Berkshire Hathaway 2004 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2004 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66

Management’s Discussion (Continued)

Contractual Obligations (Continued)

Berkshire and its subsidiaries are parties to contracts associated with ongoing business and financing activities, which

will result in cash payments to counterparties in future periods. Notes payable and securities sold under agreements to

repurchase are reflected in the Consolidated Financial Statements along with accrued but unpaid interest as of the balance sheet

date. In addition, Berkshire will be obligated to pay interest under debt obligations for periods subsequent to the balance sheet

date. Although certain principal balances may be prepaid in advance of the maturity date, which could reduce future interest

obligations, it is assumed that no principal prepayments will occur for purposes of this disclosure. Further, while short-term

borrowings and repurchase agreements are currently expected to be renewed as they mature, such amounts are not assumed to

renew for purposes of this disclosure.

Berkshire and subsidiaries are also parties to long-term contracts to acquire goods or services in the future, which are

not currently reflected in the financial statements. Such obligations, including future minimum rentals under operating leases,

will be reflected in future periods as the goods are delivered or services provided. Amounts due as of the balance sheet date for

purchases where the goods and services have been received and a liability incurred are not included to the extent that such

amounts are due within one year of the balance sheet date.

Contractual obligations for unpaid losses and loss adjustment expenses arising under property and casualty insurance

contracts are estimates. The timing and amount of such payments is contingent upon the ultimate outcome of claim settlements

that will occur over many years. The amounts presented in the preceding table are based upon past claim settlement activities.

The timing and amount of such payments are subject to significant estimation error. The factors affecting the ultimate amount of

claims are discussed in the following section regarding Berkshire’ s critical accounting policies. Accordingly, the actual timing

and amount of payments may differ materially from the amounts shown in the table.

Critical Accounting Policies

Certain accounting policies require management to make estimates and judgments concerning transactions that will be

settled several years in the future. Amounts recognized in the financial statements from such estimates are necessarily based on

numerous assumptions involving varying and potentially significant degrees of judgment and uncertainty. Accordingly, the

amounts currently reflected in the financial statements will likely increase or decrease in the future as additional information

becomes available.

Property and casualty losses

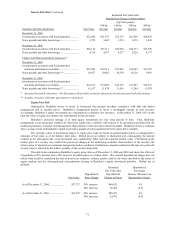

A summary of Berkshire’ s consolidated liabilities for unpaid property and casualty losses is presented in the table

below. Except for certain workers’ compensation reserves, liabilities for unpaid property and casualty reserves are reflected in

the Consolidated Balance Sheets without discounting for time value, regardless of the length of the claim-tail. Dollars are in

millions.

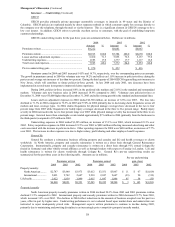

Gross unpaid losses Net unpaid losses*

Dec. 31, 2004 Dec. 31, 2003 Dec. 31, 2004 Dec. 31, 2003

General Re........................................................................... $22,258 $23,820 $20,056 $20,787

BHRG.................................................................................. 16,235 15,769 13,132 12,513

GEICO................................................................................. 5,112 4,492 4,867 4,282

Berkshire Hathaway Primary .............................................. 1,614 1,312 1,542 1,217

Total .................................................................................... $45,219 $45,393 $39,597 $38,799

* Net of reinsurance recoverable and deferred charges reinsurance assumed and before foreign currency translation effects.

Berkshire records liabilities for unpaid losses and loss adjustment expenses under property and casualty insurance and

reinsurance contracts based upon estimates of the ultimate amounts payable under the contracts related to losses occurring on or

before the balance sheet date. Depending on the type of loss being estimated, the timing and amount of property and casualty

loss payments are subject to a great degree of variability and are contingent, among other things, upon the timing of the claim

reporting from insureds and cedants and the determination and payment of the ultimate loss amount through the loss adjustment

process. A variety of techniques are used to establish and review the liabilities for unpaid losses recorded as of the balance sheet

date. While techniques may vary, significant judgments and assumptions are necessary in projecting the ultimate amount

payable in the future with respect to loss events that have occurred.

As of any balance sheet date, claims that have occurred have not all been reported, and if reported may not have been

settled. The time period between the occurrence date and payment date of a loss is referred to as the “claim-tail.” Property

claims usually have fairly short claim-tails and, absent litigation, are reported and settled within no more than a few years after