1,551 1,718 (398)

Income taxes and minority interests.............................................................................. 543 604 (114)

Net underwriting gain (loss)............................................................................. $ 1,008 $ 1,114 $ (284)

Berkshire engages in both primary insurance and reinsurance of property and casualty risks. Through General Re,

Berkshire also reinsures life and health risks. In primary insurance activities, Berkshire subsidiaries assume defined portions of

the risks of loss from persons or organizations that are directly subject to the risks. In reinsurance activities, Berkshire

subsidiaries assume defined portions of similar or dissimilar risks that other insurers or reinsurers have subjected themselves to in

their own insuring activities. Berkshire’ s principal insurance businesses are: (1) GEICO, one of the five largest auto insurers in

the U.S., (2) General Re, one of the four largest reinsurers in the world, (3) Berkshire Hathaway Reinsurance Group (“BHRG”)

and (4) Berkshire Hathaway Primary Group. Berkshire’ s management views insurance businesses as possessing two distinct

operations – underwriting and investing. Accordingly, Berkshire evaluates performance of underwriting operations without any

allocation of investment income.

A significant marketing strategy followed by all these businesses is the maintenance of extraordinary capital strength.

Statutory surplus of Berkshire’ s insurance businesses totaled approximately $48 billion at December 31, 2004. This superior

capital strength creates opportunities, especially with respect to reinsurance activities, to negotiate and enter into insurance and

reinsurance contracts specially designed to meet unique needs of sophisticated insurance and reinsurance buyers. Additional

information regarding Berkshire’ s insurance and reinsurance operations follows.