Berkshire Hathaway 2004 Annual Report Download

Download and view the complete annual report

Please find the complete 2004 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BERKSHIRE HATHAWAY INC.

2004 ANNUAL REPORT

TABLE OF CONTENTS

Business Activities.................................................... Inside Front Cover

Corporate Performance vs. the S&P 500 ................................................ 2

Chairman’ s Letter* ................................................................................. 3

Selected Financial Data For The

Past Five Years .................................................................................. 27

Acquisition Criteria ................................................................................28

Report of Independent Registered Public Accounting Firm................... 28

Consolidated Financial Statements.........................................................29

Management’ s Report on Internal Control

Over Financial Reporting ................................................................... 56

Management’ s Discussion ...................................................................... 57

Owner’ s Manual .....................................................................................73

Common Stock Data and Corporate Governance Matters......................79

Operating Companies ............................................................................. 80

Directors and Officers of the Company.........................Inside Back Cover

*Copyright © 2005 By Warren E. Buffett

All Rights Reserved

Table of contents

-

Page 1

... Public Accounting Firm...28 Consolidated Financial Statements ...29 Management' s Report on Internal Control Over Financial Reporting ...56 Management' s Discussion ...57 Owner' s Manual ...73 Common Stock Data and Corporate Governance Matters...79 Operating Companies ...80 Directors and Officers... -

Page 2

...home furnishings. Borsheim' s, Helzberg Diamond Shops and Ben Bridge Jeweler are retailers of fine jewelry. Berkshire' s finance and financial products businesses primarily engage in proprietary investing strategies (BH Finance), commercial and consumer lending (Berkshire Hathaway Credit Corporation... -

Page 3

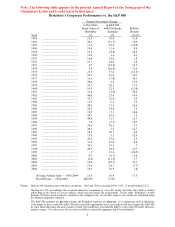

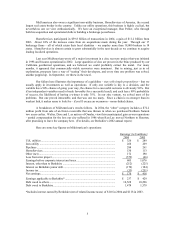

... Average Annual Gain - 1965-2004 Overall Gain - 1964-2004 Notes: Data are for calendar years with these exceptions: 1965 and 1966, year ended 9/30; 1967, 15 months ended 12/31. Starting in 1979, accounting rules required insurance companies to value the equity securities they hold at market rather... -

Page 4

... Shareholders of Berkshire Hathaway Inc.: Our gain in net worth during 2004 was $8.3 billion, which increased the per-share book value of both our Class A and Class B stock by 10.5%. Over the last 40 years (that is, since present management took over) book value has grown from $19 to $55,824, a rate... -

Page 5

... by three partners of ours: Dave Sokol and Greg Abel, the brilliant managers of these businesses, and Walter Scott, a long-time friend of mine who introduced me to the company. Because MidAmerican is subject to the Public Utility Holding Company Act ("PUHCA"), Berkshire' s voting interest is limited... -

Page 6

... war reparations - partial compensation for the loss our city suffered in 1986 when Ken Lay moved Northern to Houston, after promising to leave the company here. (For details, see Berkshire' s 2002 annual report.) Here are some key figures on MidAmerican' s operations: Earnings (in $ millions) 2004... -

Page 7

... and losses we will ultimately pay compare with the premiums we have received. When an underwriting profit is achieved - as has been the case at Berkshire in about half of the 38 years we have been in the insurance business - float is better than free. In such years, we are actually paid for holding... -

Page 8

... long time to learn the true profitability of any given year. First, many claims are received after the end of the year, and we must estimate how many of these there will be and what they will cost. (In insurance jargon, these claims are termed IBNR - incurred but not reported.) Second, claims often... -

Page 9

... way to prosper in a commodity-type business is to be the low-cost operator. Among auto insurers operating on a broad scale, GEICO holds that cherished title. For NICO, as we have seen, an ebband-flow business model makes sense. But a company holding a low-cost advantage must pursue an unrelenting... -

Page 10

... have paid for coverage, its associates earned a $191 million profit-sharing bonus that averaged 24.3% of salary, and its owner - that' s us - enjoyed excellent financial returns. There' s more good news. When Jack Byrne was rescuing the company in 1976, New Jersey refused to grant him the rates he... -

Page 11

.... In personal-lines insurance, for example, states levy assessments on solvent companies to pay the policyholders of companies that go broke. In the business-insurance field, the same arrangement applies to workers' compensation policies. "Protected" policies of these types account for about... -

Page 12

... ends; Value Capital has added other investors, negating our expectation that we would need to consolidate its financials into ours; and the trading operation that I run continues to shrink. • Both of Berkshire' s leasing operations rebounded last year. At CORT (office furniture), earnings remain... -

Page 13

... and purchasers of manufactured homes. Here Berkshire' s support has proven valuable to Clayton. We stand ready to fund whatever makes sense, and last year Clayton' s management found much that qualified. As we explained in our 2003 report, we believe in using borrowed money to support profitable... -

Page 14

... ...Apparel & Footwear ...Retailing of Jewelry, Home Furnishings and Candy ...Flight Services...McLane...Other businesses ...* From date of acquisition, May 23, 2003. • In the building-products sector and at Shaw, we' ve experienced staggering cost increases for both rawmaterials and energy... -

Page 15

... Paul this year. At Utah-based R. C. Willey, the gains from expansion have been even more dramatic, with 41.9% of 2004 sales coming from out-of-state stores that didn' t exist before 1999. The company also improved its profit margin in 2004, propelled by its two new stores in Las Vegas. I would like... -

Page 16

... spend an average of 18 days a year in training. Additionally, these pilots fly only one aircraft type whereas many flight operations juggle pilots among several types. NetJets' high standards on both fronts are two of the reasons I signed up with the company years before Berkshire bought it. Fully... -

Page 17

...Inc...M&T Bank Corporation ...Moody' s Corporation ...PetroChina "H" shares (or equivalents)...The Washington Post Company ...Wells Fargo & Company...White Mountains Insurance...Others ...Total Common Stocks ... 12.1 8.3 9.7 8.7 5.8 16.2 1.3 18.1 3.3 16.0 *This is our actual purchase price and also... -

Page 18

...(In addition, we received cash interest during our holding period that amounted to about 25% annually on our dollar cost The media continue to report that "Buffett buys" this or that stock. Statements like these are almost always based on filings Berkshire makes with the SEC and are therefore wrong... -

Page 19

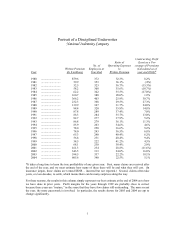

... Year 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 ... Return from GEICO ... 13.4% 4.4% (6.8%) 26.0% 3.2% (5.5%) 12.1% 2.2% 6.2% (8.8%) (10.0%) (13.8%) 30.0% 17.1% 14.0% 9.6% 6.0% 6.8% Average Annual Gain 1980-2004 18 -

Page 20

... it is typically not I who make the buying decisions. Lou Simpson manages about $2½ billion of equities that are held by GEICO, and it is his transactions that Berkshire is usually reporting. Customarily his purchases are in the $200-$300 million range and are in companies that are smaller than the... -

Page 21

..., that Mr. Smith' s statement refers to trade of product for product, not of wealth for product as our country is doing to the tune of $.6 trillion annually. Moreover, I am sure that he would never have suggested that "prudence" consisted of his "family" selling off part of its farm every day 20 -

Page 22

... I told you about a group of University of Tennessee finance students who played a key role in our $1.7 billion acquisition of Clayton Homes. Earlier, they had been brought to Omaha by their professor, Al Auxier - he brings a class every year - to tour Nebraska Furniture Mart and Borsheim' s, eat at... -

Page 23

... deals. But their mission in life has been made clear to them. • You should be aware of an accounting rule that mildly distorts our financial statements in a paintoday, gain-tomorrow manner. Berkshire purchases life insurance policies from individuals and corporations who would otherwise surrender... -

Page 24

... of a recent acquisition proposal (not from Berkshire) that was favored by management, blessed by the company' s investment banker and slated to go forward at a price above the level at which the stock had sold for some years (or now sells for). In addition, a number of directors favored the... -

Page 25

... board and committee fees totaling about $100,000 annually, scuttled the proposal, which meant that shareholders never learned of this multi-billion offer. Non-management directors owned little stock except for shares they had received from the company. Their open-market purchases in recent years... -

Page 26

... to Omaha by bus; leave in your new plane. The Bookworm shop did a terrific business last year selling Berkshire-related books. Displaying 18 titles, they sold 2,920 copies for $61,000. Since we charge the shop no rent (I must be getting soft), it gives shareholders a 20% discount. This year I' ve... -

Page 27

...and on Saturday of last year, we had the largest single-day sales in NFM' s history - $6.1 million. To get the discount, you must make your purchases between Thursday, April 28 and Monday, May 2 inclusive, and also present your meeting credential. The period' s special pricing will even apply to the... -

Page 28

...Subsidiaries Selected Financial Data for the Past Five Years (dollars in millions except per share data) 2004 Revenues: Insurance premiums earned ...Sales and service revenues...Interest, dividend and other investment income ...Interest and other revenues of finance and financial products businesses... -

Page 29

... spaniels. A line from a country song expresses our feeling about new ventures, turnarounds, or auction-like sales: "When the phone don' t ring, you' ll know it' s me." _____ REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Shareholders of Berkshire Hathaway Inc... -

Page 30

... and equipment...Goodwill of acquired businesses...Deferred charges reinsurance assumed ...Other...Investments in MidAmerican Energy Holdings Company ...Finance and Financial Products: Cash and cash equivalents...Investments in fixed maturity securities...Trading account assets ...Funds provided as... -

Page 31

BERKSHIRE HATHAWAY INC. and Subsidiaries CONSOLIDATED STATEMENTS OF EARNINGS (dollars in millions except per share amounts) Year Ended December 31, 2004 2003 2002 Revenues: Insurance and Other: Insurance premiums earned ...Sales and service revenues ...Interest, dividend and other investment income ... -

Page 32

BERKSHIRE HATHAWAY INC. and Subsidiaries CONSOLIDATED STATEMENTS OF CASH FLOWS (dollars in millions) Year Ended December 31, 2004 2003 2002 Cash flows from operating activities: Net earnings...Adjustments to reconcile net earnings to operating cash flows: Investment gains, securities and other ... -

Page 33

BERKSHIRE HATHAWAY INC. and Subsidiaries CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS' EQUITY AND COMPREHENSIVE INCOME (dollars in millions) Year Ended December 31, 2004 2003 2002 Class A & B Common Stock Balance at beginning and end of year ...$ 8 $ 8 $ 8 Capital in Excess of Par Value ... -

Page 34

... TO CONSOLIDATED FINANCIAL STATEMENTS December 31, 2004 (1) Significant accounting policies and practices (a) Nature of operations and basis of consolidation Berkshire Hathaway Inc. ("Berkshire" or "Company") is a holding company owning subsidiaries engaged in a number of diverse business activities... -

Page 35

... fair value of such contracts are included in the Consolidated Statements of Earnings. Cash collateral received from or paid to counterparties to secure trading account assets or liabilities is included in liabilities or assets of finance and financial products businesses in the Consolidated Balance... -

Page 36

... insurers and (3) estimates of incurred but not reported ("IBNR") losses. The estimated liabilities of workers' compensation claims assumed under reinsurance contracts are carried in the Consolidated Balance Sheets at discounted amounts. Discounted amounts are based upon an annual discount rate... -

Page 37

... underlying insurance and reinsurance contracts. Insurance premium acquisition costs Certain costs of acquiring insurance premiums are deferred, subject to ultimate recoverability, and charged to income as the premiums are earned. Acquisition costs consist of commissions, premium taxes, advertising... -

Page 38

... Chef, LTD. The Pampered Chef is the premier direct seller of kitchen tools in the U.S., primarily through branded product lines. The results of operations for each of the entities acquired are included in Berkshire' s consolidated results of operations from the effective date of each acquisition... -

Page 39

... Consolidated Financial Statements (Continued) (3) Investments in MidAmerican Energy Holdings Company On March 14, 2000, Berkshire acquired 900,942 shares of common stock and 34,563,395 shares of convertible preferred stock of MidAmerican Energy Holdings Company ("MidAmerican") for $35.05 per share... -

Page 40

...118 640 4,380 523 126 397 (17) $ 380 Insurance premiums receivable ...Reinsurance recoverables ...Trade and other receivables ...Allowances for uncollectible accounts... Loans and finance receivables of finance and financial products businesses are comprised of the following (in millions). December... -

Page 41

... ...Obligations of foreign governments ...Corporate bonds and redeemable preferred stocks ...Mortgage-backed securities ...Finance and financial products, available-for-sale: Obligations of U.S. Treasury, U.S. government corporations and agencies ...Corporate bonds ...Mortgage-backed securities... -

Page 42

... 2005. Based upon recent trading prices of PG common stock and the number of Gillette shares owned at December 31, 2004, Berkshire anticipates that it will recognize a pre-tax investment gain of approximately $4.4 billion when the transaction closes. (3) (1) Net of unrealized losses of $65 million... -

Page 43

Notes to Consolidated Financial Statements (Continued) (8) Goodwill of acquired businesses Effective January 1, 2002, Berkshire adopted Statement of Financial Accounting Standards ("SFAS") No. 142 "Goodwill and Other Intangible Assets." SFAS 142 changed the accounting for goodwill from a model that... -

Page 44

... market price movements. In January 2002, GRS commenced a long-term run-off of its operations. The run-off is expected to occur over a number of years during which GRS will limit its new business and will unwind its existing asset and liability positions in an orderly manner. General Re Corporation... -

Page 45

... property/casualty reinsurance businesses. Berkshire' s insurance subsidiaries are exposed to environmental, asbestos and other latent injury claims arising from insurance and reinsurance contracts. Loss reserve estimates for environmental and asbestos exposures include case basis reserves... -

Page 46

...2007. The warrants may be exercised to purchase either 0.1116 shares of Class A common stock (effectively at $89,606 per share) or 3.3480 shares (effectively at $2,987 per share) of Class B common stock for $10,000. A warrant premium is payable to Berkshire at an annual rate of 3.75% and interest is... -

Page 47

... five years are as follows (in millions). Insurance and other...Finance and financial products ...(14) Income taxes The liability for income taxes as of December 31, 2004 and 2003 as reflected in the accompanying Consolidated Balance Sheets is as follows (in millions). 2004 2003 Payable currently... -

Page 48

... income tax benefit...Foreign rate differences ...Other differences, net ...Total income taxes...(15) Investment in Value Capital Value Capital L.P., ("Value Capital"), a limited partnership, commenced operations in 1998. A wholly owned Berkshire subsidiary is a limited partner in Value Capital. The... -

Page 49

...019 Trading account liabilities ...4,794 5,445 4,794 5,445 In determining fair value of financial instruments, Berkshire used quoted market prices when available. For instruments where quoted market prices were not available, independent pricing services or appraisals by Berkshire' s management were... -

Page 50

... value, end of year...$3,293 $2,908 $3,192 $2,676 $2,819 $2,548 78 78 (165) (150) 302 332 11 5 $3,039 $2,819 Defined benefit pension plan obligations to U.S. employees are funded through assets held in trusts and are not included as assets in Berkshire' s Consolidated Financial Statements. Pension... -

Page 51

... paid during the year for: Income taxes...$2,674 $3,309 $1,945 Interest of finance and financial products businesses ...495 372 509 Interest of insurance and other businesses...146 215 207 Non-cash investing and financing activities: Liabilities assumed in connection with acquisitions of businesses... -

Page 52

... Homes, XTRA, CORT, Berkshire Hathaway Life and General Re Securities ("Finance and financial products") FlightSafety and NetJets ("Flight services") McLane Company Nebraska Furniture Mart, R.C. Willey Home Furnishings, Star Furniture Company, Jordan' s Furniture, Borsheim' s, Helzberg Diamond Shops... -

Page 53

...Total insurance group...Apparel...Building products ...Finance and financial products...Flight services ...McLane Company ...Retail ...Shaw Industries ...Other businesses...Reconciliation of segments to consolidated amount: Investment gains...Equity in earnings of MidAmerican Energy Holdings Company... -

Page 54

... Operating Businesses: Insurance group...Apparel...Building products ...Finance and financial products...Flight services ...McLane Company...Retail ...Shaw Industries ...Other businesses... $1,002 * Excludes capital expenditures which were part of business acquisitions. Goodwill at year-end 2003... -

Page 55

... and Europe. In 2004, consolidated sales and service revenues included $8.5 billion of sales to Wal-Mart Stores, Inc. which were primarily related to McLane' s wholesale distribution business that Berkshire acquired in May 2003. Premiums written and earned by Berkshire' s property/casualty and life... -

Page 56

...remaining non-cancelable terms in excess of one year are as follows. Amounts are in millions. After 2006 2007 2008 2009 2009 Total 2005 $364 $290 $238 $180 $148 $408 $1,628 Several of the Company' s subsidiaries have made long-term commitments to purchase goods and services used in their businesses... -

Page 57

... Public Accounting Firm To the Board of Directors and Shareholders of Berkshire Hathaway Inc. We have audited management' s assessment, included in the accompanying Management' s Report on Internal Control Over Financial Reporting, that Berkshire Hathaway Inc. and subsidiaries (the "Company... -

Page 58

... sales, marketing, purchasing or human resources) and there is minimal involvement by Berkshire' s corporate headquarters in the day-to-day business activities of the operating businesses. Berkshire' s corporate office management participates in and is ultimately responsible for significant capital... -

Page 59

... due to higher salary, profit sharing and other employee benefit expenses. General Re General Re conducts a reinsurance business offering property and casualty and life and health coverages to clients worldwide. In North America, property and casualty reinsurance is written on a direct basis through... -

Page 60

... increases in workers' compensation reserves in 2004 reflected escalating medical utilization and inflation, and casualty reserve increases related primarily to losses under financial institutions errors and omissions and directors and officers' lines of business and asbestos and environmental... -

Page 61

Management's Discussion (Continued) Insurance - Underwriting (Continued) Berkshire Hathaway Reinsurance Group The Berkshire Hathaway Reinsurance Group ("BHRG") underwrites excess-of-loss reinsurance and quota-share coverages for insurers and reinsurers around the world. BHRG' s business includes ... -

Page 62

... pricing services. Invested assets derive from shareholder capital and reinvested earnings as well as net liabilities assumed under insurance contracts or "float." The major components of float are unpaid losses, unearned premiums and other liabilities to policyholders less premiums and reinsurance... -

Page 63

... and pre-tax earnings between 2004, 2003 and 2002 for the non-insurance businesses follows. Dollars are in millions. Revenues Pre-tax earnings (loss) 2004 2003 2002 2004 2003 2002 Apparel...Building products ...Finance and financial products...Flight services * ...McLane Company...Retail ...Shaw... -

Page 64

... of new customers since Berkshire' s acquisition and growth in the food service business. In 2004, approximately 33% of McLane' s annual revenues derived from sales to Wal-Mart Stores, Inc. McLane' s business is marked by high sales volume and very thin profit margins. Retail Berkshire' s principal... -

Page 65

... costs. Sales price increases have lagged raw material supplier price increases resulting in a decline in gross sales margins during 2004. Further margin declines in 2005 are possible. Equity in Earnings of MidAmerican Energy Holdings Company Earnings from MidAmerican represent Berkshire' s share... -

Page 66

... which expire in May 2007. A warrant premium is payable to Berkshire at an annual rate of 3.75% and interest is payable to note holders at a rate of 3.00%. Each warrant provides the holder the right to purchase either 0.1116 shares of Class A or 3.348 shares of Class B stock for $10,000. In addition... -

Page 67

... are not assumed to renew for purposes of this disclosure. Berkshire and subsidiaries are also parties to long-term contracts to acquire goods or services in the future, which are not currently reflected in the financial statements. Such obligations, including future minimum rentals under operating... -

Page 68

... the time the claim is first reported. Therefore, additional case development reserve estimates are established, usually as a percentage of the case reserve. In general, case development factors are selected by historical statistical analysis, which includes incurred case loss analysis for groups of... -

Page 69

... reviews. Actuaries classify all loss and premium data into segments (reserve cells) primarily based on product (e.g., treaty, facultative, and program) and line of business (e.g., auto liability, property, etc.). For each reserve cell, losses are aggregated by accident year and analyzed over time... -

Page 70

...selected by reserve cell, by accident year, based upon reviewing indicated ultimate loss ratios predicted from aggregated pricing statistics. Indicated ultimate loss ratios are calculated using the selected loss emergence pattern, reported losses and earned premium. If the selected emergence pattern... -

Page 71

... or other interest rate sensitive instruments. Berkshire' s strategy is to acquire securities that are attractively priced in relation to the perceived credit risk. Management recognizes and accepts that losses may occur. Berkshire has historically utilized a modest level of corporate borrowings and... -

Page 72

... average levels of shareholder capital to provide a margin of safety against short term equity price volatility. The carrying values of investments subject to equity price risks are based on quoted market prices or management' s estimates of fair value as of the balance sheet dates. Market prices... -

Page 73

...that causes losses insured by Berkshire' s insurance subsidiaries, changes in insurance laws or regulations, changes in Federal income tax laws, and changes in general economic and market factors that affect the prices of securities or the industries in which Berkshire and its affiliates do business... -

Page 74

...effect, our shareholders behave in respect to their Berkshire stock much as Berkshire itself behaves in respect to companies in which it has an investment. As owners of, say, Coca-Cola or Gillette shares, we think of Berkshire as being a non-managing partner in two extraordinary businesses, in which... -

Page 75

... goal by directly owning a diversified group of businesses that generate cash and consistently earn above-average returns on capital. Our second choice is to own parts of similar businesses, attained primarily through purchases of marketable common stocks by our insurance subsidiaries. The price and... -

Page 76

..., Berkshire has access to two low-cost, non-perilous sources of leverage that allow us to safely own far more assets than our equity capital alone would permit: deferred taxes and "float," the funds of others that our insurance business holds because it receives premiums before needing to pay out... -

Page 77

...the time of the sale that our stock was overvalued, though many media have reported that we did.) 11. You should be fully aware of one attitude Charlie and I share that hurts our financial performance: Regardless of price, we have no interest at all in selling any good businesses that Berkshire owns... -

Page 78

... regularly report our per-share book value, an easily calculable number, though one of limited use. The limitations do not arise from our holdings of marketable securities, which are carried on our books at their current prices. Rather the inadequacies of book value have to do with the companies we... -

Page 79

... in this business to the managers of our subsidiaries. In fact, we delegate almost to the point of abdication: Though Berkshire has about 180,000 employees, only 17 of these are at headquarters. Charlie and I mainly attend to capital allocation and the care and feeding of our key managers. Most of... -

Page 80

... owners. Price Range of Common Stock Berkshire' s Class A and Class B Common Stock are listed for trading on the New York Stock Exchange, trading symbol: BRK.A and BRK.B. The following table sets forth the high and low sales prices per share, as reported on the New York Stock Exchange Composite List... -

Page 81

... (1) Star Furniture United Consumer Finance Company (1) United States Liability Insurance Group Wayne Water Systems (1) Wesco Financial Corp. Western Enterprises (1) Western Plastics (1) R. C. Willey Home Furnishings World Book (1) XTRA Operating Companies total Corporate Office Employees 17 170... -

Page 82

... of Financial Assets THOMAS S. MURPHY, Former Chairman of the Board and CEO of Capital Cities/ABC. JO ELLEN RIECK, Director of Taxes RONALD L. OLSON, Partner of the law firm of Munger, Tolles & Olson LLP. WALTER SCOTT, JR., Chairman of Level 3 Communications, a successor to certain businesses of...