Berkshire Hathaway 2004 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2004 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

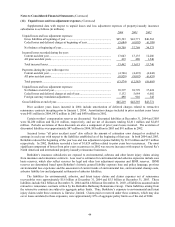

Notes to Consolidated Financial Statements (Continued)

(19) Pension plans (Continued)

Pension plan assets are generally invested with the long-term objective of earning sufficient amounts to cover

expected benefit obligations, while assuming a prudent level of risk. There are no target investment allocation

percentages with respect to individual or categories of investments. Allocations may change rapidly as a result of

changing market conditions and investment opportunities. The expected rates of return on plan assets reflect Berkshire’ s

subjective assessment of expected invested asset returns over a period of several years. Berkshire does not give

significant consideration to past investment returns when establishing assumptions for expected long-term rates of

returns on plan assets. Actual experience will differ from the assumed rates, in particular over quarterly or annual

periods as a result of market volatility and changes in the mix of assets.

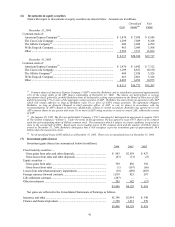

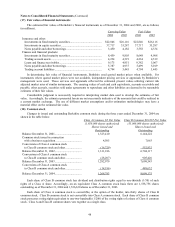

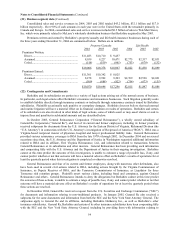

The funded status of the plans as of December 31, 2004 and 2003 is as follows (in millions).

2004 2003

Excess of projected benefit obligations over plan assets.................................................. $254 $373

Unrecognized net actuarial gains and other...................................................................... 262 135

Accrued benefit cost liability............................................................................................ $516 $508

The total net deficit status for plans (including unfunded plans) with accumulated benefit obligations in excess of

plan assets was $425 million and $378 million as of December 31, 2004 and 2003, respectively. Expected contributions

to plans during 2005 are estimated to be $82 million.

The benefit payments, which reflect expected future service as appropriate, are expected to be paid as follows (in

millions): 2005 - $146; 2006 - $151; 2007 - $158; 2008 - $169; 2009 - $174; and 2010 to 2014 - $1,133.

Weighted average assumptions used in determining projected benefit obligations were as follows. These rates are

substantially the same as the weighted average rates used in determining the net periodic pension expense.

2004 2003

Discount rate............................................................................................................................ 5.9 6.0

Discount rate – non-U.S. plans................................................................................................ 5.2 5.3

Expected long-term rate of return on plan assets..................................................................... 6.5 6.5

Rate of compensation increase ................................................................................................ 4.5 4.6

Rate of compensation increase – non-U.S. plans..................................................................... 3.7 2.6

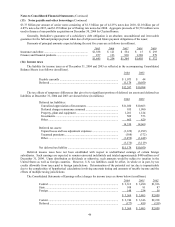

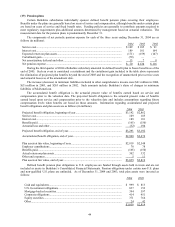

Most Berkshire subsidiaries also sponsor defined contribution retirement plans, such as 401(k) or profit sharing

plans. The plans generally cover all employees who meet specified eligibility requirements. Employee contributions to

the plans are subject to regulatory limitations and the specific plan provisions. Berkshire subsidiaries generally match

these contributions up to levels specified in the plans, and may make additional discretionary contributions as

determined by management. The total expenses related to employer contributions for these plans were $338 million,

$242 million and $202 million for the years ended December 31, 2004, 2003 and 2002, respectively.

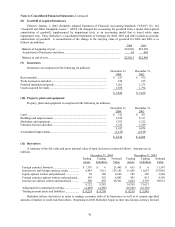

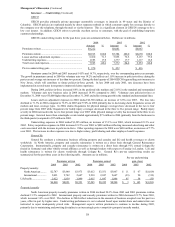

(20) Supplemental cash flow information

A summary of supplemental cash flow information for each of the three years ending December 31, 2004 is

presented in the following table (in millions).

2004 2003 2002

Cash paid during the year for:

Income taxes................................................................................................................. $2,674 $3,309 $1,945

Interest of finance and financial products businesses................................................... 495 372 509

Interest of insurance and other businesses.................................................................... 146 215 207

Non-cash investing and financing activities:

Liabilities assumed in connection with acquisitions of businesses............................... 72 2,167 700

Common shares issued in connection with acquisitions of businesses......................... — — 324

Securities sold (purchased) offset by decrease (increase) in repurchase agreements ... 2,075 5,936 6,666

Excess over cost in the value of equity securities acquired from exercise

of warrants.............................................................................................................. 585 — —