Berkshire Hathaway 2004 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2004 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

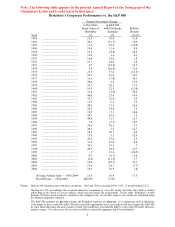

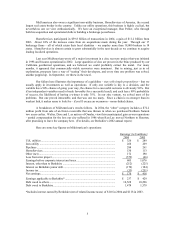

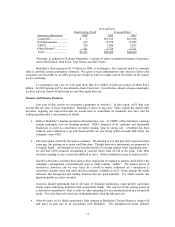

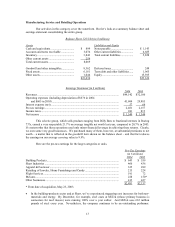

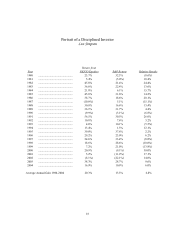

(in $ millions)

Underwriting Profit Yearend Float

Insurance Operations 2004 2004 2003

General Re ....................... $ 3 $23,120 $23,654

B-H Reinsurance.............. 417 15,278 13,948

GEICO ............................. 970 5,960 5,287

Other Primary*................. 161 1,736 1,331

Total................................. $1,551 $46,094 $44,220

*Includes, in addition to National Indemnity, a variety of other exceptional insurance businesses,

run by Rod Eldred, John Kizer, Tom Nerney and Don Towle.

Berkshire’ s float increased $1.9 billion in 2004, even though a few insureds opted to commute

(that is, unwind) certain reinsurance contracts. We agree to such commutations only when we believe the

economics are favorable to us (after giving due weight to what we might earn in the future on the money

we are returning).

To summarize, last year we were paid more than $1.5 billion to hold an average of about $45.2

billion. In 2005 pricing will be less attractive than it has been. Nevertheless, absent a mega-catastrophe,

we have a decent chance of achieving no-cost float again this year.

Finance and Finance Products

Last year in this section we discussed a potpourri of activities. In this report, we’ ll skip over

several that are now of lesser importance: Berkadia is down to tag ends; Value Capital has added other

investors, negating our expectation that we would need to consolidate its financials into ours; and the

trading operation that I run continues to shrink.

• Both of Berkshire’ s leasing operations rebounded last year. At CORT (office furniture), earnings

remain inadequate, but are trending upward. XTRA disposed of its container and intermodal

businesses in order to concentrate on trailer leasing, long its strong suit. Overhead has been

reduced, asset utilization is up and decent profits are now being achieved under Bill Franz, the

company’ s new CEO.

• The wind-down of Gen Re Securities continues. We decided to exit this derivative operation three

years ago, but getting out is easier said than done. Though derivative instruments are purported to

be highly liquid – and though we have had the benefit of a benign market while liquidating ours –

we still had 2,890 contracts outstanding at yearend, down from 23,218 at the peak. Like Hell,

derivative trading is easy to enter but difficult to leave. (Other similarities come to mind as well.)

Gen Re’ s derivative contracts have always been required to be marked to market, and I believe the

company’ s management conscientiously tried to make realistic “marks.” The market prices of

derivatives, however, can be very fuzzy in a world in which settlement of a transaction is

sometimes decades away and often involves multiple variables as well. In the interim the marks

influence the managerial and trading bonuses that are paid annually. It’ s small wonder that

phantom profits are often recorded.

Investors should understand that in all types of financial institutions, rapid growth sometimes

masks major underlying problems (and occasionally fraud). The real test of the earning power of

a derivatives operation is what it achieves after operating for an extended period in a no-growth

mode. You only learn who has been swimming naked when the tide goes out.

• After 40 years, we’ ve finally generated a little synergy at Berkshire: Clayton Homes is doing well

and that’ s in part due to its association with Berkshire. The manufactured home industry

11