Berkshire Hathaway 2004 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2004 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

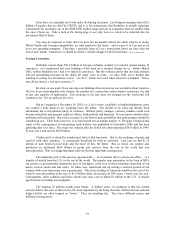

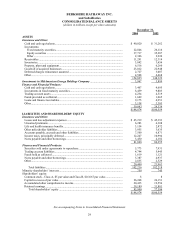

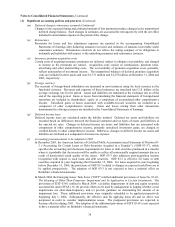

BERKSHIRE HATHAWAY INC.

and Subsidiaries

CONSOLIDATED BALANCE SHEETS

(dollars in millions except per share amounts)

December 31,

2004 2003

ASSETS

Insurance and Other:

Cash and cash e

q

uivalents.............................................................................................. $ 40,020 $ 31,262

Investments:

Fixed maturit

y

securities............................................................................................. 22,846 26,116

E

q

uit

y

securities ......................................................................................................... 37,717 35,287

Othe

r

........................................................................................................................... 2,346 2,924

Receivables .................................................................................................................... 11,291 12,314

Inventories...................................................................................................................... 3,842 3,656

Pro

p

ert

y

,

p

lant and e

q

ui

p

men

t

........................................................................................ 6,516 6,260

Goodwill of ac

q

uired businesses.................................................................................... 23,012 22,948

Deferred char

g

es reinsurance assumed .......................................................................... 2,727 3,087

Othe

r

............................................................................................................................... 4,508 4,468

154,825 148,322

Investments in MidAmerican Ener

gy

Holdin

g

s Com

p

an

y

............................................. 3,967 3,899

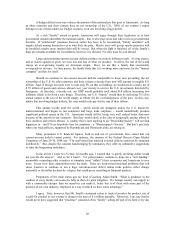

F

inance and Financial Products:

Cash and cash e

q

uivalents.............................................................................................. 3,407 4,695

Investments in fixed maturi

t

y

securities......................................................................... 8,459 9,803

Tradin

g

account assets ................................................................................................... 4,234 4,519

Funds

p

rovided as collateral........................................................................................... 1,649 1,065

Loans and finance receivables........................................................................................ 9,175 4,951

Othe

r

............................................................................................................................... 3,158 3,305

30,082 28,338

$188,874 $180,559

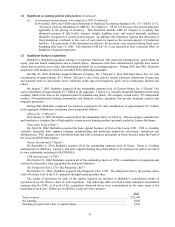

LIABILITIES AND SHAREHOLDERS’ E

Q

UITY

Insurance and Other:

Losses and loss ad

j

ustment ex

p

enses ............................................................................. $ 45,219 $ 45,393

Unearned

p

remiums ....................................................................................................... 6,283 6,308

Life and health insurance benefits.................................................................................. 3,154 2,872

Other

p

olic

y

holder liabilities.......................................................................................... 3,955 3,635

Accounts

p

a

y

able, accruals and other liabilities............................................................. 7,500 6,871

Income taxes,

p

rinci

p

all

y

deferre

d

................................................................................. 12,247 10,994

N

otes

p

a

y

able and other borrowin

g

s .............................................................................. 3,450 4,182

81,808 80,255

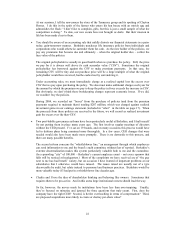

F

inance and Financial Products:

Securities sold under a

g

reements to re

p

urchase............................................................. 5,773 7,931

Tradin

g

account liabilities.............................................................................................. 4,794 5,445

Funds held as collateral .................................................................................................. 1,6191,121

N

otes

p

a

y

able and other borrowin

g

s .............................................................................. 5,387 4,937

Other............................................................................................................................... 2,835 2,529

20,408 21,963

Total liabilities.............................................................................................................. 102,216 102,218

Minorit

y

shareholders’ inte

r

ests........................................................................................ 758 745

Shareholders’ e

q

uit

y

:

Common stock - Class A, $5

p

ar value and Class B, $0.1667

p

ar value........................ 8 8

Ca

p

ital in excess of

p

ar value......................................................................................... 26,268 26,151

Accumulated other com

p

rehensive income.................................................................... 20,435 19,556

Retained earnin

g

s ........................................................................................................... 39,189 31,881

Total shareholders’ e

q

uit

y

........................................................................................ 85,900 77,596

$188,874 $180,559

See accompanying Notes to Consolidated Financial Statements