Berkshire Hathaway 2004 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2004 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

Management’s Discussion (Continued)

Insurance — Underwriting (Continued)

GEICO

GEICO provides primarily private passenger automobile coverages to insureds in 49 states and the District of

Columbia. GEICO policies are marketed mainly by direct response methods in which customers apply for coverage directly to

the company over the telephone, through the mail or via the Internet. This is a significant element in GEICO’ s strategy to be a

low cost insurer. In addition, GEICO strives to provide excellent service to customers, with the goal of establishing long-term

customer relationships.

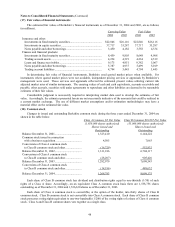

GEICO’ s underwriting results for the past three years are summarized below. Dollars are in millions.

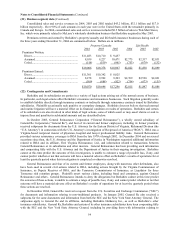

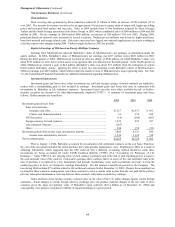

2004 2003 2002

Amount %Amount %Amount %

Premiums written ............................................................... $9,212 $8,081 $6,963

Premiums earned................................................................ $8,915 100.0 $7,784 100.0 $6,670 100.0

Losses and loss adjustment expenses ................................. 6,360 71.3 5,955 76.5 5,137 77.0

Underwriting expenses....................................................... 1,585 17.8 1,377 17.7 1,117 16.8

Total losses and expenses................................................... 7,945 89.1 7,332 94.2 6,254 93.8

Pre-tax underwriting gain................................................... $ 970 $ 452 $ 416

Premiums earned in 2004 and 2003 increased 14.5% and 16.7%, respectively, over the corresponding prior year amounts.

The growth in premiums earned in 2004 for voluntary auto was 14.2% and reflects an 11.8% increase in policies-in-force during the

past year and average rate increases of less than two percent. During the third quarter of 2004 GEICO began selling auto insurance in

New Jersey, which will contribute to future policies-in-force growth. In late 2004 and early 2005, rate decreases have been

implemented in several states in response to improved claims experience.

During 2004, policies-in-force increased 8.8% in the preferred risk markets and 21.6% in the standard and nonstandard

markets. Voluntary auto new business sales in 2004 increased 14.9% compared to 2003. Voluntary auto policies-in-force at

December 31, 2004 were 635,000 higher than at December 31, 2003 and reflect strong growth in the standard and nonstandard lines.

Losses and loss adjustment expenses in 2004 totaled $6,360 million, an increase of 6.8% over 2003. The loss ratio

declined to 71.3% in 2004 compared to 76.5% in 2003 and 77.0% in 2002 primarily due to decreasing claim frequencies across all

markets and most coverage types. In 2004, claims frequencies for physical damage coverages have decreased in the two to four

percent range from 2003 while frequencies for bodily injury coverages decreased in the three to five percent range. Bodily injury

severity in 2004 increased in the two to four percent range over 2003 while physical damage severity has increased in the three to six

percent range. Incurred losses from catastrophe events totaled approximately $71 million in 2004 (primarily from the hurricanes in

the third quarter) compared to $57 million in 2003.

Underwriting expenses in 2004 totaled $1,585 million, an increase of 15.1% over 2003, which increased 23.3% over

2002. Policy acquisition expenses in 2004 increased 21.5% over 2003 to $889 million reflecting increased advertising and other

costs associated with the increase in policies-in-force. Other operating expenses for 2004 were $696 million, an increase of 7.7%

over 2003. The increase in other expenses was due to higher salary, profit sharing and other employee benefit expenses.

General Re

General Re conducts a reinsurance business offering property and casualty and life and health coverages to clients

worldwide. In North America, property and casualty reinsurance is written on a direct basis through General Reinsurance

Corporation. Internationally, property and casualty reinsurance is written on a direct basis through 91% owned Cologne Re

(based in Germany) and other wholly-owned affiliates as well as through brokers with respect to Faraday in London. Life and

health reinsurance is written for clients worldwide through Cologne Re. General Re’ s pre-tax underwriting results are

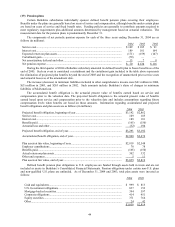

summarized for the past three years in the following table. Amounts are in millions.

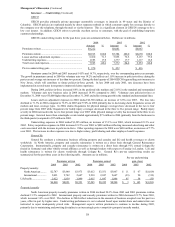

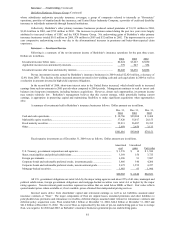

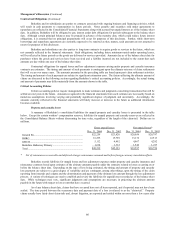

Pre-tax underwriting

Premiums written Premiums earned gain (loss)

2004 2003 2002 2004 2003 2002 2004 2003 2002

Property/casualty:

North American ......... $2,747 $3,440 $3,975 $3,012 $3,551 $3,967 $ 11 $ 67 $(1,019)

International............... 2,091 2,742 2,647 2,218 2,847 2,647 (93) 20 (319)

Life/health ....................... 2,022 1,839 1,899 2,015 1,847 1,886 85 58 (55)

$6,860 $8,021 $8,521 $7,245 $8,245 $8,500 $ 3 $ 145 $(1,393)

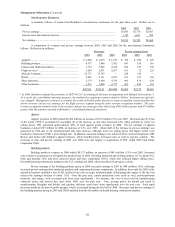

Property/casualty

North American property/casualty premiums written in 2004 declined 20.1% from 2003 and 2003 premiums written

declined 13.5% compared to 2002. International property and casualty premiums written in 2004 decreased 23.7% from 2003,

which increased 3.6% over 2002. The declines in 2004 reflect reductions in the amounts of business accepted over the past two

years, offset in part by higher rates. Underwriting performance is not evaluated based upon market share and underwriters are

instructed to reject inadequately priced risks. Management expects written premiums to continue to decline during 2005,

primarily due to maintaining underwriting discipline in an increasingly price-competitive property/casualty market.