Berkshire Hathaway 2004 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2004 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

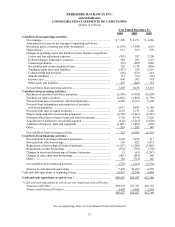

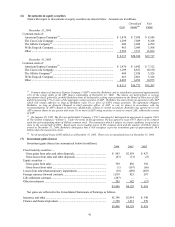

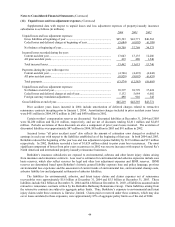

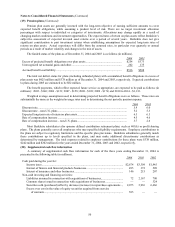

(6) Investments in equity securities

Data with respect to investments in equity securities are shown below. Amounts are in millions.

Unrealized Fair

Cost Gains(3) Value

December 31, 2004

Common stock of:

American Express Company(1) ............................................................................ $ 1,470 $ 7,076 $ 8,546

The Coca-Cola Company .................................................................................... 1,299 7,029 8,328

The Gillette Company(2) ...................................................................................... 600 3,699 4,299

Wells Fargo & Company..................................................................................... 463 3,045 3,508

Other .................................................................................................................... 5,505 7,531 13,036

$ 9,337 $28,380 $37,717

December 31, 2003

Common stock of:

American Express Company(1) ............................................................................ $ 1,470 $ 5,842 $ 7,312

The Coca-Cola Company .................................................................................... 1,299 8,851 10,150

The Gillette Company(2) ...................................................................................... 600 2,926 3,526

Wells Fargo & Company..................................................................................... 463 2,861 3,324

Other .................................................................................................................... 4,683 6,292 10,975

$ 8,515 $26,772 $35,287

(1) Common shares of American Express Company ("AXP") owned by Berkshire and its subsidiaries possessed approximately

12% of the voting rights of all AXP shares outstanding at December 31, 2004. The shares are held subject to various

agreements which, generally, prohibit Berkshire from (i) unilaterally seeking representation on the Board of Directors of AXP

and (ii) possessing 17% or more of the aggregate voting securities of AXP. Berkshire has entered into an agreement with AXP

which will remain effective so long as Berkshire owns 5% or more of AXP's voting securities. The agreement obligates

Berkshire, so long as Kenneth Chenault is chief executive officer of AXP, to vote its shares in accordance with the

recommendations of AXP's Board of Directors. Additionally, subject to certain exceptions, Berkshire has agreed not to sell

AXP common shares to any person who owns 5% or more of AXP voting securities or seeks to control AXP, without the consent

of AXP.

(2) On January 28, 2005, The Proctor and Gamble Company (“PG”) announced it had signed an agreement to acquire 100%

of The Gillette Company (“Gillette”). Under the terms of the agreement, PG has agreed to issue 0.975 shares of its common

stock for each outstanding share of Gillette common stock. The transaction which is subject to certain conditions is expected to

close in the second half of 2005. Based upon recent trading prices of PG common stock and the number of Gillette shares

owned at December 31, 2004, Berkshire anticipates that it will recognize a pre-tax investment gain of approximately $4.4

billion when the transaction closes.

(3) Net of unrealized losses of $65 million as of December 31, 2003. There were no unrealized losses at December 31, 2004.

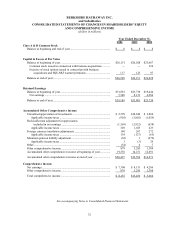

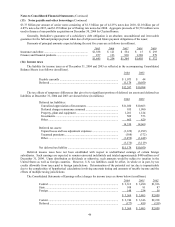

(7) Investment gains (losses)

Investment gains (losses) are summarized below (in millions).

2004 2003 2002

Fixed maturity securities —

Gross gains from sales and other disposals.............................................. $ 883 $2,559 $ 927

Gross losses from sales and other disposals............................................. (63) (31) (8)

Equity securities —

Gross gains from sales ............................................................................. 769 850 392

Gross losses from sales ............................................................................ (1) (167) (66)

Losses from other-than-temporary impairments ......................................... (19) (289) (607)

Foreign currency forward contracts............................................................. 1,839 825 297

Life settlement contracts.............................................................................. (207) — —

Other investments ........................................................................................ 295 382 (17)

$3,496 $4,129 $ 918

Net gains are reflected in the Consolidated Statements of Earnings as follows.

Insurance and other...................................................................................... $1,746 $2,914 $ 340

Finance and financial products .................................................................... 1,750 1,215 578

$3,496 $4,129 $ 918