Berkshire Hathaway 2004 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2004 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

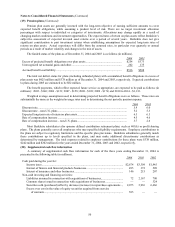

Insurance — Underwriting (Continued)

General Re (Continued)

Property/casualty (Continued)

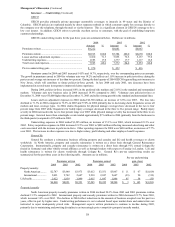

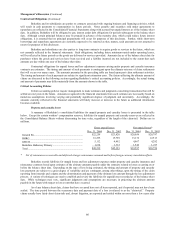

The decline in premiums earned in 2004 from North American operations was attributed to cancellations/non-renewals

over new contracts (estimated at $697 million), partially offset by renewal rate increases and changes in renewal terms and

conditions across all lines of business (estimated at $158 million). The decline in premiums earned in 2003 from 2002 reflected

cancellations/non-renewals exceeding new contracts (estimated at $761 million), partially offset by rate increases across all lines

(estimated at $345 million). The decline in international premiums earned in 2004 versus 2003 reflected the reductions of

premium volume partially offset by a lower value of the U.S. dollar. In local currencies, 2004 premiums earned declined 29.1%

compared with 2003, which, in turn, declined 5.5% in 2003 versus 2002.

The North American property/casualty business produced a pre-tax underwriting gain of $11 million in 2004 compared

with a gain of $67 million in 2003, and a loss of $1,019 million in 2002. The $11 million net underwriting gain in 2004 was

comprised of current accident year gains of $166 million, partially offset by $155 million in prior accident year losses. Current

accident year results included approximately $120 million of catastrophe losses from the four hurricanes that struck the

Southeast United States in the third quarter. Despite these losses, current accident year underwriting results benefited from the

favorable effects of re-pricing efforts and improved coverage terms and conditions implemented over the past three years and a

one time reduction of $70 million in pension expense during the third quarter, resulting from the curtailment of certain benefits at

the end of 2005. Underwriting results for 2003 included net underwriting gains for the current accident year of $200 million

compared to $66 million in 2002. The current accident year results in 2003 and 2002 reflected re-pricing efforts and unusually

low amounts of large individual and catastrophe-related property losses. In both 2003 and 2002, the current accident year gains

were reduced or eliminated by additional losses ($133 million in 2003 and $1,085 million in 2002) established for prior accident

years’ loss occurrences.

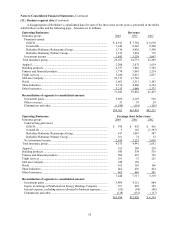

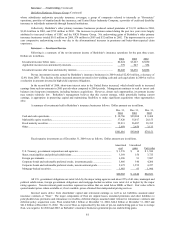

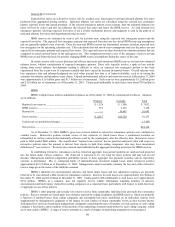

In 2004, the $155 million charge related to prior accident year loss occurrences consisted of $729 million of increases

in casualty and workers’ compensation reserves, $110 million related to discount accretion on workers’ compensation reserves

and deferred charge amortization on retroactive reinsurance coverages, offset by $307 million of reserve reductions for prior year

property losses and $377 million of gains associated with contract commutations and settlements. The aforementioned increases

in workers’ compensation reserves in 2004 reflected escalating medical utilization and inflation, and casualty reserve increases

related primarily to losses under financial institutions errors and omissions and directors and officers’ lines of business and

asbestos and environmental mass tort exposures. The decrease in property reserves in 2004 was primarily due to reductions in

estimated World Trade Center losses.

As previously stated, underwriting results in 2003 and 2002 included $133 million and $1,085 million, respectively, in

losses related to prior accident years, which included $99 million and $95 million, respectively, from discount accretion on

workers’ compensation reserves and deferred charge amortization on retroactive reinsurance contracts. In 2002, reserve

increases also included $990 million in increased loss estimates mostly related to casualty lines of business (general liability,

workers’ compensation, medical malpractice, auto liability and professional liability coverages), principally for the 1997 through

2000 accident years, partially offset by $115 million of reserve reductions related to reduced estimates for certain World Trade

Center claims.

Although loss reserve levels are now believed to be adequate, there are no guarantees. A relatively small change in the

estimate of net reserves can produce large changes in annual underwriting results. In addition, the timing and magnitude of

catastrophe and large individual property losses are expected to continue to contribute to volatile periodic underwriting results in

the future. See “Critical Accounting Policies” for additional information concerning loss reserves.

International property/casualty businesses produced a pre-tax underwriting loss of $93 million in 2004 compared with

a gain of $20 million in 2003, and a loss of $319 million in 2002. Underwriting results in 2004 include $110 million of

catastrophe losses from the third quarter hurricanes. In 2003, losses from catastrophes and large individual property losses were

minimal and in 2002 totaled $124 million, primarily from flood and storm losses in Europe. Underwriting results for each of the

last three years benefited from favorable results of the aviation business and relatively low non-catastrophe property losses.

Underwriting results of the international businesses have improved overall over the last two years as a result of re-pricing efforts

and more disciplined underwriting. Underwriting results of the international property and casualty businesses included losses

from prior years’ loss occurrences of $102 million in 2004, $104 million in 2003 and $320 million in 2002.

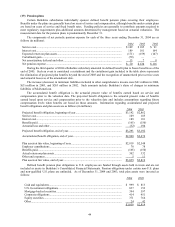

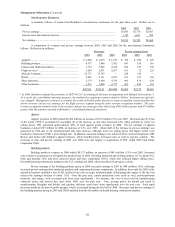

Life and health

Life and health premiums earned in 2004 increased $168 million (9.1%) over 2003, which decreased by $39 million

(2.1%) compared with 2002. Adjusting for the effects of foreign currency exchange, premiums earned increased 3.7% in 2004

and declined 9.6% in 2003. The increase in premiums earned is due in part to the strengthening of foreign currencies and an

increase in European life business. The decline in 2003 was primarily due to decreases in the group and individual health

businesses in the U.S. life/health operations.

Underwriting results for the global life/health operations produced pre-tax underwriting gains of $85 million in 2004

and $58 million in 2003, compared with an underwriting loss of $55 million in 2002. While both the U.S. and international

life/health operations were profitable in both 2004 and 2003, most of the gains were earned in the international life business.

The underwriting losses for 2002 were principally due to increased reserves on run-off business in the U.S. life/health operations.