Berkshire Hathaway 2004 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2004 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

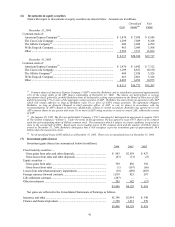

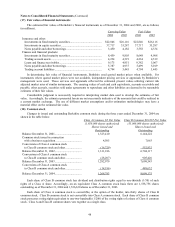

(19) Pension plans

Certain Berkshire subsidiaries individually sponsor defined benefit pension plans covering their employees.

Benefits under the plans are generally based on years of service and compensation, although benefits under certain plans

are based on years of service and fixed benefit rates. Funding policies are generally to contribute amounts required to

meet regulatory requirements plus additional amounts determined by management based on actuarial valuations. The

measurement date for the pension plans is predominantly December 31.

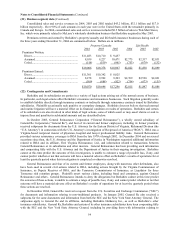

The components of net periodic pension expense for each of the three years ending December 31, 2004 are as

follows (in millions).

2004 2003 2002

Service cost....................................................................................................................... $ 109 $ 105 $ 91

Interest cost....................................................................................................................... 189 181 164

Expected return on plan assets.......................................................................................... (171) (159) (147)

Curtailment gain............................................................................................................... (70) — —

Net amortization, deferral and other................................................................................. 13 7 8

Net pension expense......................................................................................................... $ 70 $ 134 $ 116

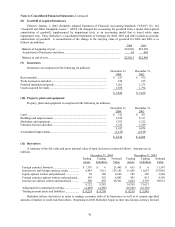

During the third quarter of 2004 a Berkshire subsidiary amended its defined benefit plan to freeze benefits as of the

end of 2005. Such an event is considered a curtailment and the curtailment gain included in the table above represents

the elimination of projected plan benefits beyond the end of 2005 and the recognition of unamortized prior service costs

and actuarial losses as of the amendment date.

The increase (decrease) in minimum liabilities included in other comprehensive income were $41 million in 2004,

$(3) million in 2003, and $263 million in 2002. Such amounts include Berkshire’ s share of changes in minimum

liabilities of MidAmerican.

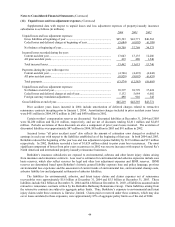

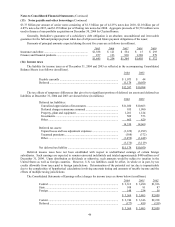

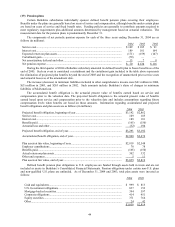

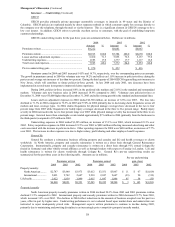

The accumulated benefit obligation is the actuarial present value of benefits earned based on service and

compensation prior to the valuation date. The projected benefit obligation is the actuarial present value of benefits

earned based upon service and compensation prior to the valuation date and includes assumptions regarding future

compensation levels when benefits are based on those amounts. Information regarding accumulated and projected

benefit obligations and plan assets are as follows (in millions).

2004 2003

Projected benefit obligation, beginning of year................................................................ $3,192 $2,862

Service cost....................................................................................................................... 109 105

Interest cost....................................................................................................................... 189 181

Benefits paid..................................................................................................................... (165) (150)

Actuarial loss and other.................................................................................................... (32) 194

Projected benefit obligation, end of year.......................................................................... $3,293 $3,192

Accumulated benefit obligation, end of year.................................................................... $2,908 $2,676

Plan assets at fair value, beginning of year....................................................................... $2,819 $2,548

Employer contributions .................................................................................................... 78 78

Benefits paid..................................................................................................................... (165) (150)

Actual return on plan assets.............................................................................................. 302 332

Other and expenses........................................................................................................... 5 11

Plan assets at fair value, end of year................................................................................. $3,039 $2,819

Defined benefit pension plan obligations to U.S. employees are funded through assets held in trusts and are not

included as assets in Berkshire’ s Consolidated Financial Statements. Pension obligations under certain non-U.S. plans

and non-qualified U.S. plans are unfunded. As of December 31, 2004 and 2003, total plan assets were invested as

follows:

2004 2003

Cash and equivalents..................................................................................................... $ 999 $ 813

U.S. Government obligations ........................................................................................ 837 152

Mortgage-backed securities........................................................................................... 394 597

Corporate obligations .................................................................................................... 414 451

Equity securities ............................................................................................................ 371 764

Other.............................................................................................................................. 24 42

$3,039 $2,819